The VI Oil, Gas, and Energy Summit hosted a compelling panel discussion centered on the future of natural gas, and self-sufficiency in the medium and long term.

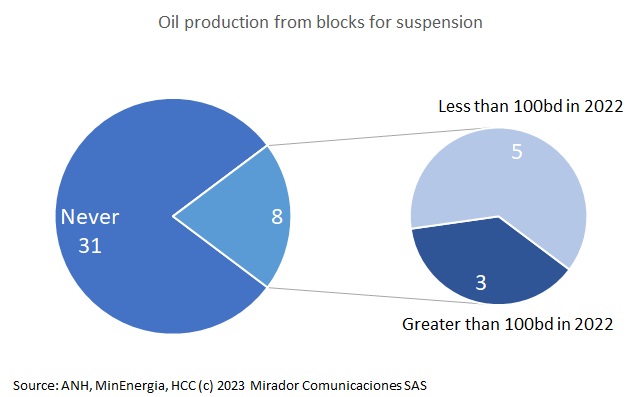

In its passion to avoid auctioning additional oil and gas exploration contracts, the Petro government wants to revive 39 blocks that the ANH has suspended at the companies’ request. Is there really an opportunity to “return the suspension request to sender” and create new reserves and production? And if so, how much production could be affected?

The Colombian government announced that it is working on a new round for the permanent allocation of hydrocarbon areas.

The National Mining Agency (ANM) granted new mining contracts.

Colombia’s Vice Minister of Energy, Miguel Lotero Robledo spoke about the possibility of holding a new oil auction this year.

ANH’s Armando Zamora Reyes spoke about the possibility of holding a new hydrocarbons auction in Colombia.

Colombian authorities and oil companies signed the contracts awarded in the last oil round.

The Colombian Chamber of Oil, Gas and Energy (Campetrol) spoke about the current state of the oil sector in the country.

The government has managed to reactivate the signing of oil contracts in recent years, creating great prospects for investment in the country.

This past week, the ANH held its Colombia Round 2021 auction and there can be no doubt it was a great success. Thirty blocks were awarded, the most since 2012 when oil prices were over US$100/bl (and to be frank, many of the blocks assigned were never worked). What went well and what could be improved?