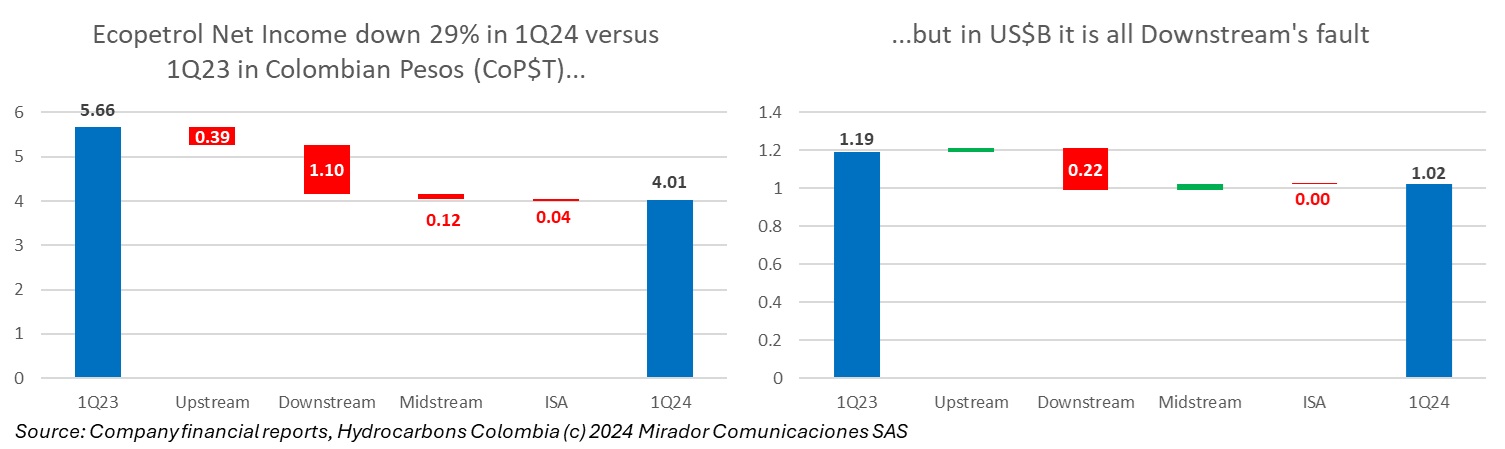

The headlines scream “Ecopetrol Net Income falls 29%!” with a picture of Ricardo Roa looking forlorn (as he often does these days). The text alludes to Roa’s (many) legal issues caused by his responsibility for Gustavo Petro’s presidential election campaign, trying to tie these somehow to the NOC’s falling performance. As always, the reality is considerably different – and more complex than what you read in the popular press although they sometimes get it right. Roa’s leadership and tenure remain controversial.

Colombian President Gustavo Petro said this in his X (Twitter) account after the country’s Armed Forces successfully downed 15 dissident FARC soldiers near hotspot El Plateado, Cauca. Maybe it was the president’s well-known flare for the dramatic. Maybe it was frustration. Maybe it was a message to the dissident FARC or the ELN or the Clan del Golfo or all. Maybe it was a mix of all three reasons.

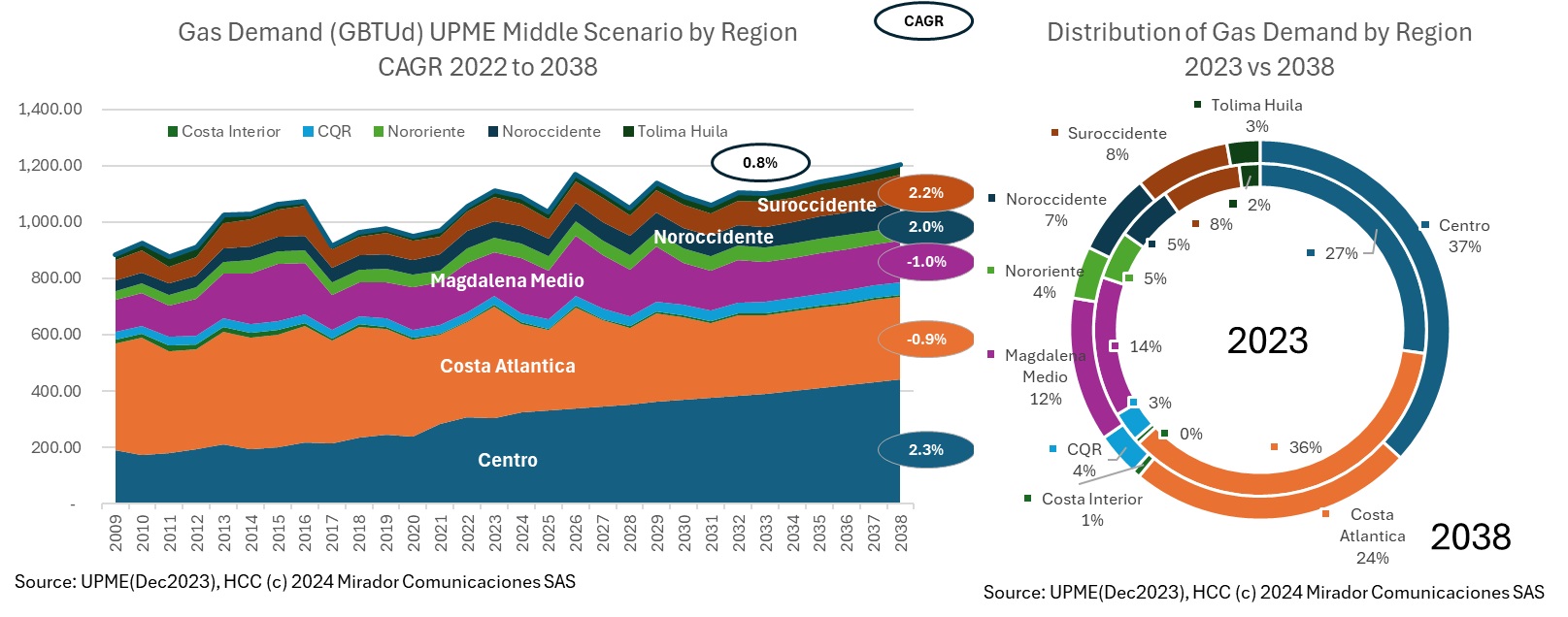

As the year ends or as the next one starts, MinEnergia’s research institute, the UPME, updates its gas logistics plan, based on a new demand forecast. They never announce it. It never hits the press. We look for it and sometimes find it easily. Sometimes not. Recently it appeared (to us at least) dated December 2023. Here are some quick graphs and comparisons, in the light of last year’s MinEnergia “roadmap” for a just energy transition.

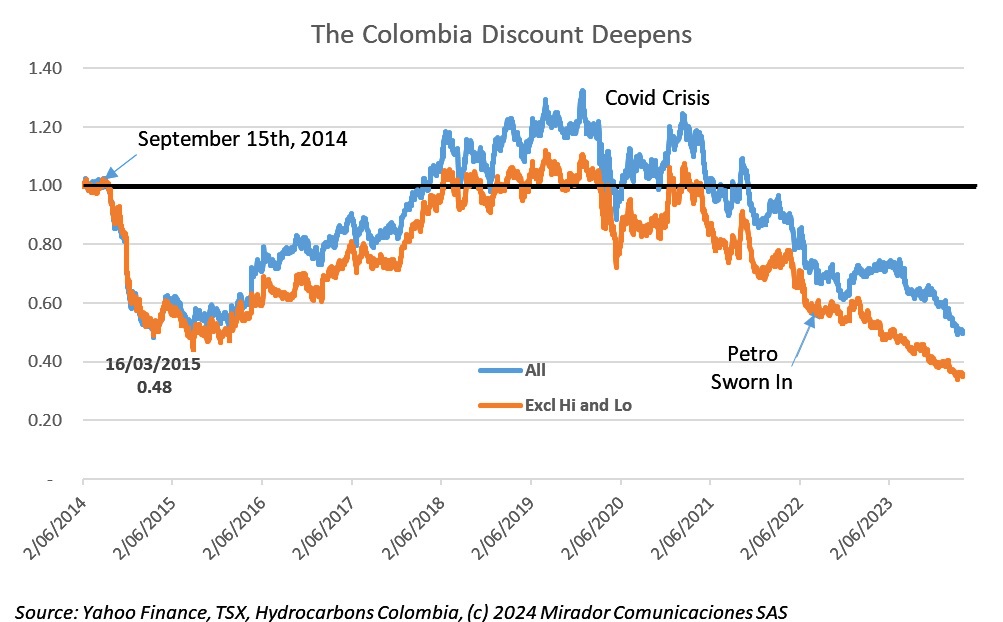

Just under two weeks ago on April 4th, 2024, we published the news that the Administrative Tribunal of Cundinamarca (TAC) had rejected Hupecol’s lawsuit over its environmental license for the Serrania block. In 2016, the license had been granted and then revoked days later after a public outcry, rendering the block useless. The TAC’s decision suggests that existing environmental licenses can be revoked at the whim of the National Environmental Licensing Agency (ANLA) at any time, significantly weakening investor confidence in Colombia’s legal stability. We asked Dentons Cardenas & Cardenas (Dentons) for its opinion and we provide some non-legal opinions of our own.

Former Pacific Rubiales CEO, Ronald Pantin, (now a board member at NG Energy) used to complain about a “Colombia discount” that investors imposed on E&Ps share prices. He believed the discount arose from unfavorable Colombian government policies that penalized the industry. Statistically, the discount disappeared for a while but returned with a vengeance and, seemingly, in free fall, deepens steadily.

Against the backdrop of Naturgas’ annual congress, this week in Cartagena, contributor Tomás de la Calle worries about the impact of Petro-government policies on Colombia’s self-sufficiency in gas. He foresees a sellers’ market – which usually means higher prices – in the near future.

Another month of low press activity – one more than February with two more days – and another ride on the rollercoaster although we moved neither closer nor further away from peace by the end. Both the ELN and alias Mordisco processes came off-the-rails during March and both also were righted by Easter. However, the ExFarc / Mordisco negotiations remain on very shaky ground with the ceasefire suspended and the Army preparing to dislodge the dissident leader’s gang from Jamundí.

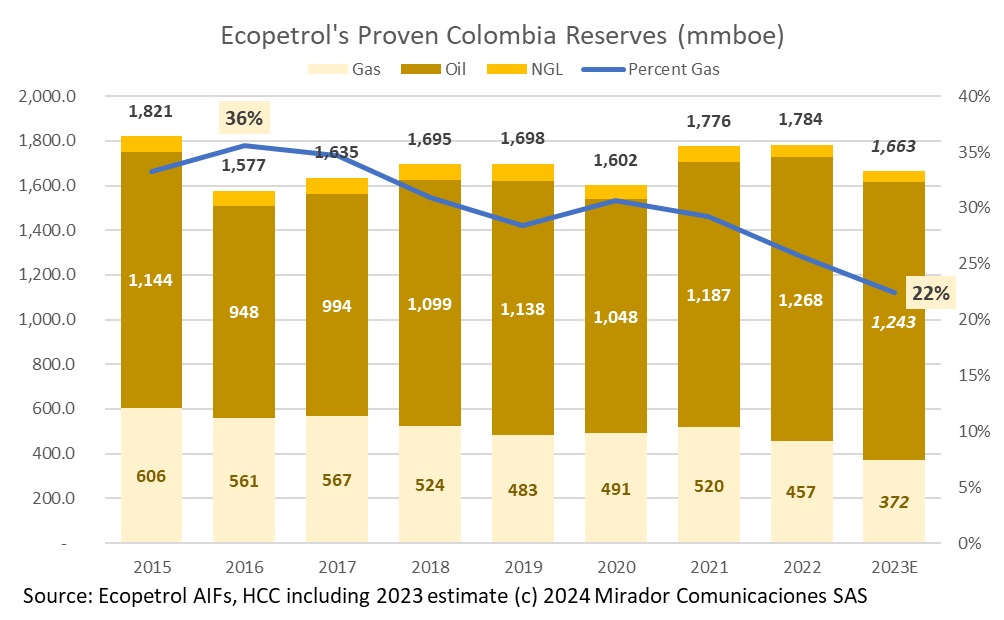

We won’t see the official reserves report for a month or so but we have the reports of the major Colombia-focused players. That should give an indicator of how things went last year. Do not expect great news especially when the NOC – which contributes over 60% of reserves – has a down report.

Ironic that anti-oil Colombian President Gustavo Petro should lead a so-called “petrostate”, a country with an above-average dependence on petroleum for its economy and especially its government revenues. However, an updated study by Carbon Tracker of countries threatened by energy transition shows Colombia in a low risk category.

The company, MinHacienda and those sympathetic to the government quickly blamed Ecopetrol’s 43% drop in Net Income in 2023 on oil prices. Petro attributed it to the end of fossil fuels. The opposition blamed government mismanagement. Who is right or perhaps, what is the right balance between the various partial explanations?