But we still think the issues are mostly beyond management’s control. That is, it is not Ricardo Roa and the Petro government’s fault (entirely) at least at the operational level. Strategy? Management distractions? That’s another issue.

Next Sunday, March 8th, Colombians go to the polls for two separate but related purposes. Roughly half will vote in one of three primary elections for the right (excluding the leading candidate), the left (excluding the leading candidate) and the not-so-left. Perhaps the more important votes will be for Senate and Congress although these get less press coverage.

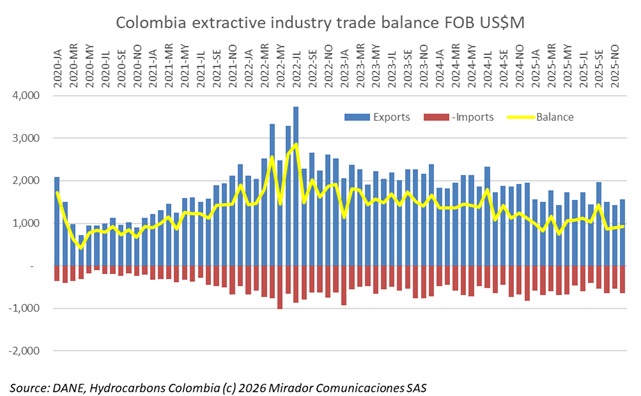

Colombia registered its worst trade deficit in history in 2025, reaching US$16.B FOB, surpassing pandemic-era records. Meanwhile, extractive industry trade balance contributed positively, although declining as well. DANE also published GDP for 4Q25 so we look at that from a sector perspective.

My “give back gig” is I work with the electrical engineer’s association (ACIEM) where I get involved in high technology and some energy issues. In that role, I’ve spent a lot of time at ACIEM events (like Enercol) where I got to meet ex-GEB president, Sandra Fonseca and see her discuss sectoral issues. I was somewhat surprised to see she’d left Asoenergia (where she was Executive Director) but then less surprised to see she was running for senator, under the umbrella of Nuevo Liberalismo.

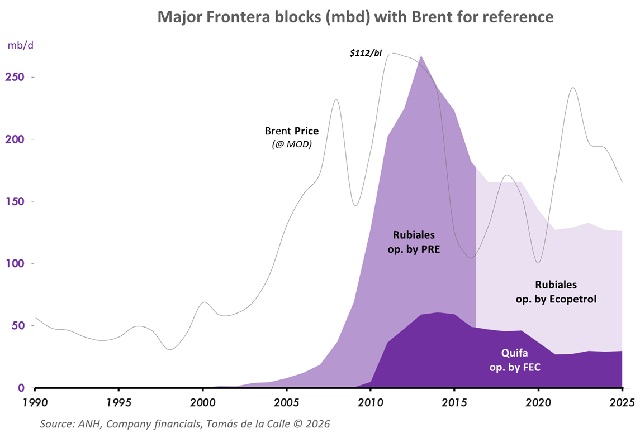

Colombian industry consultant and HCC contributor Tomás de la Calle was struck by the Geopark / Frontera transaction and inspired to write this historical reflection.

For reasons that should be obvious, this quarter’s big topic of discussion (already) is the fate of Venezuela and what it means for the global oil and gas sector – and Colombia’s industry in particular. A (virtual) panel discussion at Colombo-Canadian Chamber of Commerce (CCCC) shed much light on the topic with much heat (passion) as well.

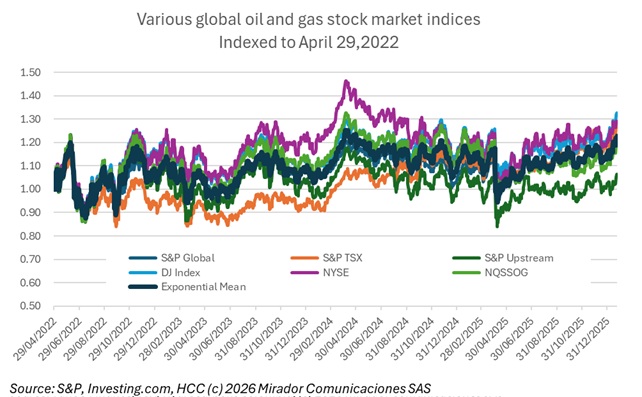

A new year and we thought we should do an update / upgrade to our index of Colombia-focused publicly listed oil and gas companies.

We are only a little over two weeks into 2026 and the number one theme from last year, natural gas, is the number one theme this year.

We should just write 500 words on why accurate forecasting this year will be impossible, add 200 words on the benefits of scenario-based planning and try to otherwise keep our head down. But we promise you courageous comments so here we go.

We justify our three-week end-of-year vacation by the limited amount of news the industry produces over the period. This year was no exception, at least in the oil and gas sector as strictly defined. However, President Gustavo Petro continues his class warfare. NOTE: See end of article for a brief commentary on this weekend’s events.