We thought it would be useful for others to read the complete text of ConocoPhilllips (NYSE:COP) statement on the tense situation in San Martin, Cesar. It lays out clearly what the company has done, what the ANH and MinMinas have done, the blockades that arose despite this effort and what the company’s reaction is to the blockades.

The propane gas association Gasnova sent out a warning that there is a 7% monthly deficit in the supply of propane gas for domestic use and if immediate action is not taken 240,000 families which rely on the fuel could see their supply put at risk.

The National Hydrocarbons Agency (ANH) and the Ministry of Mines and Energy (MinMinas) have received approval to create special tax free zones for offshore production in the Colombian Caribbean waters.

Is it a leak or is that oil seeping from the ground? A peculiar instance of environmental problems has occurred in Barrancabermeja in the Campo 23 village, after oil started seeping from the area. Ecopetrol (NYSE:EC) responded but says it is a natural occurrence.

The Barranquilla Chamber of Commerce has signed a cooperation agreement with the Chamber of Commerce of Aberdeen and Grampian, Scotland, to exchange information on the offshore industry and promote production in the Caribbean city.

The Ministry of Mines and Energy (MinMinas) said the second phase of its joint program with the National Hydrocarbons Agency (ANH) to reduce community conflict, the “Territorial Strategy” (ETH), has consolidated its second phase. The ministry shared results thus far in 2016,

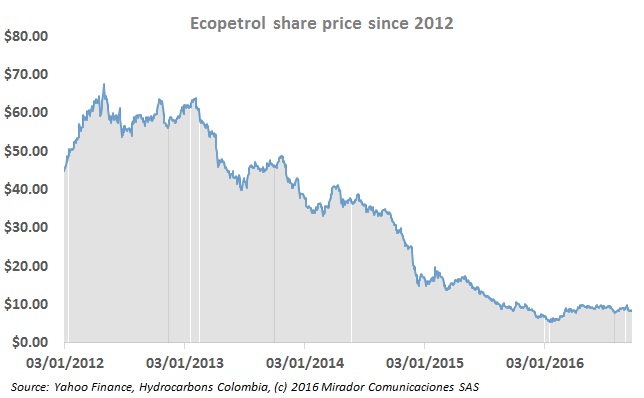

Ecopetrol (NYSE:EC) needs capital to start a new exploration campaign and add new production, and non-committal statements from its president Juan Carlos Echeverry have led to speculation that the government could issue another round of shares.

Following on a push to encourage offshore production, the National Hydrocarbons Agency (ANH) is planning to offer 45 offshore blocks in Caribbean and Pacific waters in an upcoming auction.

The governors of Arauca and Meta spoke at the launch of an employment initiative being put on by the Labor Ministry, and accused oil companies of ignoring local workers, contractors and not participating in public employment services.

The USO has been politicking and reaching out to friends in high places, in an effort to build political momentum and recruit allies ahead of an Ecopetrol (NYSE:EC) strike planned for October.