While Latin America’s oil and gas sector surges ahead, Colombia has chosen to sit quietly on the sidelines.

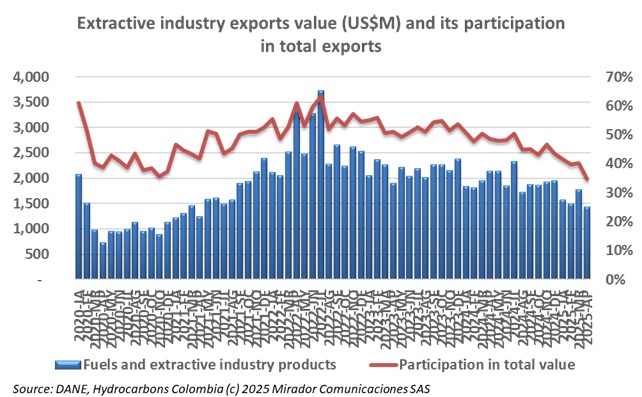

The National Administrative Department of Statistics (DANE) reported the value of Colombian exports during April 2025.

Colombia could be forced to rely permanently on oil and gas imports if the current government policies under President Gustavo Petro are not reversed, according to a stark warning from the national Comptroller General’s Office.

According to the latest Latam Pulse report released by Bloomberg and AtlasIntel, Colombia ranks as the second-most politically risky country among key Latin American economies and also holds the second-lowest presidential approval rating in the region.

President Gustavo Petro has once again urged Ecopetrol (NYSE: EC) to sell its fracking operations in the US.

The presidency of Ricardo Roa at Ecopetrol (NYSE: EC) is facing intensifying scrutiny as corruption allegations continue to mount.

Colombia has been ranked as the fifth most complex country in the world to do business, according to the 2025 Global Business Complexity Index released by TMF Group. The list is led by Greece, followed by France, Mexico, Turkey, and then Colombia.

Oil and gas investment in Colombia is set to decline by 10% in 2025 due to lower Brent crude prices and an increased withholding tax on natural gas companies, according to the Colombian Petroleum and Gas Association (ACP).

Following the release of its official 2024 report on oil and gas reserves, Colombia’s National Hydrocarbons Agency (ANH) hosted a public presentation from Bogotá to share key findings.

The Colombian Association of Petroleum and Gas (ACP) released its annual economic report, “Investment Trends in Oil and Gas Exploration and Production in Colombia 2024 and Perspectives 2025: A Strategic Sector in Critical Condition.”