Commercial tensions between Colombia and Ecuador escalated dramatically after Ecuadorian President Daniel Noboa announced initial tariffs on Colombian imports, triggering a 900% increase in crude oil transport fees that directly impacts Ecopetrol’s operations.

But we still think the issues are mostly beyond management’s control. That is, it is not Ricardo Roa and the Petro government’s fault (entirely) at least at the operational level. Strategy? Management distractions? That’s another issue.

The Ethics Council of Norway’s Government Global Pension Fund, administered by Norges Bank Investment Management, recommended excluding Ecopetrol from its portfolio over alleged human rights violations in its operating areas, effective March 2, 2026.

Martín Ravelo, who assumed the presidency of the Unión Sindical Obrera (USO) one month ago, outlined the union’s defense of Colombia’s oil and gas industry and its concerns about the government’s energy transition approach in an interview addressing fracking, Ecopetrol’s challenges, and political developments.

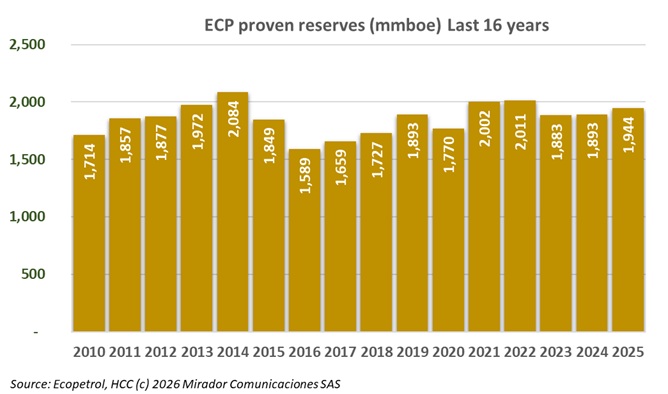

Ecopetrol S.A. reported today its proven reserves of oil, condensate, and natural gas (1P reserves), including its share in proven reserves from subsidiaries, estimated based on the standards of the U.S. Securities and Exchange Commission (SEC).

Colombia’s plans to import Venezuelan natural gas face regulatory and infrastructure obstacles following talks in Caracas between Minister of Mines and Energy Edwin Palma and Venezuelan interim president Delcy Rodríguez. While Venezuela’s side of the Antonio Ricaurte pipeline—enabled in 2007—is ready, Colombia’s segment remains non-operational and Ecopetrol cannot lead the project.

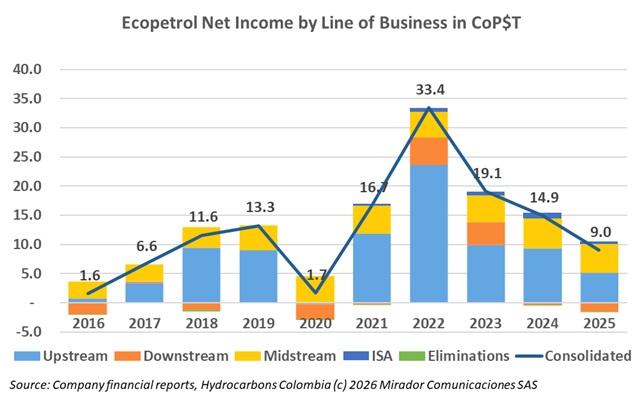

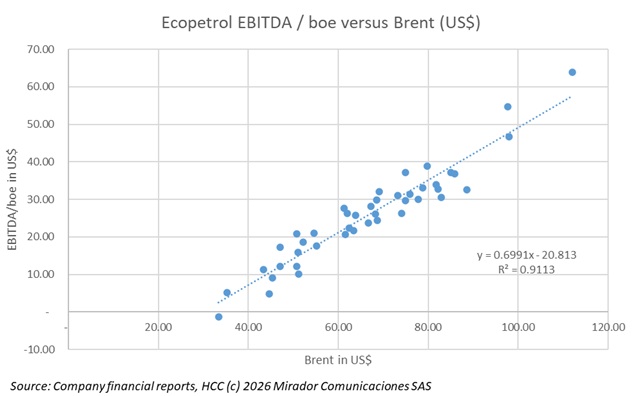

Colombia’s 2026 Medium-Term Fiscal Framework assumes Brent crude averaging US$62.3 per barrel, positioning Ecopetrol comfortably above its US$50 per barrel breakeven point quoted in third quarter 2025.

DIAN notified Ecopetrol of Resolution 000571 confirming a CoP$5.3T sanction (including interest and penalties) related to 19% VAT on gasoline imports between 2022-2024, escalating the ongoing legal dispute between Colombia’s tax authority and the state oil company.

Colombia’s potential role in Venezuelan reconstruction—particularly through energy sector initiatives led by Ecopetrol—emerged as a central topic during President Gustavo Petro’s nearly two-hour meeting with President Donald Trump on February 4, 2026, according to Colombian Ambassador Daniel García-Peña.

Ecopetrol’s incoming board of directors inherited a contested and unresolved legal services contract with Washington-based law firm Covington & Burling, after the Comptroller General’s Office (General Controllers Office) issued formal audit findings warning of governance failures and a potential US$1.592 million fiscal risk stemming from the contract’s suspension.