Donald Trump’s eminent possession of the White House has the Mexican peso in a tailspin: it is down over 10% since election day. The President-elect is an external factor.

With all quarterly-reporting public companies now in our database, we can update our trend graphs for netback and average realized oil prices.

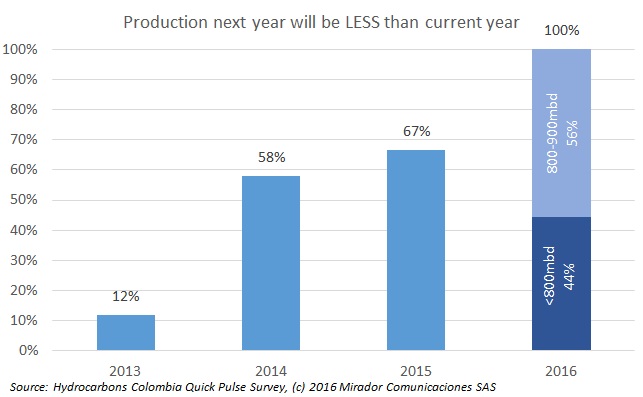

We have been tracking some questions for several editions of our Quick Pulse survey and that allows us to look at how pessimism has changed over the recent past; the evolution of ‘bad’ if you will.

Government negotiators and Farc spokespersons announced that a new peace agreement had been achieved. However, I wonder if this really means that we are closer to the post-conflict in Colombia or whether this is still way off in the distance.

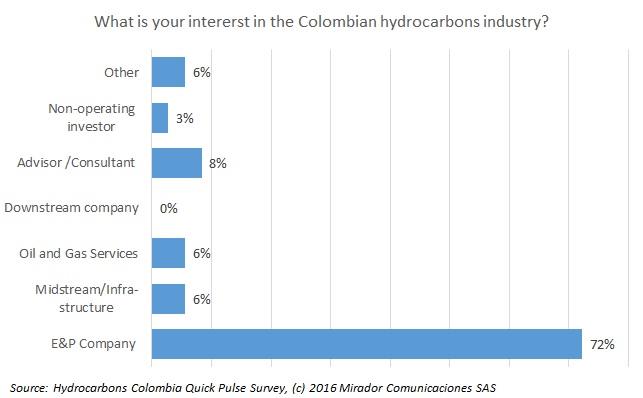

This week we temporarily merge our ‘From our analyst’s desk’ and ‘What we think’ features to analyze what you think.

Caquetá represents the new frontier for oil production in Colombia, a region with promising potential to develop reserves and a basin without much activity thus far, especially if the armed conflict ceases.

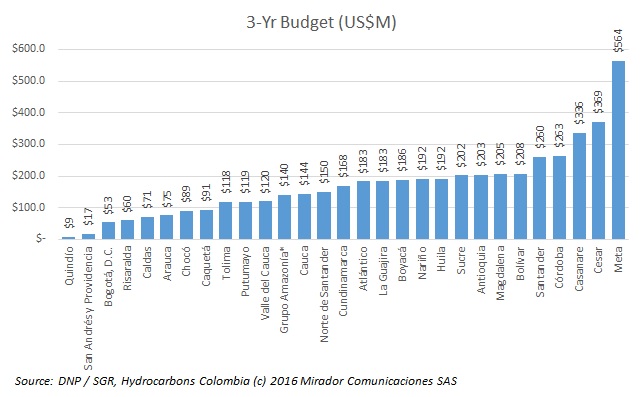

This week we published a press release by the senator from Meta, Maritza Martínez where she accused the recently-approved royalties budget of being unfair to Llanos producers including her home department.

Last week’s main story was on royalties because the Senate had summoned the Finance and Mining ministries in to explain themselves.

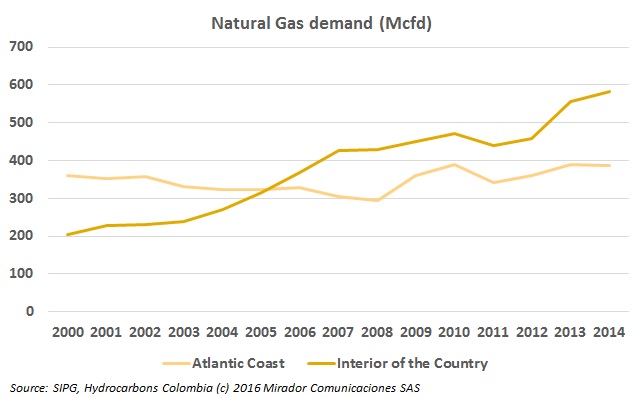

Last week we discussed changes in natural gas production but skipped over the evolution of demand. The research unit of the Ministry of Mines and Energy, UPME, recently published its 2016 overview of the natural gas market, and broke down how consumption of gas has fared in different economic sectors.

I have already written about the recent Semana / ANH conference on offshore exploration and development, expressing my concerns about what I heard on gas strategy.