MinEnergia and the Colombian Natural Gas Association (Naturgas) reviewed progress on 20 government measures designed to guarantee sufficient gas supply, system reliability, and price stability.

Colombia’s main Pacific port Buenaventura faces operational collapse threatening national competitiveness, according to urgent warnings from the Colombian Federation of International Trade Logistics Agents (Fitac).

Colombia’s vehicular natural gas prices increased 80% between 2022 and 2026, rising from approximately CoP$1,930 per cubic meter to nearly CoP$3,490, with annual average increases of 18% confirming a sustained upward trend at service stations.

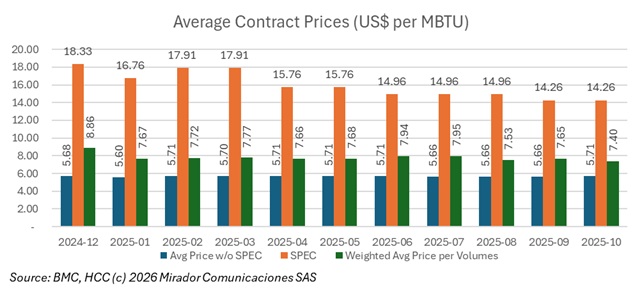

President Gustavo Petro ordered the National Legal Defense Agency (Andje) to recover property from the SPEC regasification plant in Cartagena, claiming it represents an unconstitutional private monopoly that substantially raises electricity tariffs.

The Ministry of Mines and Energy, led by Minister Edwin Palma, activated an institutional monitoring plan for strategic fuel gas sector projects aimed at strengthening supply and guaranteeing energy system functionality.

We are only a little over two weeks into 2026 and the number one theme from last year, natural gas, is the number one theme this year.

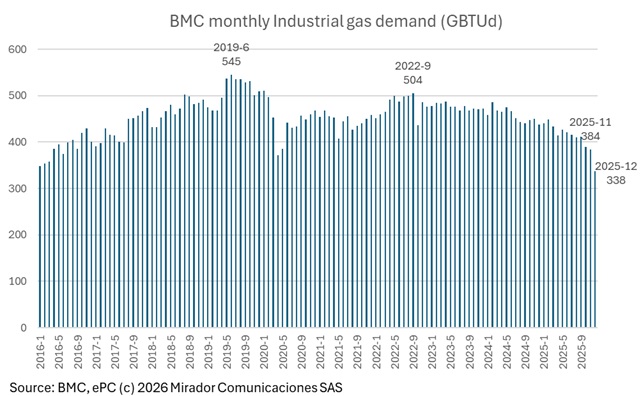

Colombia’s industrial natural gas demand fell 23.7% between November and December 2025 following sharp price increases triggered by the expiration of supply contracts on November 30.

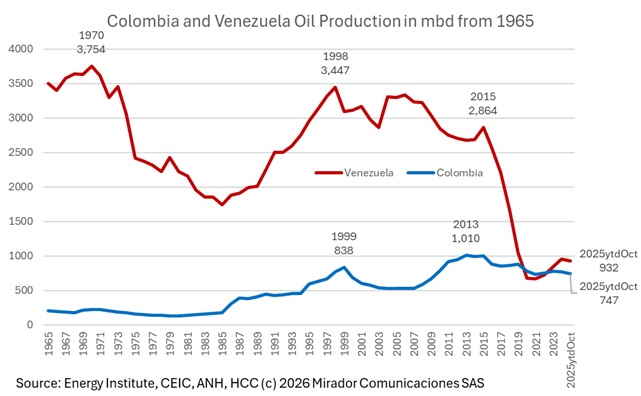

President Donald Trump’s ambitious plan to revitalize Venezuela’s oil industry through USD$100B in private investment faces significant obstacles as major oil companies express skepticism, culminating in Trump threatening Sunday to exclude ExxonMobil from the South American nation after its CEO called Venezuela “uninvestable.”

Despite the Petro government’s criticism of U.S. intervention in Venezuela following Nicolás Maduro’s capture, Energy Minister Edwin Palma signaled openness to negotiating with the Trump administration.

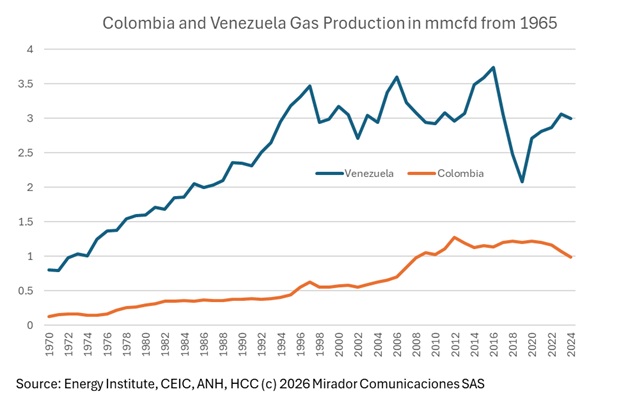

President Gustavo Petro requested that state-owned Ecopetrol substantially reduce internal natural gas prices as Colombia confronts a growing gas shortage forcing dependence on costlier imports. According to the country’s commodities exchange, internal gas production is projected to fall up to 20% below demand next year.