Colombia’s Works for Taxes (Obras por Impuestos) mechanism will begin 2026 without an approved quota, according to the Territorial Renewal Agency (ART), which confirmed that despite inquiries from companies, territorial entities, and community organizations, the maximum amount for 2026 remains undefined.

Colombia’s government seeks to convert a transitional 1% tax on petroleum, gas, and coal extraction into a permanent levy through an economic emergency decree, following Congress’s rejection of the tax reform legislation that originally contained this measure. Finance Minister Germán Ávila indicated that, after the financing law’s failure, the emergency mechanism would be utilized to recoup resources needed to complete the COP$546T budget.

Colombia’s National Planning Department (DNP) identified execution alerts in 3,275 royalty-funded projects valued at COP$19.7 trillion through the General Royalties System monitoring. The alerts emerged among 5,950 total projects reviewed, affecting potential completion and development of these initiatives.

Colombia’s Colombian Petroleum and Gas Association (ACP) president Frank Pearl acknowledged the Petro government presented significant challenges for the oil and gas sector, but emphasized some technical advances occurred despite policy headwinds.

Colombia’s government unveiled comprehensive measures addressing anticipated 2026 gas deficits through coordinated actions with sector agents, the Superintendence of Public Utilities (SSPD), and the Superintendence of Industry and Commerce (SIC).

We justify our three-week end-of-year vacation by the limited amount of news the industry produces over the period. This year was no exception, at least in the oil and gas sector as strictly defined. However, President Gustavo Petro continues his class warfare. NOTE: See end of article for a brief commentary on this weekend’s events.

President Gustavo Petro defended his government’s economic achievements while directly attributing Ecopetrol’s declining profits to the state oil company’s failure to adopt the energy transition he advocates.

Colombia’s exports totaled US$4.3B FOB in October 2025, declining 0.2% compared to October 2024, breaking the positive trend from September when the country reached its highest export value of the year, according to DANE.

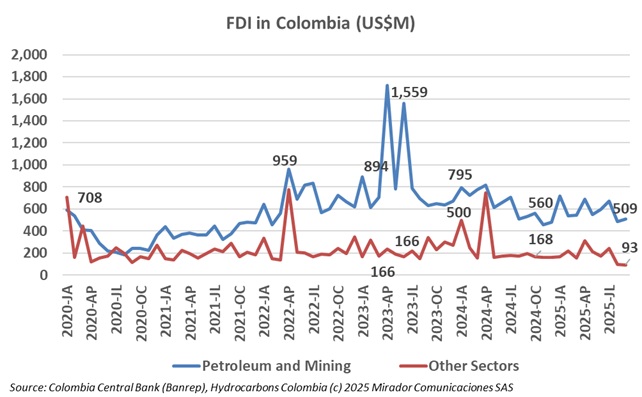

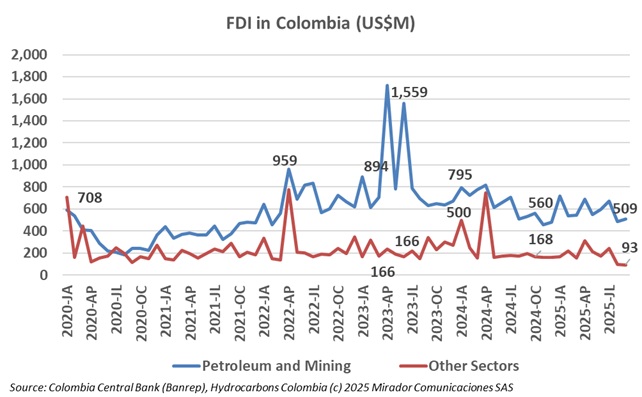

Foreign Direct Investment (FDI) in Colombia has declined for two consecutive years, reflecting increased risk perception and deteriorating investment conditions. According to Banco de la República’s Balance of Payments data, accumulated FDI through the third quarter of 2025 reached US$6.969 billion, representing a 20% drop compared to US$8.671 billion in the same period of 2024.

The Unión Sindical Obrera (USO) called on November 28, 2025, for Colombia to develop experimental fracking pilot projects with “the highest oversight” to open possibilities for developing unconventional deposits as an effective short-term measure to increase oil and gas reserves.