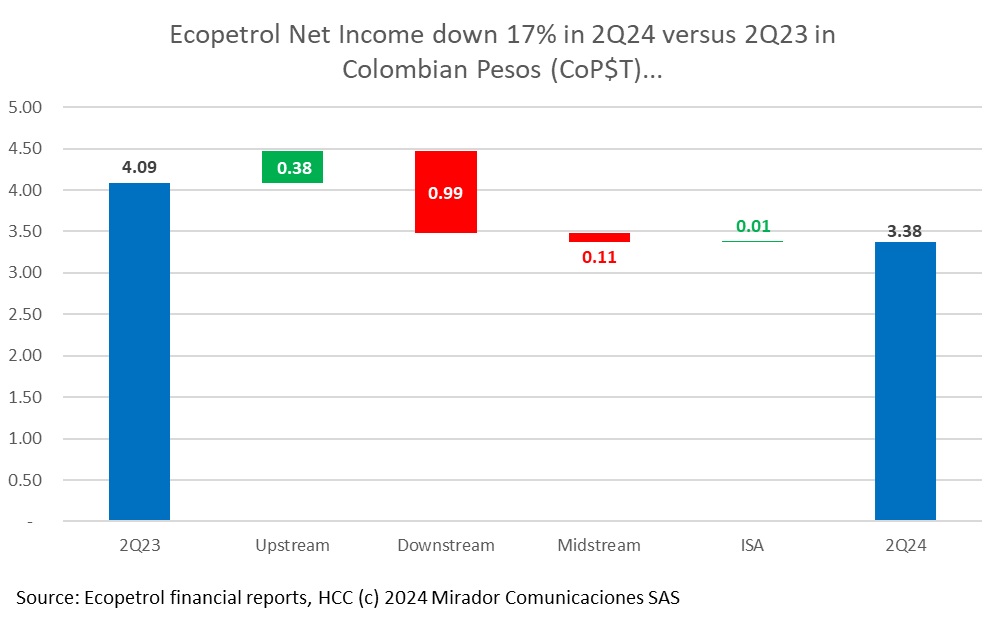

On the first day of Shareholder Stewardship 101, the professor reminds everyone that different investors measure performance differently. One group of shareholders prioritizes short-term performance, long-term performance concerns others, and dividend flow to others. We know that Colombian President Gustavo Petro never attended that class but Ecopetrol Ricardo Roa seems to have missed it as well.

And it’s only half over… The past two years since President Gustavo Petro’s inauguration on August 7th 2022 have not lacked for excitement – or risk. For oil and gas investments in Colombia, the Chinese curse “May you live in interesting times” has never been more apt. But, frankly, we are living it and surviving.

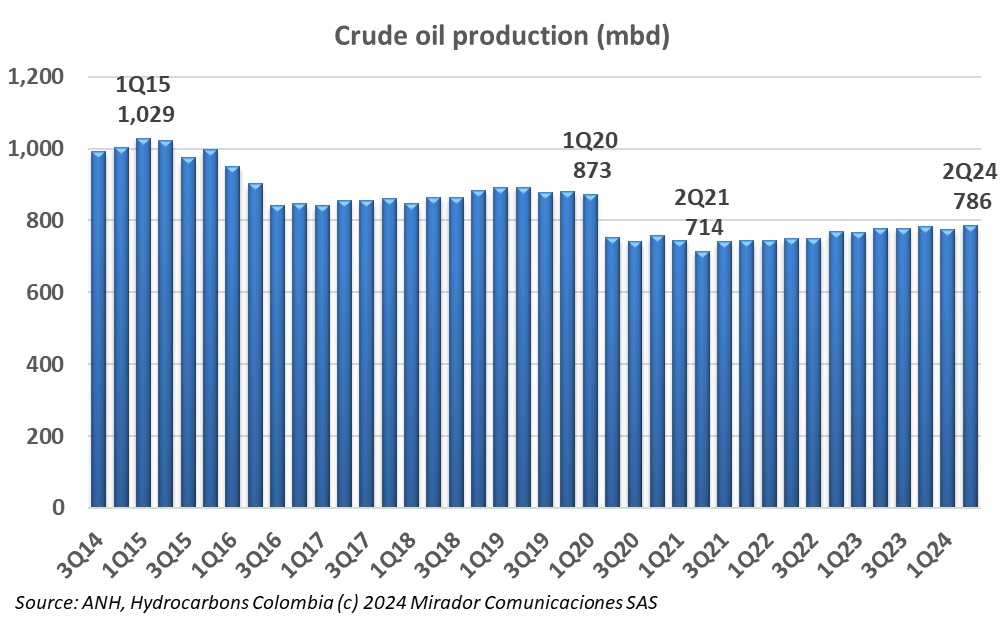

For all the doom and gloom from commentators (like us!) and falling key driver statistics, oil production is up in 2024 versus 2023. Who or what is responsible?

The Petro government is no less scandal-ridden than previous Colombian governments, despite its rhetoric during the campaign, but this month embarrassing incidents exploded within the peace process, making an already shaking situation even worse. One of these may even have contributed directly to problems in the ELN negotiations, which seem mere days away from suspension if not collapse.

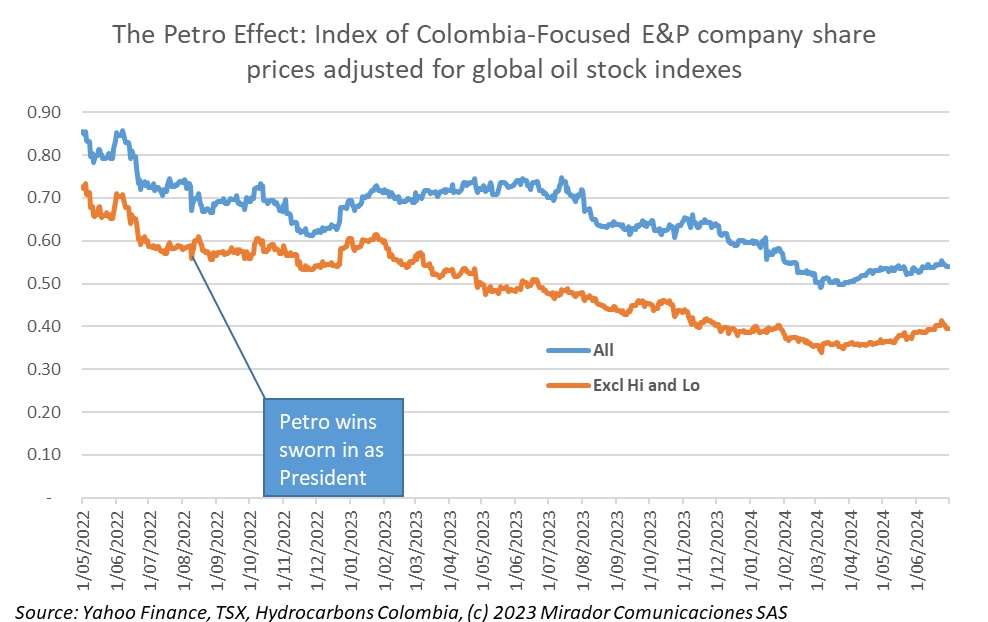

Our index of the share prices of Colombia-focused, publicly traded companies still lies well below where it was on May 1st, 2022 when the prospect of a Gustavo Petro presidency seemed distant. But there has been some improvement in the last quarter or so.

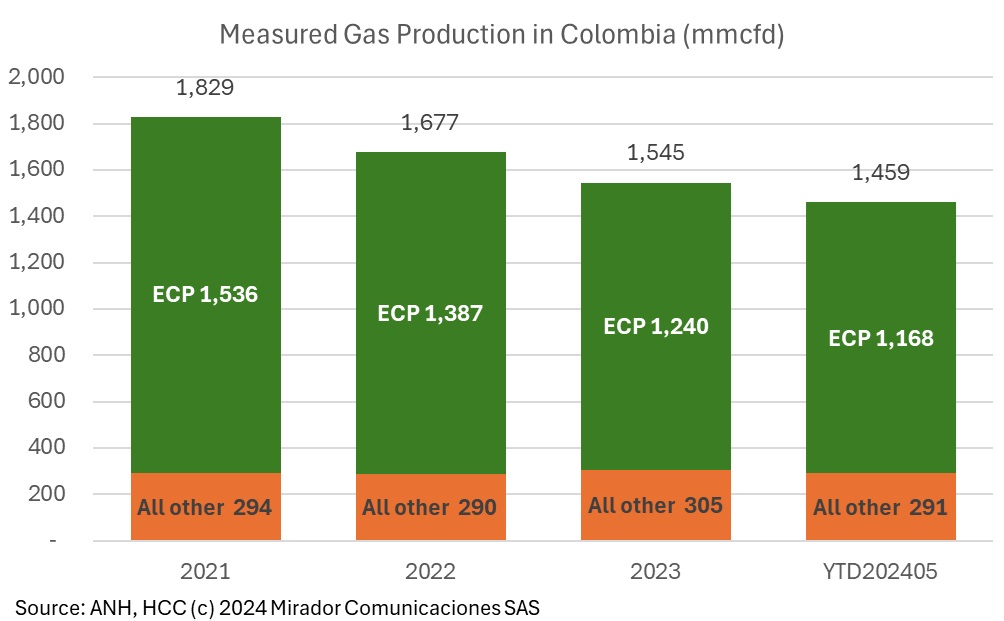

Recently, the Ministry published gas production forecasts on a steep downslope. We do not entirely trust MinEnergia, since the president wants to justify importing gas from Venezuela so we looked at the data. The story is not good although maybe not as bad as the government wants us to believe.

Frequent contributor Tomás de la Calle brings us his overview of 100 years of Colombian government oil industry policy. He tells us to look at the history in terms of three distinct ages: The Ancient Age, The Elephants Age and The Capybaras Age.

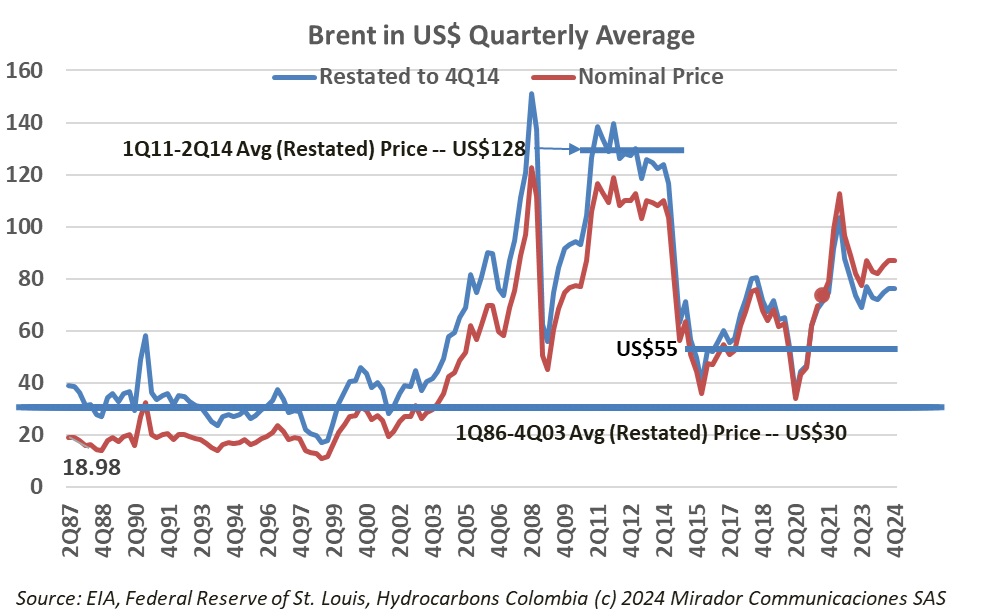

Half of 2024 is now over. In most companies, while work continues on executing the 2024 plan, attention turns to planning 2025, setting budgets and targets. The critical external variable is the price of oil. We collect and analyse statistics on Brent which we offer here with commentary to help with the process.

Well maybe not as bad as last month, but bad. More news items than we have ever seen (not a good sign by itself) and all topics trending down. Only good news out of the Segunda Marquetalia negotiations gave any positive glimmers.

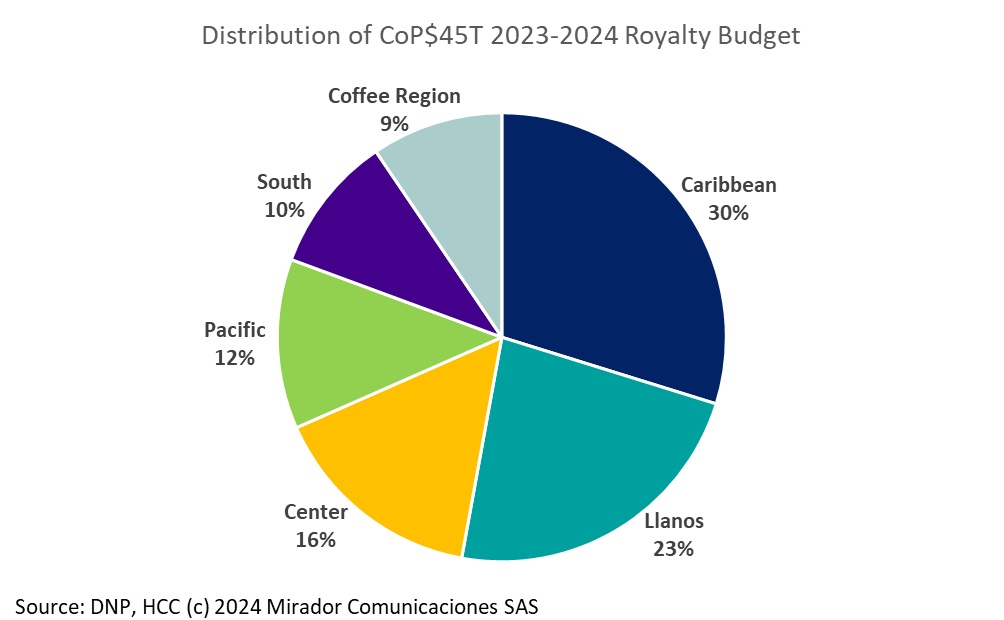

We came across the National Planning Department’s detailed royalty budget for 2023 – 2024 (a two-year budget) and a bit of analysis got us thinking about what drives the allocation. The simple pie-chart illustrates some of the key points but we did some more sophisticated work to show the main levers.