Ecopetrol’s Unión Sindical Obrera (USO) announced support for Roy Barreras in the March 8, 2026 presidential consultation for the Frente por la Vida coalition, marking a clear break from the government coalition’s expected candidate Iván Cepeda.

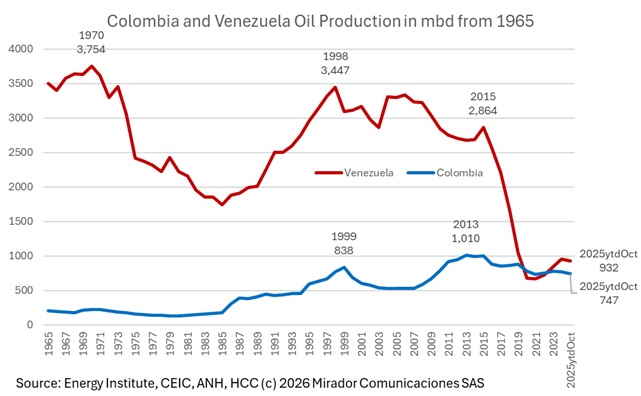

Colombia’s plans to import Venezuelan natural gas face regulatory and infrastructure obstacles following talks in Caracas between Minister of Mines and Energy Edwin Palma and Venezuelan interim president Delcy Rodríguez. While Venezuela’s side of the Antonio Ricaurte pipeline—enabled in 2007—is ready, Colombia’s segment remains non-operational and Ecopetrol cannot lead the project.

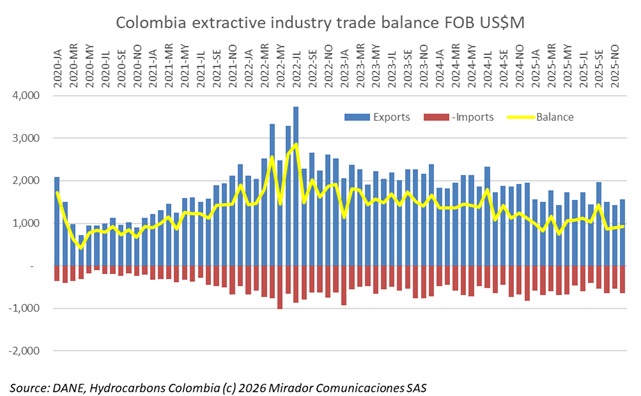

Colombia registered its worst trade deficit in history in 2025, reaching US$16.B FOB, surpassing pandemic-era records. Meanwhile, extractive industry trade balance contributed positively, although declining as well. DANE also published GDP for 4Q25 so we look at that from a sector perspective.

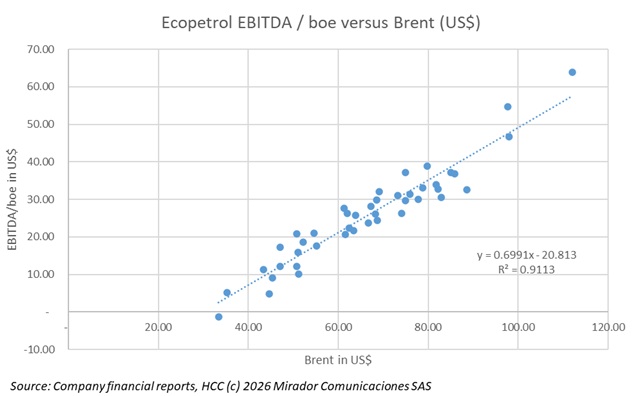

Colombia’s 2026 Medium-Term Fiscal Framework assumes Brent crude averaging US$62.3 per barrel, positioning Ecopetrol comfortably above its US$50 per barrel breakeven point quoted in third quarter 2025.

The Ministry of Mines and Energy announced February 11, 2026, that Pablo Yesid Fajardo Benítez assumed the presidency of Colombia’s National Hydrocarbons Agency (ANH), marking what the government described as “a new phase in the management of subsurface energy resources” amid energy security challenges and clean energy transition.

Colombia’s potential role in Venezuelan reconstruction—particularly through energy sector initiatives led by Ecopetrol—emerged as a central topic during President Gustavo Petro’s nearly two-hour meeting with President Donald Trump on February 4, 2026, according to Colombian Ambassador Daniel García-Peña.

Colombia’s Council of State suspended President Petro’s late-2025 minimum wage decree and ordered the government to issue a new provisional wage determination within eight calendar days, following strict criteria outlined by the high court. on February 13, 2026.

The prospect of political change in Venezuela has revived debate over what a mass return of migrants would mean—not just for Venezuela, but for the labor markets and demographics of the countries that have absorbed them over the past decade, Bloomberg Línea reported on January 21, 2026.

My “give back gig” is I work with the electrical engineer’s association (ACIEM) where I get involved in high technology and some energy issues. In that role, I’ve spent a lot of time at ACIEM events (like Enercol) where I got to meet ex-GEB president, Sandra Fonseca and see her discuss sectoral issues. I was somewhat surprised to see she’d left Asoenergia (where she was Executive Director) but then less surprised to see she was running for senator, under the umbrella of Nuevo Liberalismo.

Acting Environment Minister Irene Vélez Torres led a dialogue with 40 Colombian ambassadors and diplomatic mission representatives to advance preparations for the First Conference for Transition Beyond Fossil Fuels.