Three months ago, we asked our readers if we should continue with our monthly peace essays. Absolutely no one commented and we assumed we should stop. But we do get questions about the security situation, so we thought we’d do a mid-year assessment.

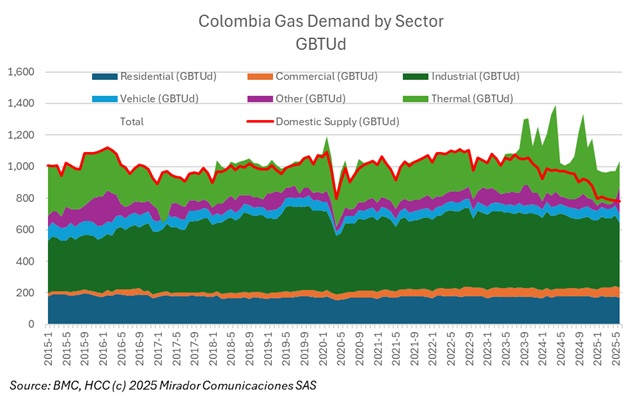

Gas supply continues to fall while gas demand rises. The obvious consequence is that imports rise and thus the average cost of gas. The Petro government has even stopped saying that everything is under control or threatening to fine E&Ps that “waste” gas. Where did it go?

We didn’t attend the ACP conference last week in Cali because of a prior commitment but we cannot imagine that there were a lot of smiling faces.

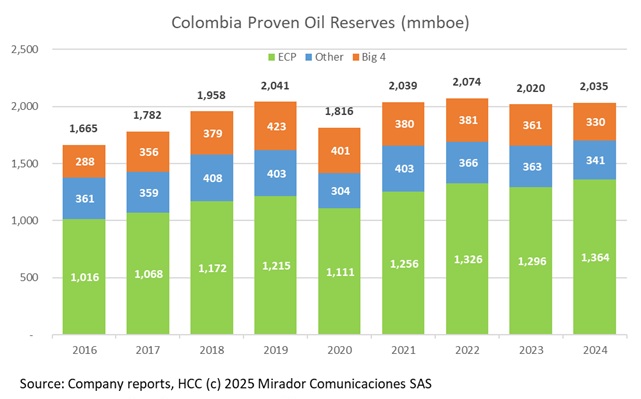

We cannot really blame Orlando Velandia and the ANH for spin-doctoring the recent oil and gas reserves report. His ultimate boss, Colombian President Gustavo Petro, doesn’t need any more bad press. But second derivatives, while interesting, do not tell the story.

I wrote reluctantly about Colombia’s apparently scandal-ridden NOC just two weeks ago. Reluctantly because I rarely find scandals to be strategic. I hoped I would not have to do it again this year. But independent board member, Monica de Greiff, resigned this past week and the press assumes that CEO Ricardo Roa will leave shortly.

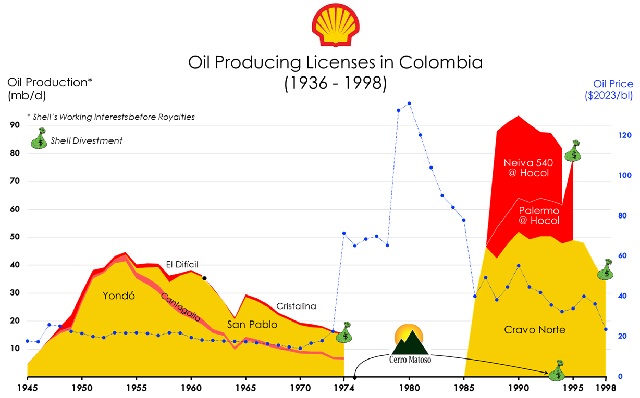

This week’s Analyst’s Desk contribution is from periodic contributor Tomás de la Calle, who brings us the checkered history of Shell’s on-again-off-again relationship with Colombia.

We used to think that the Petro government and its Ecopetrol leadership were no more subject to scandals than any other Colombian government we have observed at close range. They’re not. They’re definitely worse. What implications (if any) for the industry, and those doing business with Ecopetrol?

Another fall in Ecopetrol’s earnings, more handwringing and more questions about the Petro government’s handling of the country’s most important economic asset. This time, someone even tried floating a rumor that CEO Ricardo Roa would step down after the board meeting.

This week a “potpourri” of varied, vaguely related small notes that, together, turn into a commentary on the state of the Colombian hydrocarbons industry.

Although next week we should start seeing 1Q25 results, we are just getting around to our summary of 2024 Average Realized Oil Prices, Netbacks and other operating key indicators for the Colombian industry. Brent was down slightly (3%) last year so what could we hope for in netback?