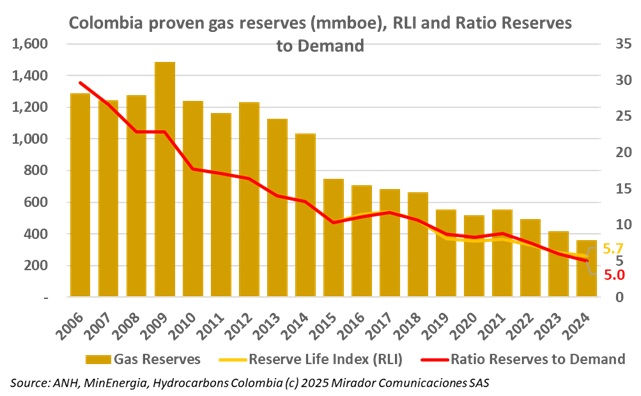

Colombia’s looming natural gas shortage has reignited debate over where to build the country’s next regasification terminal, or whether it should, in fact, build two.

Colombia’s industrial sector is bracing for a challenging energy outlook. Following recent maintenance work at the Cartagena regasification terminal, which nearly led to rationing in the Caribbean region, industrial leaders are now warning of a 50% increase in natural gas prices by 2026, alongside growing uncertainty about supply.

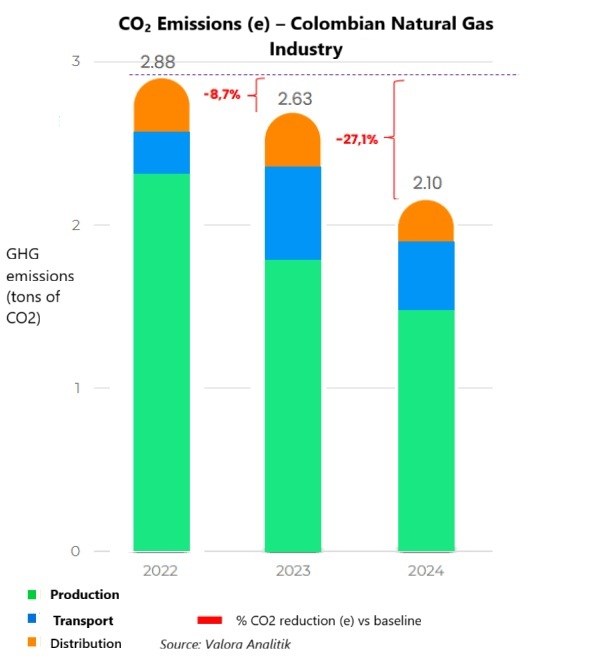

Colombia’s natural gas industry has made major strides toward decarbonization, achieving a 27.1% reduction in greenhouse gas (GHG) emissions compared to 2022 levels, according to the 2024 Carbon Footprint Report released by Naturgas.

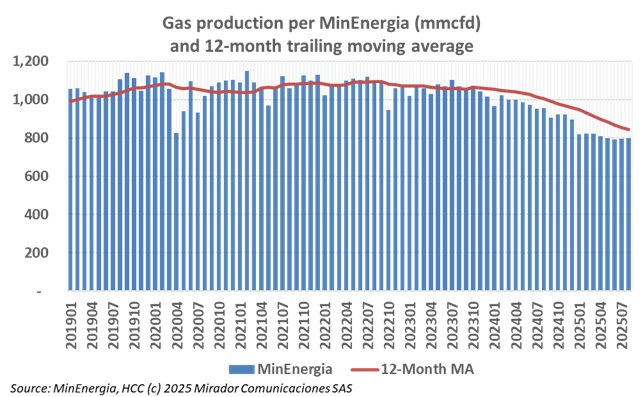

Colombia’s natural gas production has fallen sharply in 2025, deepening the country’s reliance on imports to meet domestic demand.

The Caribbean coast of Colombia faces a growing risk of gas rationing as thermal power plants in the region have secured only 35% of the gas needed to operate during the scheduled maintenance of the SPEC regasification terminal in Cartagena, set for October 10–14.

Colombia’s industrial sector could face a severe competitiveness crisis in 2026, as natural gas prices are projected to rise by up to 200%, driven by costly imports and inefficient transport logistics from the Caribbean coast.

Colombia’s industrial leaders are sounding the alarm over potential gas rationing tied to upcoming maintenance at the SPEC regasification terminal, warning that a government plan to prioritize gas supply to thermal power plants could devastate factories and regional economies.

With Colombia facing a looming shortfall in natural gas starting in 2026, Transportadora de Gas Internacional (TGI), a subsidiary of Grupo Energía Bogotá (GEB), unveiled a plan it says could prevent a full-blown energy crisis.

Six new prior consultations have emerged as the main threat to Petrobras’ (NYSE: PBR) ambitious plan to begin natural gas production from the offshore Sirius field before 2030. The company warns that regulatory uncertainty could delay Colombia’s return to energy self-sufficiency.

Colombia’s Senate is set to debate a new proposal, Bill 247 of 2025, that would overhaul the rules for importing and marketing natural gas.