Sunday, February 1st, 2026

For reasons that should be obvious, this quarter’s big topic of discussion (already) is the fate of Venezuela and what it means for the global oil and gas sector – and Colombia’s industry in particular. A (virtual) panel discussion at Colombo-Canadian Chamber of Commerce (CCCC) shed much light on the topic with much heat (passion) as well.

Colombia’s Environment and Sustainable Development Ministry has opened a public consultation to define the roadmap for implementing the Escazú Agreement, aiming to strengthen environmental democracy and guarantee rights to information, public participation, and environmental justice.

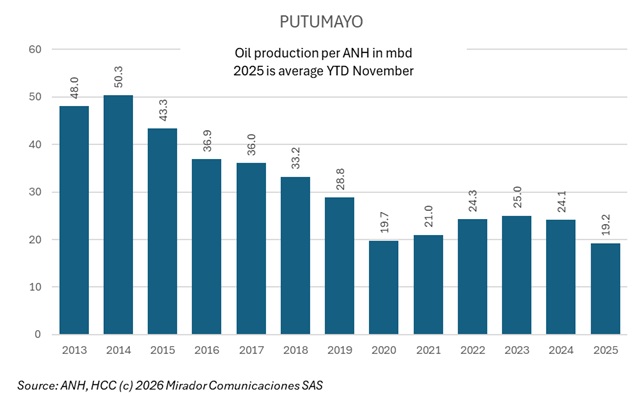

Ecuador’s decision to raise crude transport tariffs through its Trans-Ecuadorian Pipeline System (SOTE) from US$3 to US$30 per barrel—a 900% increase—has forced Colombian oil companies to evaluate costly alternatives for evacuating production from southern Putumayo department.

Guyana’s petroleum boom transformed the South American nation of 800,000 inhabitants into the world’s largest per capita oil producer and Latin America’s fastest-growing economy.

Ecopetrol and the José Benito Vives De Andréis Marine and Coastal Research Institute (Invemar) signed a renewed collaboration agreement to advance knowledge generation and conservation of Caribbean seabed ecosystems, building on their existing framework partnership.

Colombia’s Superintendency of Corporations (Supersociedades) chief Billy Escobar revealed that state-owned enterprises Industria Militar (Indumil) or Ecopetrol could acquire struggling fertilizer manufacturer Monómeros if U.S. sanctions are lifted.

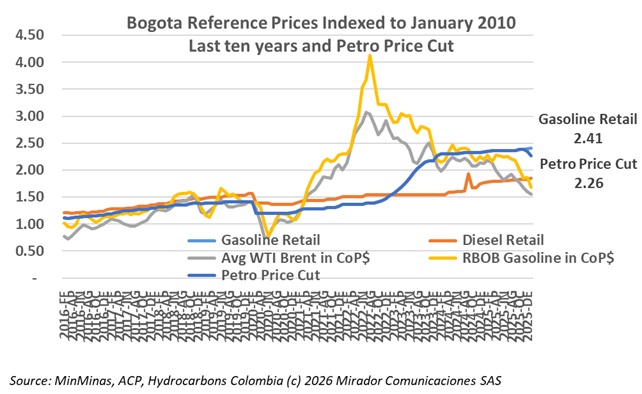

President Gustavo Petro announced Colombia will begin reducing gasoline prices after fully settling the Fuel Price Stabilization Fund (FEPC) debt that reached approximately $70 trillion inherited from the previous administration.