The new Minister of Mines and Energy Germán Arce gave his first interview to national press, addressing controversy surrounding the electrical energy offer and the issuing of environmental licenses for sustainable projects. He also defended fracking.

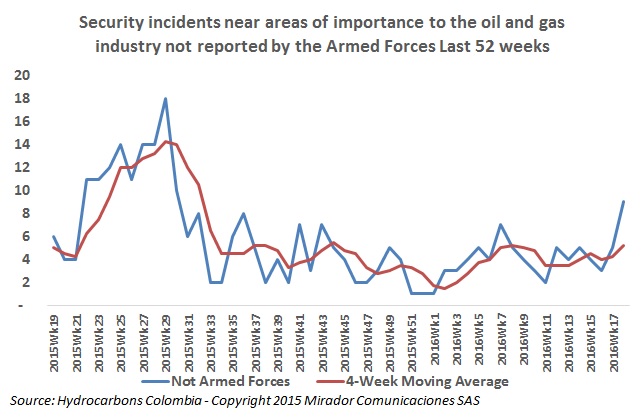

This week, we recorded the highest number of guerrilla-initiated incidents since last July. And they included the first large-scale attack on the Coveñas / Caño-Limón pipeline in some time. This will not be good for the peace process with the ELN nor for May production results.

The USO said that it is ready for Rubiales field to be reverted to Ecopetrol (NYSE:EC) and discarded any notions that Pacific E&P workers affiliated with rival union UTEM would keep their jobs.

Editor’s Note: Jaime Checa is one of Colombia’s most respected geophysicists. When he speaks the industry listens. Checa is passionate about his profession, his industry and his country.

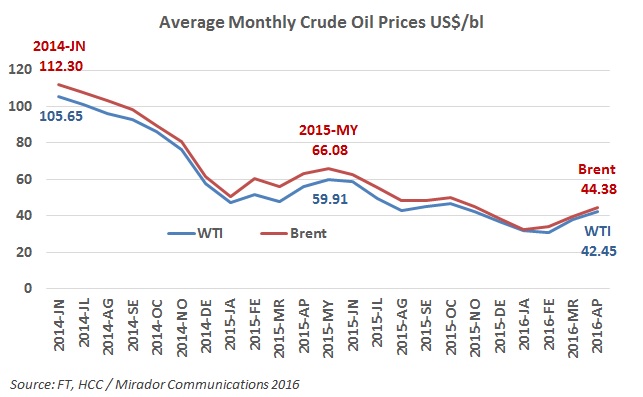

Brent finished the month of April, 2016 at US$47.37 and briefly was even over US$48 during Friday’s trading. Prices are now back to where they were in late October.

While the national and local governments continue to roll out the natural gas network, there are still many municipalities functioning with propane, which suffers from higher prices and an informal distribution network. No quick solution is in sight.

Ecopetrol’s (NYSE:EC) former president Javier Gutiérrez defended his actions involving the Cartagena Refinery (Reficar) while at the helm of the NOC, and said without the controls he enacted, the cost could have been worse.

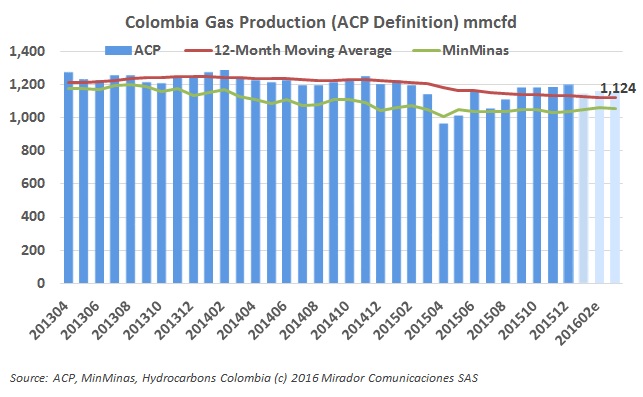

GasIn mid-October of last year, we published an article where Naturgas president, Eduardo Pizano promised an additional 130mmcfd of gas would become available in 1Q16. It might have become available but it did not translate into additional demand.

President Juan Manuel Santos paid a visit to Ecuador to deliver aid to the victims of the recent earthquake, and confirmed that the peace negotiations with the ELN would start there.

Luis Gilberto Murillo has been named by President Juan Manuel Santos as the new Ministry of Environment. What will the former governor of Chocó and a mining engineer with formal training in the USSR bring to this embattled position?