The Colombia-Canada Chamber of Commerce (CCCC) is a protagonist in the oil and gas industry, considering the importance of Canadian investors in the sector.

For us, last week was the last of the quarter because we use Friday closing prices for our tracking. Traders feared the impact on demand of a ‘Grexit’ and Baker Hughes North American rig counts finished higher for the first time in this year.

We think Ernesto Borda is one of the clearest observers of the social and security challenges in Colombia’s countryside. His firm, Trust Consulting, helps companies in the extractive sector manage the complex political, social and security environment where they operate.

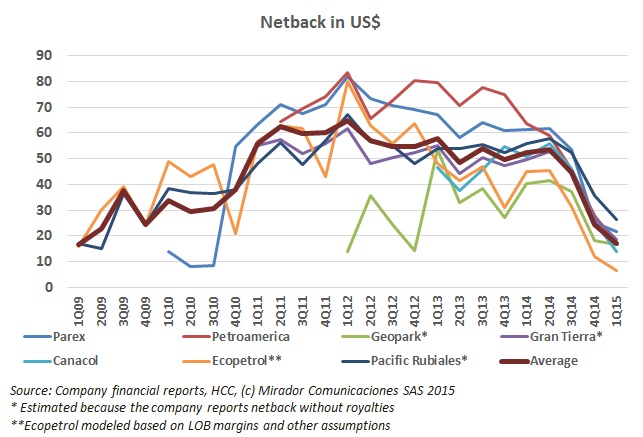

We published this article on operating costs and netback at the beginning of June but it did not seem to get much attention from readers until we published an article comparing operating costs for the regions various NOCs.

This week it became clear that companies are engaging the benefits offered by the National Hydrocarbons Agency (ANH), and more are planned. Attacks have taken their toll, especially in Putumayo and we mark the one-year milestone of the fall in oil prices.

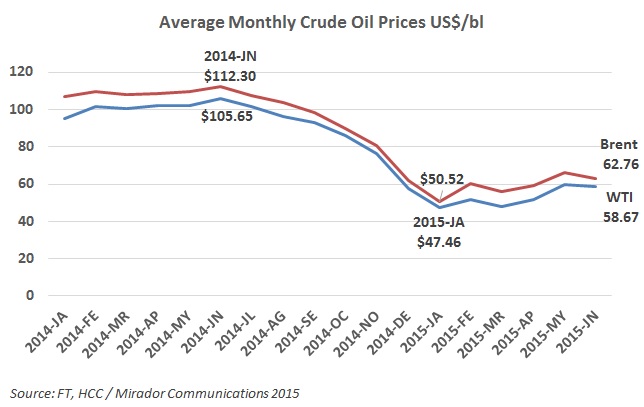

The issue of the industry’s viability continues to haunt us as oil prices stubbornly stay below US$70 and a long way from US$100 where they were only 1 year ago.

Our opinion this month comes from the ACP’s Francisco José Lloreda on how the current crisis will negatively impact Colombia’s broader goals. Too bad we have only seen this expressed in the industry press and not where voters would see it.

Apart from oil prices (still going down!), Ecopetrol transition is one of the key issues for the industry at the present time and we start with a harsh commentary on soon-to-be CEO Juan Carlos Echeverry from political commentator, Mauricio Vargas who worries that the NOC will become yet another source of political patronage.

The USO will not go forward with threats of an indefinite strike and the National Hydrocarbons Agency (ANH) has a new president, who faces a steep challenge from day one.

This month we start with a commentary by industry consultant Warren Levy on a healthier relationship between E&P and services companies.