This month the centerpiece is a debate between Pacific Rubiales José Francisco Arata and environmentalist Juan Pablo Ruiz Soto on the issue of whether extractive industries are incompatible with sound environmental management: well worth reading.

Hydrocarbons Colombia organized a debate on environmental management in the hydrocarbons industry between two Colombian heavyweights: environmentalist Juan Pablo Ruiz Soto (the only Colombian to have climbed Mount Everest) and Jose Francisco Arata, president of Colombia’s largest entirely shareholder-owned oil company, Pacific Rubiales.

Our Inner Circle Monthly Report for November 2013 marks the start of our second year of operation.

The Canada-Colombia Chamber of Commerce held a session recently at the University Sergio Arboleda with experts from both countries on the controversial topic of prior community consultation, and how they are applied in each country.

The Colombian government’s long awaited draft decree on unconventional hydrocarbons was published last Thursday and companies will have until October 29th to comment.

This week the report from the peace talks was mostly smiles and mutual backslapping with both the Farc and former senator Piedad Cordoba praising the results achieved to date.

Gasoline pricing is a hot topic in Colombia these days so this month we take up the issue. Luis Ernesto Mejía’s article this month succinctly deals with the major reasons why arbitrarily setting fuel prices based on misguided populism or a misunderstanding of opportunity cost will cause more harm than good.

Regulation and PolicyOn the evening of Monday, September 2, 2013 the entire cabinet of President Juan Manuel Santos tendered their resignations, in the height of the agricultural crisis, so that he would be free to name new players if required.

This month we have three interviews with important figures in the industry.

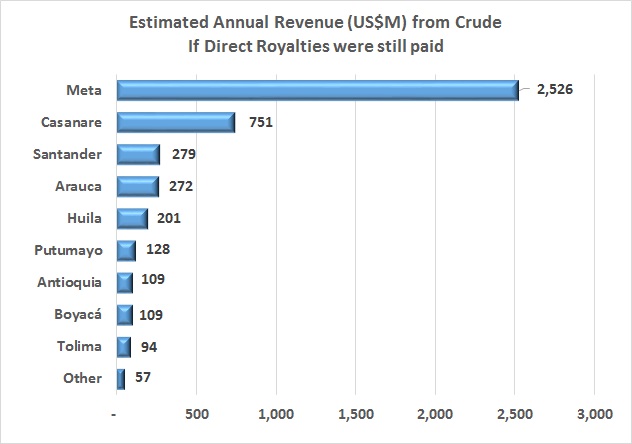

The interview with Meta Governor Alan Jara in this month’s issue makes clear the challenges of royalty reform for producer communities.

Although there is a transition, the impact on local finances has been devastating.