I doubt many of our readers were off from Christmas to today – although it appears most Colombian political decision makers were (as usual). But you were probably off for at least some of the period so an overview should be helpful.

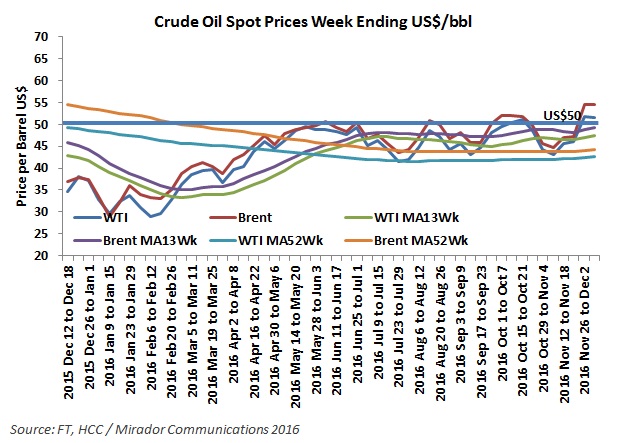

Higher oil prices gave E&P stocks a boost and Colombian-committed companies were no exception.

The USO is the union for Ecopetrol (NYSE:EC) workers and, perhaps surprisingly, one of the loudest voices against the oil industry and the ‘evil multinationals’ who dare to operate in Colombia.

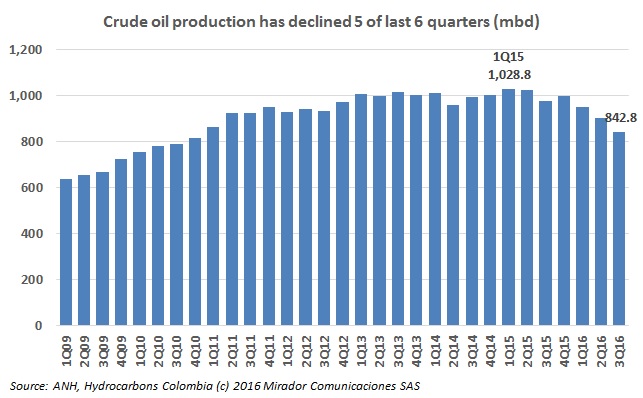

The drop in crude oil production during 3Q16 was the steepest quarter-over-quarter drop since 4Q01, well before anyone in the Colombian government thought about transforming the industry.

I should have written this in January where the analogy is somewhat more timely but diversifying the Colombian economy is like resolving to exercise more. Everyone agrees it is a good idea but it never seems to happen.

The OPEC announcement in Vienna a few weeks ago pushed oil prices up, pushed stock markets up in oil exporting countries and got everyone thinking that the worst was finally over.

The tax reform is poised to be the dominant issue in this month as 2016, and the congressional session, winds to a halt. The oil industry has submitted its wish list, but the financial shortfalls of the government’s budget makes any landmark gains look unlikely.

Ecopetrol (NYSE:EC) 3Q16 Line of Business (LoB) results show that Refining is once again profitability challenged while E&P is getting better all the time.

Donald Trump’s eminent possession of the White House has the Mexican peso in a tailspin: it is down over 10% since election day. The President-elect is an external factor.

With all quarterly-reporting public companies now in our database, we can update our trend graphs for netback and average realized oil prices.