Mónica de Greiff, former president of Ecopetrol’s Board of Directors, explained in an extensive Revista Semana interview the circumstances surrounding her October 2025 resignation after initially attempting to resign in May 2025.

The US Department of Treasury’s Office of Foreign Assets Control (OFAC) issued General License 46 on January 29, authorizing established US entities to engage in Venezuelan oil sector activities including “lifting, exportation, reexportation, sale, resale, supply, storage, marketing, purchase, delivery, or transportation of Venezuelan-origin oil, including the refining of such oil,” subject to strict conditions.

For reasons that should be obvious, this quarter’s big topic of discussion (already) is the fate of Venezuela and what it means for the global oil and gas sector – and Colombia’s industry in particular. A (virtual) panel discussion at Colombo-Canadian Chamber of Commerce (CCCC) shed much light on the topic with much heat (passion) as well.

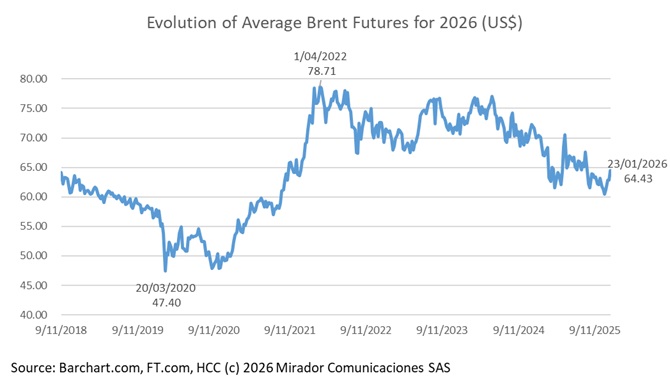

Fitch Ratings’ ‘neutral’ 2026 outlook for the global Oil & Gas sector reflects its assumption that the Brent oil price will average about USD63/barrel, down from USD69/barrel in 2025, with geopolitical risks supporting prices while large oversupply constrains them, Fitch says in a report published today (December 12, 2205).

Ecopetrol’s Board of Directors approved a 2026 Annual Investment Plan ranging from COP$22T to COP$27T, confronting a challenging environment marked by declining profits, low oil prices, and structural exploration restrictions.

According to Colombia’s Superintendente de Sociedades Billy Escobar, Canacol Energy’s cross-border reorganization process is advancing with a proposed US$67M financing package that could enable the Canadian gas producer to exit insolvency by late 2026. Publishing this because we get questions and some of you may not have seen this interview, but we cannot vouch for the information because this does not come from company press releases. Caveat Lector.

Colombia’s Environment and Sustainable Development Ministry has opened a public consultation to define the roadmap for implementing the Escazú Agreement, aiming to strengthen environmental democracy and guarantee rights to information, public participation, and environmental justice.

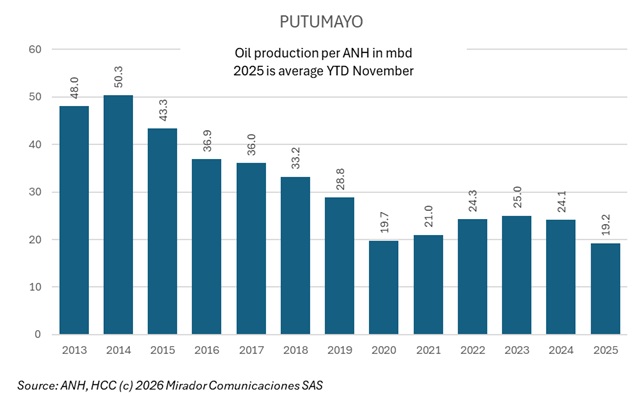

Ecuador’s decision to raise crude transport tariffs through its Trans-Ecuadorian Pipeline System (SOTE) from US$3 to US$30 per barrel—a 900% increase—has forced Colombian oil companies to evaluate costly alternatives for evacuating production from southern Putumayo department.

Guyana’s petroleum boom transformed the South American nation of 800,000 inhabitants into the world’s largest per capita oil producer and Latin America’s fastest-growing economy.

Ecopetrol and the José Benito Vives De Andréis Marine and Coastal Research Institute (Invemar) signed a renewed collaboration agreement to advance knowledge generation and conservation of Caribbean seabed ecosystems, building on their existing framework partnership.