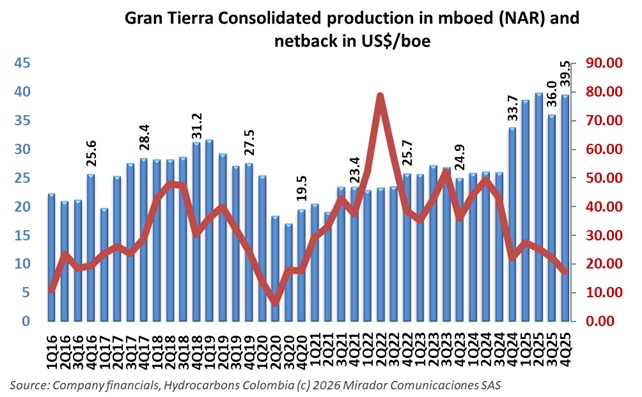

Gran Tierra Energy announced Q4 2025 average working interest production of 46,344 boed and full-year 2025 production of 45,709 boed, representing a 32% increase from 2024, driven by positive exploration results in Ecuador, full-year Canadian operations, partially offset by pipeline disruptions in Southern Colombia and Ecuador. The company achieved its seventh consecutive year of South American reserves growth with over 100% reserve replacement for both PDP and 2P categories, reporting year-end reserves of 142 mmboe (1P), 258 mmboe (2P), and 329 mmboe (3P).

GeoPark Limited announced a private investment in public equity (PIPE) transaction with Colden Investments S.A., an affiliate of Jaime Gilinski’s Grupo Gilinski, in which Colden invested approximately US$107M to acquire 12,876,053 newly issued common shares at US$8.31 per share.

The Ethics Council of Norway’s Government Global Pension Fund, administered by Norges Bank Investment Management, recommended excluding Ecopetrol from its portfolio over alleged human rights violations in its operating areas, effective March 2, 2026.

Martín Ravelo, who assumed the presidency of the Unión Sindical Obrera (USO) one month ago, outlined the union’s defense of Colombia’s oil and gas industry and its concerns about the government’s energy transition approach in an interview addressing fracking, Ecopetrol’s challenges, and political developments.

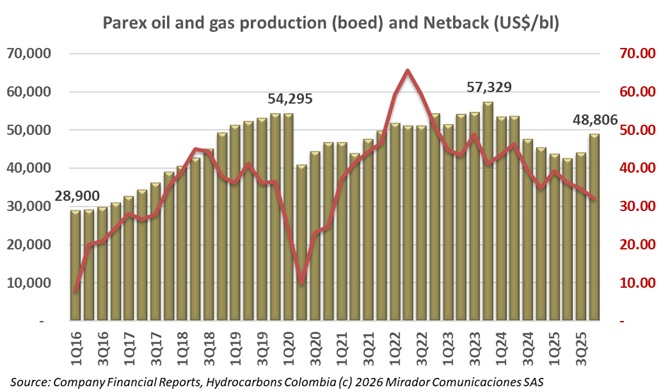

Parex Resources reported 2025 annual funds flow from operations of US$455M and free funds flow of US$145M, while increasing proved developed producing and proved reserves per share by 4% and proved plus probable reserves per share by 8% compared to 2024.

Arrow Exploration announced successful drilling and production results from two appraisal wells at the Mateguafa Attic field on the Tapir Block in Colombia’s Llanos Basin, where the company holds a 50% beneficial interest. Both wells were drilled on time and under budget, adding significant production to Arrow’s portfolio.

The Colombian Association of Geologists is developing legislation to integrate geological expertise into energy policy and territorial development planning, aiming to protect the environment while guaranteeing energy security.

Colombian economic think tank ANIF warned that hourly labor costs will surge 34.7% over approximately one year, rising from CoP$7,736 in the first half of 2025 to CoP$10,422 by the second half of 2026.

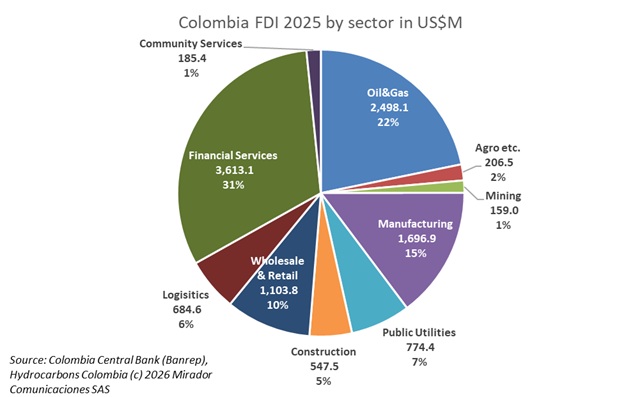

Colombia’s foreign direct investment (FDI) totaled US$11.469B in 2025, representing a 16.1% decline from US$13.684B in 2024 and marking a 33.2% cumulative drop since the 2022 peak of US$17.182B.

Parex Resources will invest more than US$100M in two exploratory wells in Colombia’s Piedemonte Llanero region as part of an alliance with Ecopetrol aimed at discovering oil and gas reserves to address the country’s supply challenges.