Colombia’s General Controller (Contraloría General de la República) flagged a presumed loss of CoP$86.054 billion in two Ecopetrol contracts following a 2024 audit, raising fresh concerns about oversight and project management at the state oil company, La República reported on January 19, 2026.

Brazil leads Latin America in billionaire wealth concentration with 66 billionaires controlling US$253.2B, followed by Mexico (over US$200B), Chile, Colombia, and Argentina, according to an Oxfam report presented at the World Economic Forum in Davos. Meanwhile the CIDA says Colombia is the most unequal society in the region.

My “give back gig” is I work with the electrical engineer’s association (ACIEM) where I get involved in high technology and some energy issues. In that role, I’ve spent a lot of time at ACIEM events (like Enercol) where I got to meet ex-GEB president, Sandra Fonseca and see her discuss sectoral issues. I was somewhat surprised to see she’d left Asoenergia (where she was Executive Director) but then less surprised to see she was running for senator, under the umbrella of Nuevo Liberalismo.

The Administrative Court of Cundinamarca has admitted a public interest lawsuit against Ecopetrol and the Ministry of Finance aimed at blocking any potential sale of the state oil company’s Permian Basin assets in the United States, Valora Analitik reported on January 28.

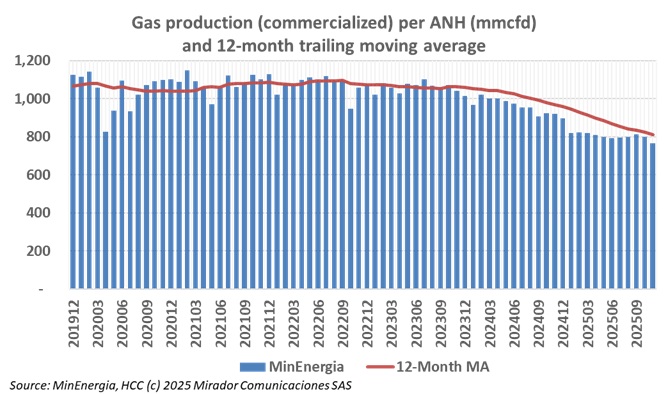

Colombia’s industrial natural gas demand reached its lowest level in a decade during December 2025, triggering increased consumption of more polluting fuels as companies abandon gas for coal, diesel, fuel oil, and liquefied petroleum gas.

Acting Environment Minister Irene Vélez Torres led a dialogue with 40 Colombian ambassadors and diplomatic mission representatives to advance preparations for the First Conference for Transition Beyond Fossil Fuels.

Colombia’s utility industry association Andesco and energy think tank CREE published a study in late January warning of mounting structural risks to the country’s natural gas supply, with all three articles covering the same report released on January 28.

Colombia’s natural gas production averaged 1,265 million cubic feet daily between January and November 2025, representing an 11.7% decline compared to the same period in 2024.

Colombia has identified 14 regasification projects to address its natural gas deficit, spanning both Caribbean and Pacific regions.

Naturgas president Luz Stella Murgas warned that any disruption to operations at the Sociedad Portuaria El Cayao (Spec) regasification plant would jeopardize Colombia’s electricity supply, responding to President Gustavo Petro’s recent order to recover the facility’s property over alleged monopoly concerns.