This phrase of Clausewitz comes to mind this month as Mordisco gets more “stick” than in recent months while others, including the ELN, get offered “carrots”. Meanwhile, the Segunda Marquetalia’s alias Ivan Marquez has not returned anyone’s calls for month so the press speculated he was dead. High Peace Commissioner Otty Patiño assures us he’s just resting.

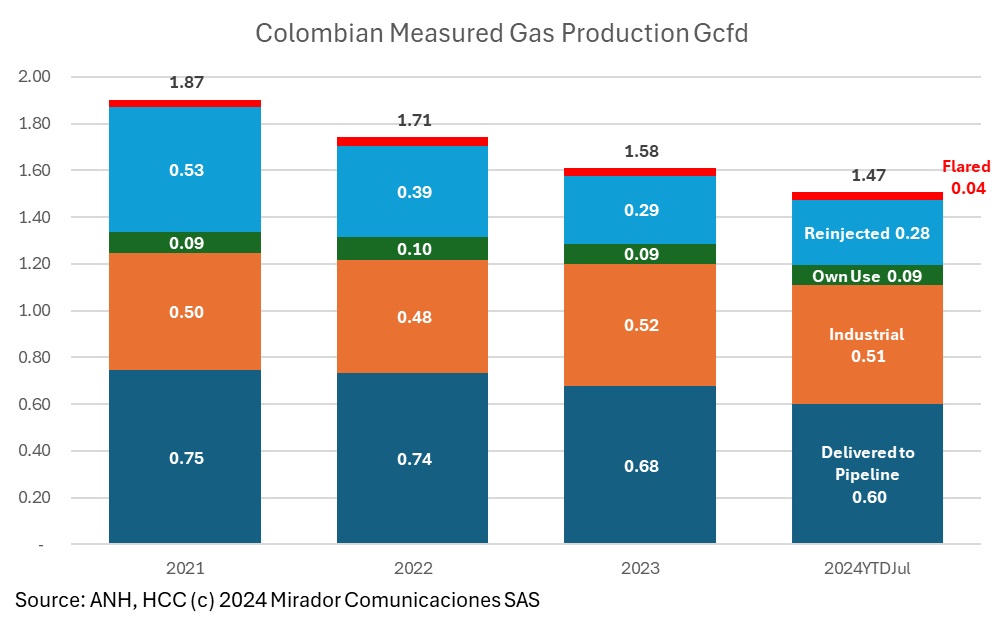

And would it make a difference? MinEnergia Andres Camacho said that all gas produced should go to an end consumer suggesting they would audit fields to ensure no gas was “wasted” and thereby address the national shortfall. Is this really a solution? We looked at the data.

At the beginning of October, the oil and gas industry held its annual three-day summit, this time in Cartagena. Overlapping slightly, the Petro government also held a three-day summit called Feria de las Economias para la Vida (Economies for Life Fair) or FEV. The President and the Minister of Energy at least seemed to position it as the opposite of the Oil and Gas Summit.

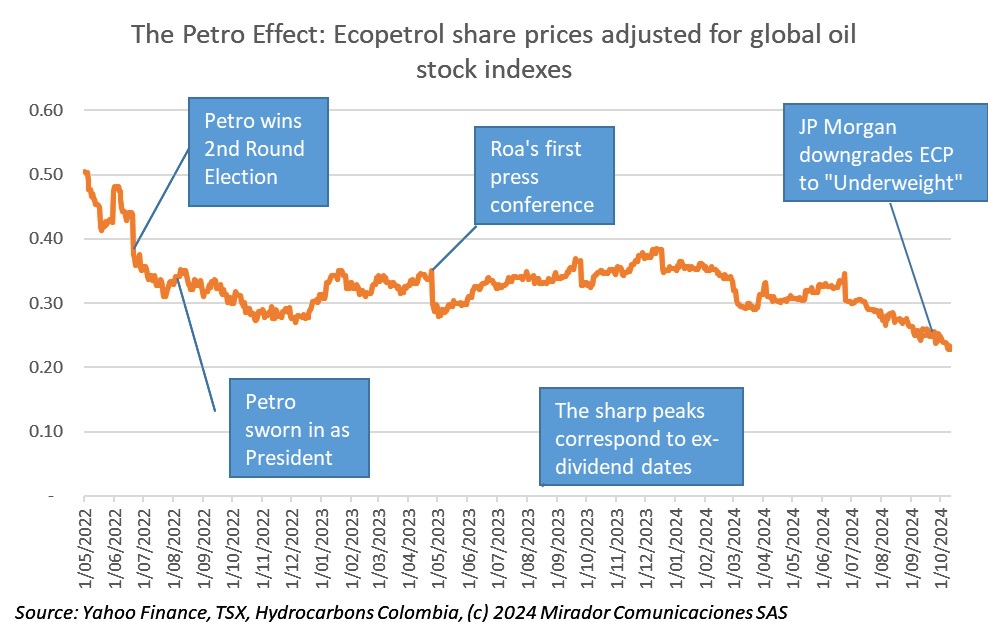

The press has been chattering about Ecopetrol’s stock price for most of the third quarter. The ADRs were US$12.67 on June 24th (the last ex-dividend date) and closed last Friday at US$8.74 down 31%. The Colombian government, Ecopetrol’s 88% owner, seems unconcerned.

The ELN process is suspended! No wait. We reported that last month. But this month, Petro confirmed it. He’s given up on them. Still old news. The process with the Segunda Marquetalia almost fell off the rails but the two sides will meet now in Cuba. Didn’t we say that before? Maybe. Or something similar. The Clan? No change? Mordisco? Still blowing things up? Calarca? Not clear. Yesterday’s news.

Frank Pearl, president of the Colombian Oil and Gas Association (ACP), stands on the front lines of the industry’s relationship with the fervently anti-oil government of President Gustavo Petro. Pearl had just passed his one-year anniversary and Petro his second, so recently, I dropped by the ACP’s offices for a visit. I asked Frank where he saw the industry and where the association was going.

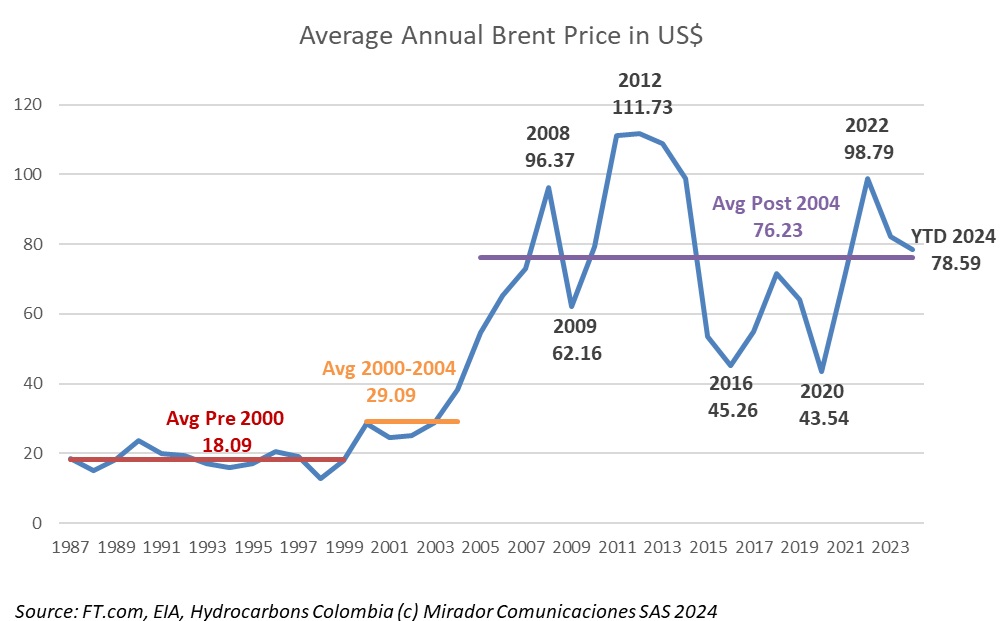

Its late September and most companies have started their planning processes for 2025. By November or December management teams will present their CAPEX budgets and performance targets for approval. For oil-focused E&Ps – and everyone else as well probably – most of the debate will be about the price of Brent.

A few weeks ago, we attended a meeting of the Colombo-Canadian Chamber of Commerce’s Mining and Energy Committee, which was held in the offices of Dentons Cardenas & Cardenas. The topic concerned changes to Colombia’s environmental sanctioning law and while the industry hopes never to have to confront a sanctionable situation, it is important to understand the penalties and how they might be assessed. We asked Maria Margarita Lorduy, Head of the Environmental Law Department at Dentons Cardenas & Cardenas to provide our readers with a brief overview.

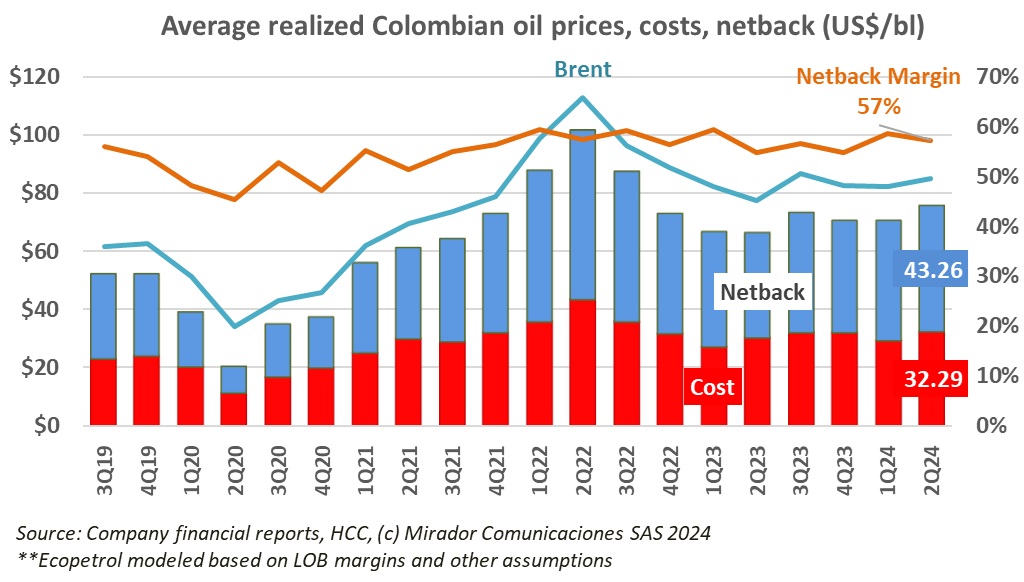

Ecopetrol’s Net Income decline in 2Q24 attracted much negative commentary. While we worry about the NOC’s medium and long term performance, this was not a great quarter for anyone from a Net Income perspective while operating results were as expected.

The government hasn’t scheduled the funeral but the ELN process died this month, even if only unofficially. The autopsy is pending and resurrection is not out of the question, but for now, the corpse is lying in the front room waiting for somebody to do something with it. Fighting has restarted. As we begin the third year of President Gustavo Petro’s “Total Peace” initiative, everyone, including the government, wonders about a change of strategy.