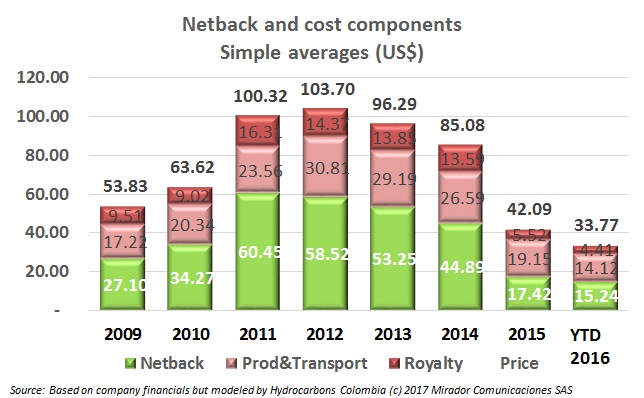

Costs were up in 4Q16 so despite higher prices, the average crude oil netback for publicly-listed reporting companies was down slightly in the quarter.

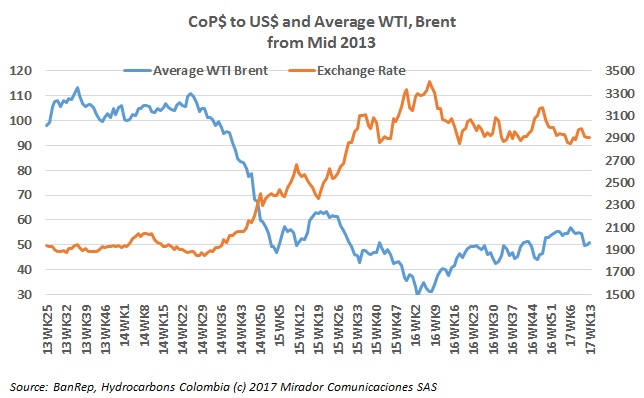

Revisa Dinero columnist Gregorio Gandini recently showed a graph that seems to show fairly clearly that the Colombian peso and oil prices are almost perfectly (negatively) correlated.

A couple of weeks ago, we reported an announcement by ANH head Orlando Velandia that the long-anticipated Agreement 2 was ready. I wondered why only one newspaper picked up the story and now we know: it is not ready.

Jaime Checa is a prominent geophysicist who is troubled by the way the industry is evolving, especially its complicated relationship with communities.

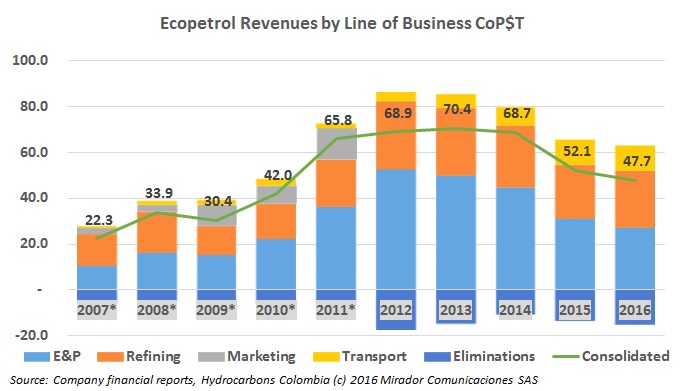

Ecopetrol (NYSE:EC) published its 4Q16 results which allows us to update our Line-of-Business (LoB) charts for the entire year. After an encouraging 2015 and significant new capability in Reficar and Barrancabermeja, ECP’s refinery business was again the loser.

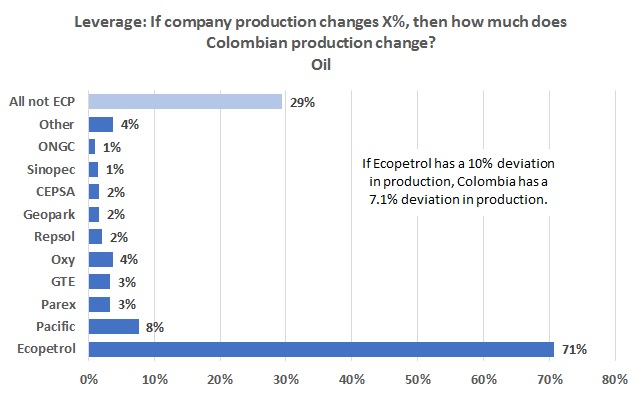

This past week Ecopetrol published its results and both the popular press – and Hydrocarbons Colombia – was focused on this event. But is this media attention justified?

We have made this point before but this is a different way to look at it. It will be very hard for Colombia to hit the production goal the ANH is talking about – 900 mbd – if Ecopetrol (NYSE:EC) is only going to be about flat with its production.

Three tax experts from Bogotá-based law firm Briggard & Urrutia gave us their opinions on the impact of the December 2016 Tax Reform on oil and gas companies.

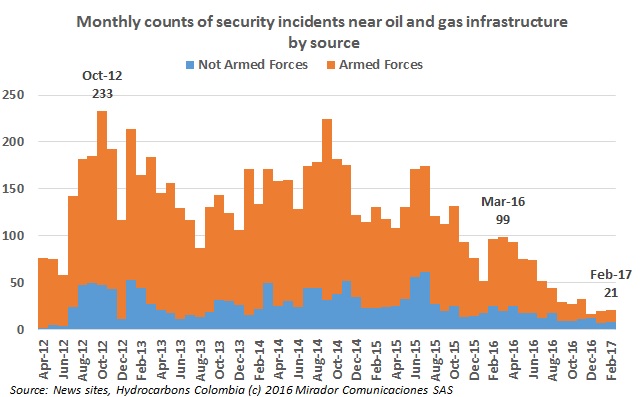

Security incidents near oil and gas infrastructure went up slightly last month (by one) and the ELN remains the protagonist.

Crudo Transparente is a non-governmental organization that “informs, socializes and analyzes the socio-economic impacts of the hydrocarbons sector in the country”.