The prospect of political change in Venezuela has revived debate over what a mass return of migrants would mean—not just for Venezuela, but for the labor markets and demographics of the countries that have absorbed them over the past decade, Bloomberg Línea reported on January 21, 2026.

My “give back gig” is I work with the electrical engineer’s association (ACIEM) where I get involved in high technology and some energy issues. In that role, I’ve spent a lot of time at ACIEM events (like Enercol) where I got to meet ex-GEB president, Sandra Fonseca and see her discuss sectoral issues. I was somewhat surprised to see she’d left Asoenergia (where she was Executive Director) but then less surprised to see she was running for senator, under the umbrella of Nuevo Liberalismo.

Acting Environment Minister Irene Vélez Torres led a dialogue with 40 Colombian ambassadors and diplomatic mission representatives to advance preparations for the First Conference for Transition Beyond Fossil Fuels.

Colombia’s utility industry association Andesco and energy think tank CREE published a study in late January warning of mounting structural risks to the country’s natural gas supply, with all three articles covering the same report released on January 28.

President Gustavo Petro announced the government is evaluating declaring an Economic, Social and Environmental Emergency in Córdoba and Sucre departments following catastrophic flooding that has claimed 14 lives and devastated the Caribbean region.

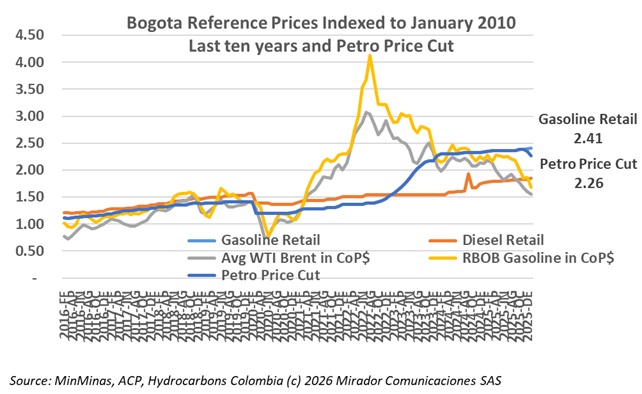

Energy Minister Edwin Palma signed a resolution making effective a CoP$500 per gallon gasoline price reduction beginning February 1, 2026, while maintaining stable diesel prices.

In a Guarumo-Ecoanalítica poll (Jan 14-22, 4,245 respondents): Iván Cepeda of Pacto Histórico leads with 33.6% support, followed by conservative attorney Abelardo De la Espriella at 18.2%, and Centro Democrático’s Paloma Valencia at 6.9%.

The Centro Nacional de Consultoría (CNC) presidential poll conducted January 15-21, 2026 among 2,202 people in 56 municipalities reveals Iván Cepeda maintaining his frontrunner position with 28.2% voter intention, while competition intensifies for second place ahead of Colombia’s May 2026 elections.

Ecuador confirmed a 900% increase in crude transport tariffs through the Sistema de Oleoducto Transecuatoriano (SOTE), raising rates from US$3 to US$30 per barrel effective January 23, 2026.

Colombia’s Constitutional Court suspended President Gustavo Petro’s economic emergency decree, halting multiple tax measures that would have significantly impacted the petroleum and mining sectors.