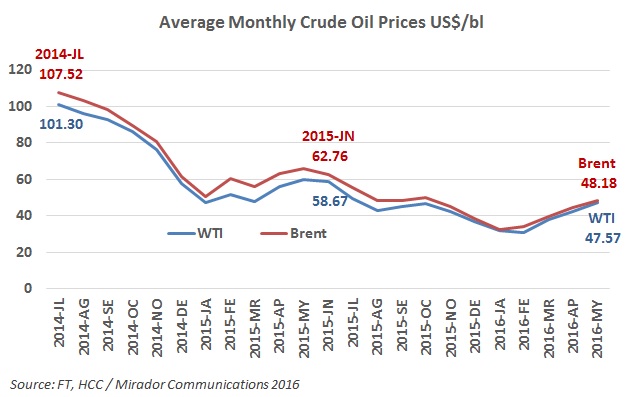

The rally in oil prices continues. Prices have risen now for three successive months in the case of WTI and four in the case of Brent. It has been difficult to break US$50 but we think traders are beginning to believe in this number.

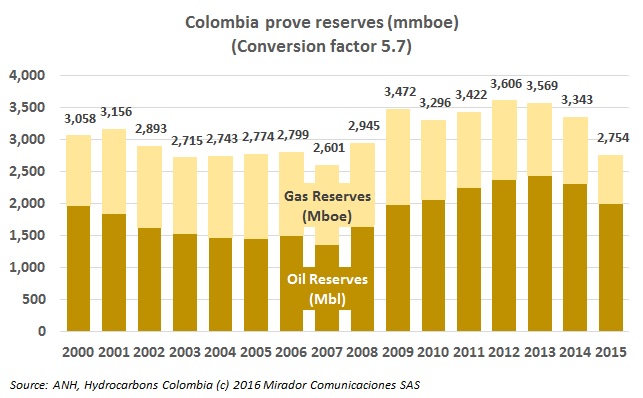

Last week, MinMinas finally published 2015 reserve data. Accentuating the positive, the press release talked mostly about probable and possible reserves, dismissing the decline in proven reserves as a temporary statistical phenomenon.

Editor’s Note: Warren Levy has been around Colombia and around the oil and gas industry for a long time. With an extensive history in the services industry, he has direct knowledge of the impact it can have on the countryside.

When I read this title in a Portafolio article, I feared the worst. So much so that I took weeks to work up the courage to read it.

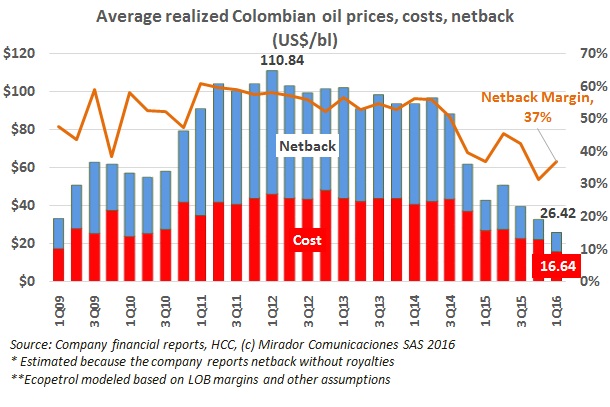

We predicted 1Q16 would be complicated for some companies based on our calculations of what Brent needed to be for them to break even. Still all the companies in our study reported positive EBITDA, at least after adjusting for impairment charges.

Editor’s Note: The Colombian Association of Petroleum Engineers (ACIPET) finds its members at the sharp end of the decline in petroleum investment, especially in exploration.

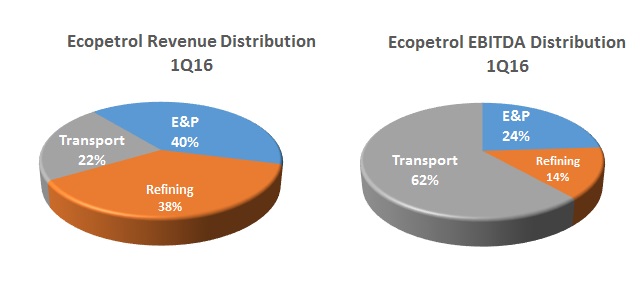

The dramatically different margins between Transport and Ecopetrol’s other Lines of Business means the profit shift continues. Although E&P and Refining represent nearly 80% of revenues, they represent less than 40% of EBITDA.

Authorities and oil industry associations have been driving home the importance of diversifying the national economy, with many operators taking on strategic projects in influence areas that stress other industries like agriculture or tourism.

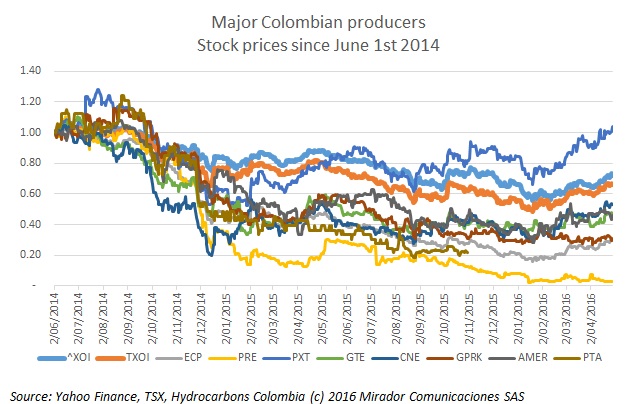

Higher oil prices definitely lifted the spirits of Colombia-committed E&P companies and their shareholders felt the same euphoria.

Editor’s Note: Jaime Checa is one of Colombia’s most respected geophysicists. When he speaks the industry listens. Checa is passionate about his profession, his industry and his country.