At the ACP conference in mid-October, Ecopetrol President Juan Carlos Echeverry said peace was the most important success factor for the oil and gas industry.

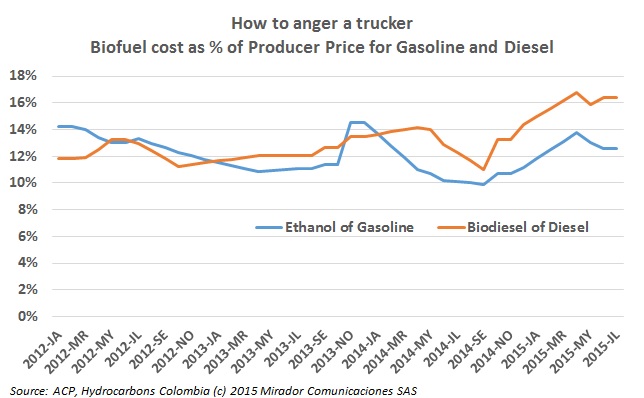

Last week we commented on the biofuel association’s attempt to win friends and influence people over rising – or at least not falling very fast – fuel prices, blamed by MinMinas on the association’s products: ethanol and biodiesel.

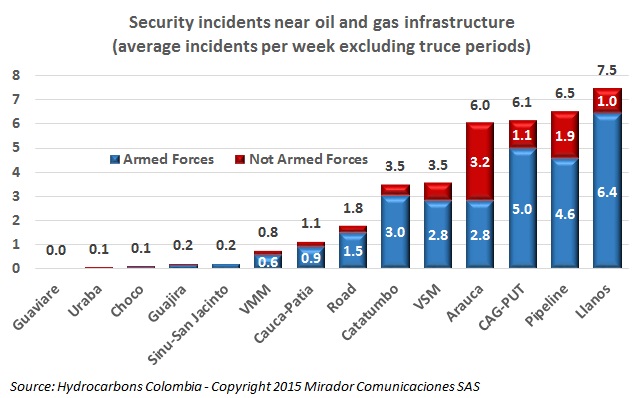

Editor’s Note: If the news from Havana is to be believed, we are less than six months away from the signing of a peace accord with the Farc.

On average, the major Colombian-committed producers gave back the gains achieved in 2Q15 in their performance relative to global indices.

October is our anniversary month. The first daily newsletter was sent on October 23, 2012. Our first Inner Circle Weekly Summary went out on October 28, 2012 although we had been publishing weekly summaries on our WordPress blog and the website (which came up in early October) before that.

Navigating the issue of indigenous rights and adhering to the prior consultation processes is one of the challenges of a responsibly managed project, and in Latin America the experience has some notable differences to the rest of the world.

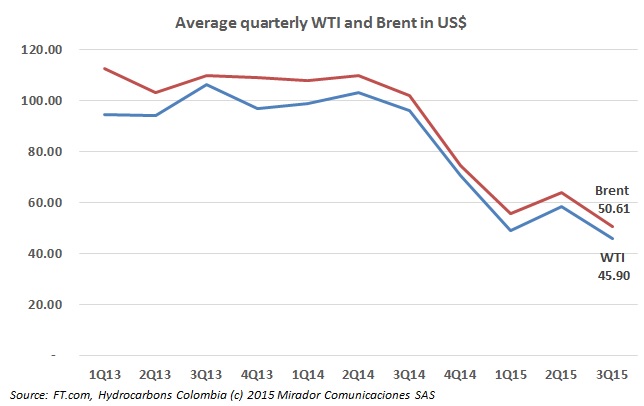

After a brief ray of sunlight in 2Q15, reality – in the form of a slowdown in the Chinese economy – sent oil prices lower, lower even than they were in 1Q15. However, September showed some signs of improvement driven (unfortunately) by troubles in the Middle East and to some extent by evidence of lower US production.

In a country full of spectacular beauty, La Macarena takes the word ‘spectacular’ to another level. Caño Cristales has to be one of the wonders of the natural world and its remote location in Colombia’s Serranía La Macarena National Park keeps it protected from commercial development.

Whatever one’s view of last Thursday’s historic handshake between Colombian President Juan Manuel Santos and Farc leader alias ‘Timochenko’, peace – at least with the Farc – looks closer today than it has for decades.

Several months ago, I published an opinion piece saying that the reorganization of Ecopetrol (NYSE:EC) in the middle part of the last decade did not go far enough and it should be broken up into several distinct businesses.