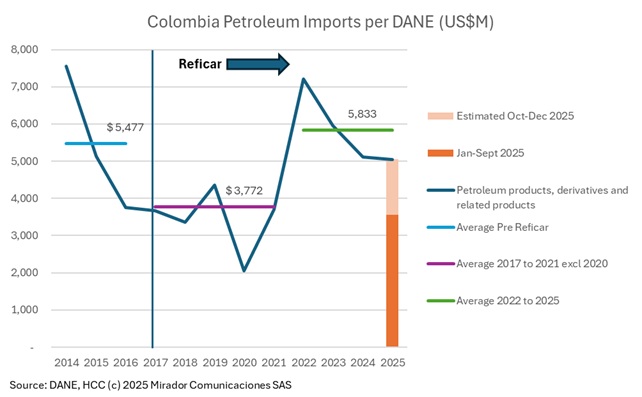

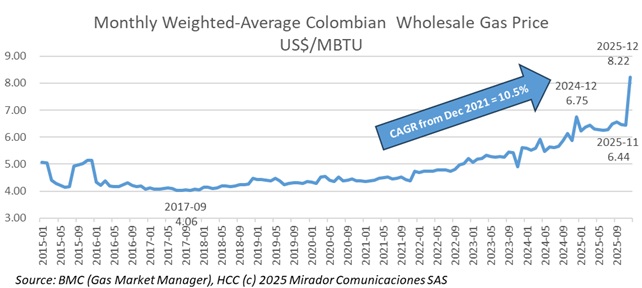

From the beginning President Gustavo Petro’s government seemed determined that Colombia would lose its self-sufficiency in fossil fuels. It appears to be accomplishing that goal, certainly in gas, and maybe in liquids as well.

The Colombian government, through the Ministry of Mines and Energy, announced an urgent package of measures to stabilize natural gas prices and protect residential users, small businesses, taxi drivers, and productive sectors dependent on this service.

Colombia’s Energy and Gas Regulatory Commission (CREG) issued two key resolutions in late November 2025 to address the country’s natural gas supply constraints and facilitate imported gas contracting. The measures aim to eliminate barriers that limit or discourage imported gas procurement while enabling short-term transportation solutions.

Venezuelan president Nicolás Maduro announced on November 20, 2025, that his country is ready to begin gas exports to Colombia before year-end, marking a potential new phase in bilateral energy cooperation.

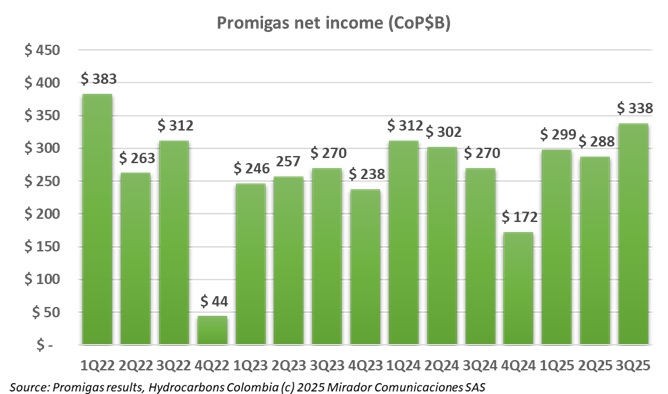

Promigas presented solid financial and operational results for the third quarter of 2025, demonstrating continued strengthening of its business portfolio while contributing to Colombia’s energy transition with reliable and innovative solutions.

Petrobras is advancing multiple natural gas exploration initiatives in Colombia’s Caribbean waters while navigating the complex approval process for its flagship Sirius project, according to Alcindo Moritz, president of Petrobras in Colombia.

Ballena on the Caribbean coast produces only a fraction of what it used to but still contributes an important amount to the country’s dwindling supplies. Ecopetrol also plans to convert it to a gas import facility.

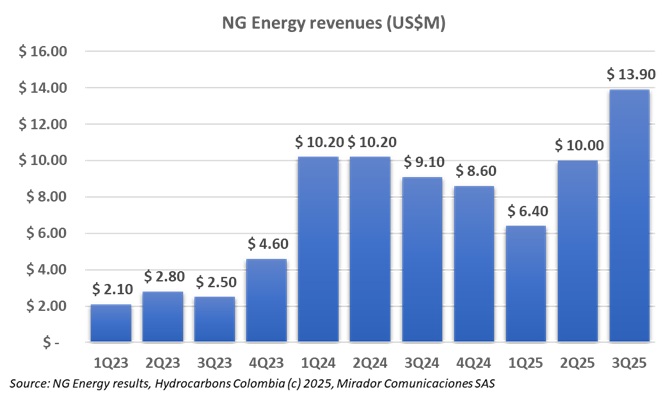

Fast growing gas producer NG Energy reported its 3Q25 financial results in a press release.

Gases del Caribe, a major player in Colombia’s energy sector, has been recognized in the Digital Transformation category of the 2025 Portafolio Awards for its innovative platform called Helious. This proprietary technology was developed to fundamentally transform the management of natural gas supply and transportation across the country.

Colombia’s long-awaited offshore gas project, Sirius, is steadily moving through its licensing stages, yet the country’s widening supply gap is prompting experts to call for an interim solution: using fracking to regain self-sufficiency while the offshore field comes online.