Oil and gas industry companies in Colombia with foreign investors have no doubt had to answer questions this week about the US government’s decision to “decertify” the country. What does this mean and what do we think of the impact?

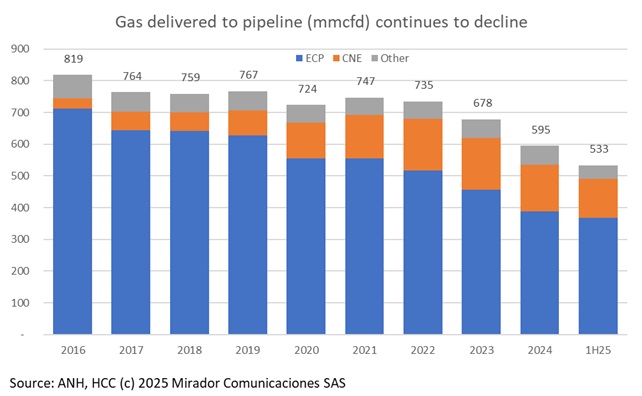

Everyone in the industry worries about natural gas production falling because that means more imports and higher prices for gas users and for electricity users. So why does it continue to decline?

There is a lot happening in the industry and whenever members get together there is lots to discuss. What do they talk about?

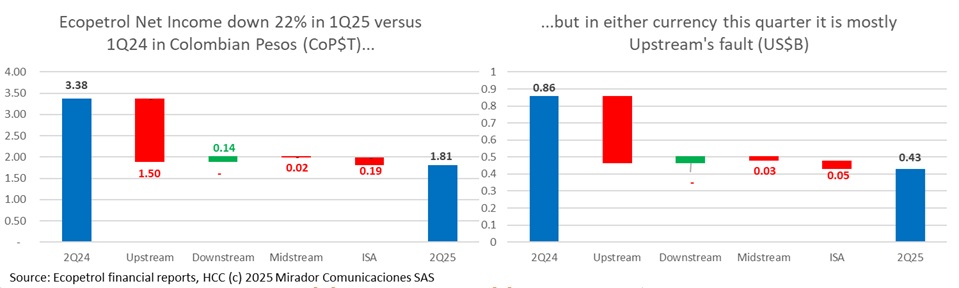

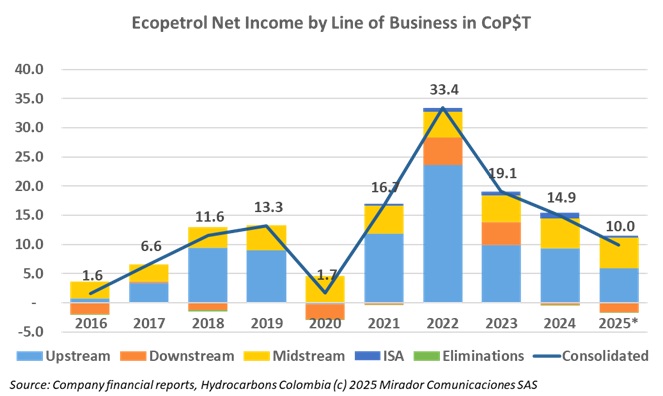

Ecopetrol’s deteriorating Net Income continues to consume (virtual) column inches in the Colombian business press. Our perhaps counter-to-the-current view has been that short-term financial performance is the wrong place to look for what might be wrong with the NOC. This week we dive deeper into the qualitative comments we made last time.

…but we think about them anyway.

… but who’s fault is it?

The Colombian press certainly wants to blame the current administration – either the company’s or the country’s – for the NOC’s declining financial performance. Management blames oil prices which are, most certainly, down over last year. Our previous analyses have supported management’s thesis about short-term, tactical performance, even as we seriously question mid and long-term strategy. Now we have another bad quarter.

We called last week’s opinion article in ePower Colombia “One year more” on the last year of Gustavo Petro’s mandate. Apparently only one person opened the article, and that might have been our editor, preparing for this week’s HCC opinion. Maybe we are all just tired of thinking about Colombian politics and the current government.

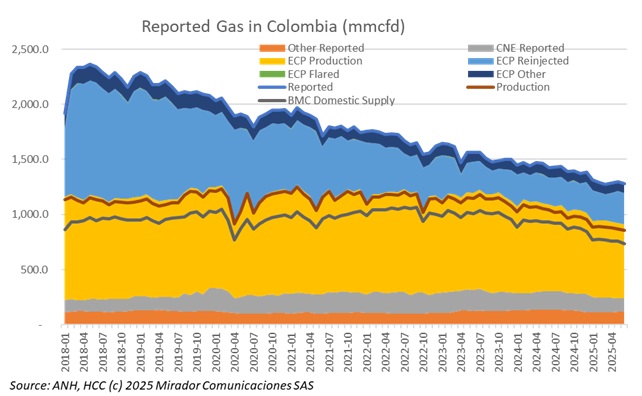

We have the ANH’s detailed data for gas production so we did some charts to get underneath the BMC’s numbers that domestic supply is sliding down inexorably, causing gas imports to be increasingly necessary.

Some of you may have seen this neuropsychology news last week: brain MRIs show optimists have similar brain processes but pessimists are unique. Also this week, US Energy Secretary, Chris Wright told The Economist optimistically that climate change is “not an existential crisis but a real, physical phenomenon that is a by-product of progress” and Colombian President Gustavo Petro pessimistically said that fossil fuel extraction “kills Colombia and kills humanity.”

Admittedly not for Canacol, LNG (formerly Lewis), PetroSantander, or NG Energy whose revenues principally come from gas, but for the rest of the industry, Brent has an oversized impact on all the big strategic decisions. It is by far the principal “known unknown”.