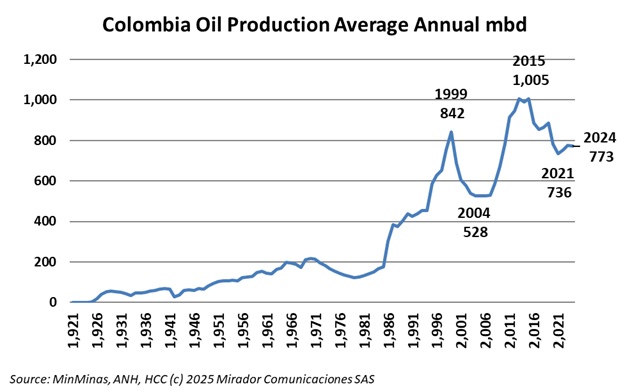

The ANH has published the detailed results for oil and gas for 2024 so it’s time to dissect what happened. Oil production was down less than 1%. We might have expected worse.

So far six ministers have resigned irrevocably from President Gustavo Petro’s cabinet, including his combative MinAmbiente Susana Mohamad since the first of February after three left in January. The rest have been asked to resign pro forma so the president can create a new cabinet. Why and where are we going?

We had planned to write about gas prices this week anyway but then on Friday, February 7th, one of the country’s biggest gas distributors, Vanti, said prices in some areas would have to go up by 36%. That got everyone’s attention

January ended with the above quote from the ELN’s supreme commander, alias Antonio Garcia. That’s how the second half of the month felt with over 100 casualties in Catatumbo and over 50,000 civilians displaced by the fighting.

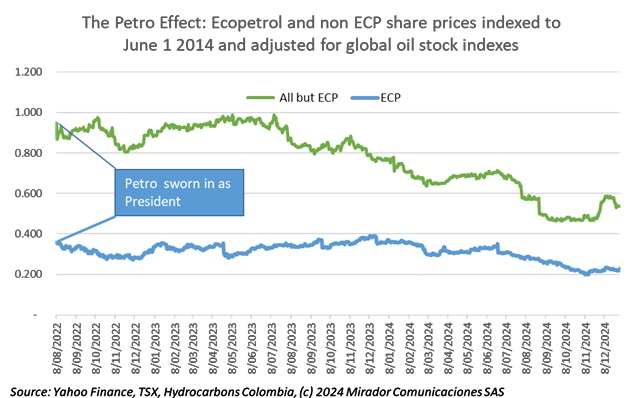

While individual company results may differ, Colombia-focused stocks as a group and Ecopetrol in particular have suffered since the arrival of Gustavo Petro as president.

Last week we wrote our annual Fearless Forecasts article which focuses on the quantitative. But we also talk about the policy environment, really about politics and that proves especially important in the runup to elections in 2026. Readers ask us frequently about what comes next after August 7th, 2026. We realized that the topic deserved an analysis of its own.

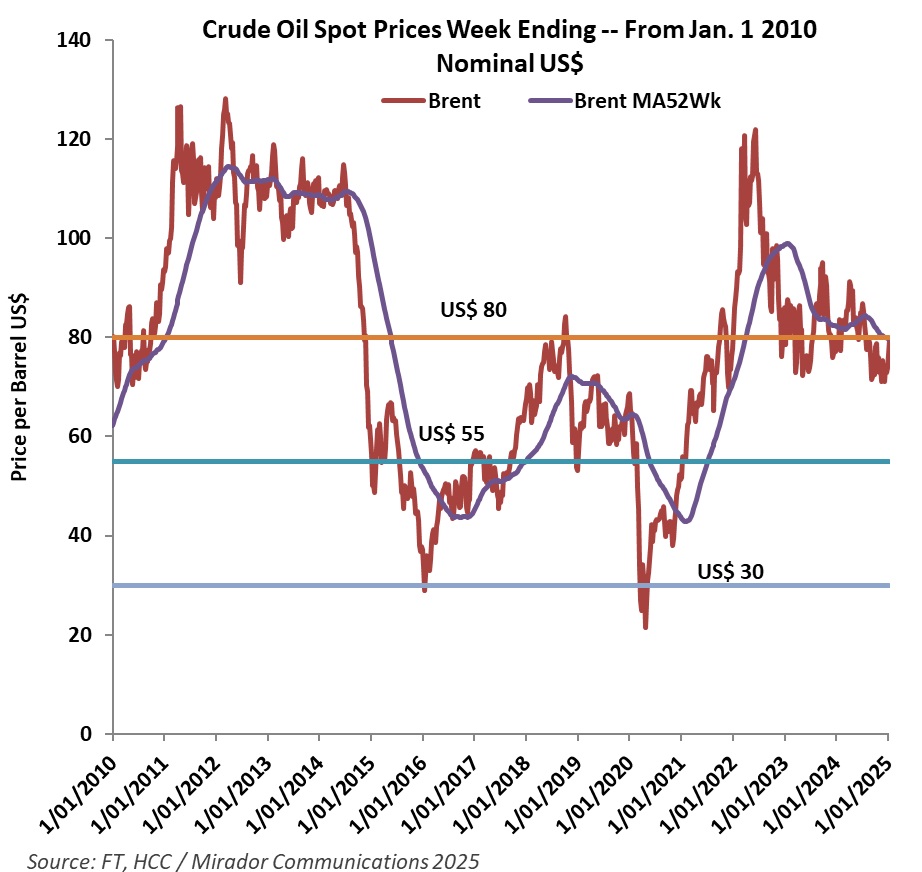

Time for our annual predictions article. Mostly focused on quantitative measures of the industry – prices, Capex, reserves, production – but also some comments on policy issues for 2025.

With this quote from High Peace Commissioner Otty Patiño, Colombia kicked off a month where virtually nothing of substance happened although the violence continued.

Statistically we do not have the final numbers. We do not even have the November numbers. And although we should be getting to the government quiet period for year-end holidays, anything could still happen. But we have a tradition of a “year-end wrap up” before the holidays so we can do our “Fearless Forecasts” in early January.

This month yet another peace process splintered with a small group staying at the table and the primary target withdrawing from the negotiations. Alias Ivan Marquez’s Segunda Marquetalia fired its negotiating team and (figuratively) went back to the mountains, leaving Alias Walter Mendoza without a mandate, except for his own troops.