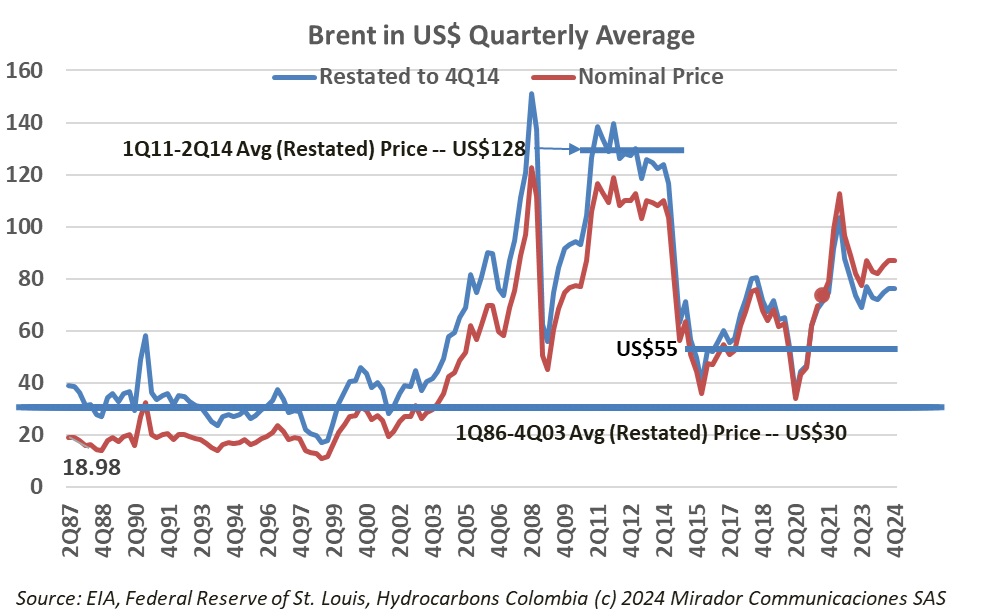

Half of 2024 is now over. In most companies, while work continues on executing the 2024 plan, attention turns to planning 2025, setting budgets and targets. The critical external variable is the price of oil. We collect and analyse statistics on Brent which we offer here with commentary to help with the process.

Well maybe not as bad as last month, but bad. More news items than we have ever seen (not a good sign by itself) and all topics trending down. Only good news out of the Segunda Marquetalia negotiations gave any positive glimmers.

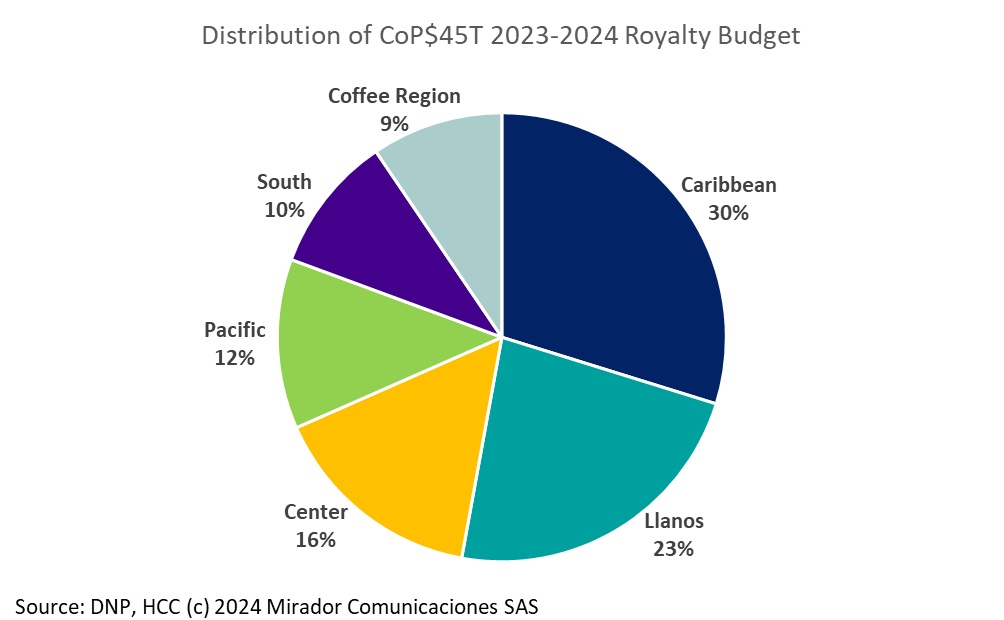

We came across the National Planning Department’s detailed royalty budget for 2023 – 2024 (a two-year budget) and a bit of analysis got us thinking about what drives the allocation. The simple pie-chart illustrates some of the key points but we did some more sophisticated work to show the main levers.

The title caught my eye instantly in Carbon Tracker’s monthly newsletter so I quickly downloaded the report and signed up for the associated webinar. I also quickly found the analysis focused exclusively on the UK and some very specific conditions but it got me thinking about Carbon Capture Usage and Storage and Colombia.

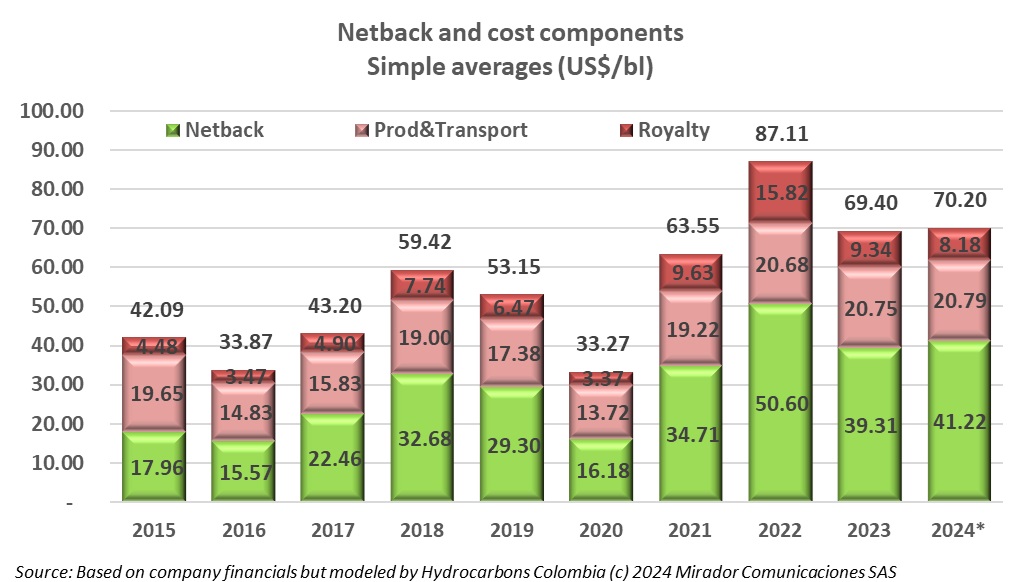

It seems trivial to reduce all the work companies do to stimulate sales and manage costs to a simple rule but, for the last five quarters, the consequences have not changed. The lead graph shows Average Realized Oil Price in 1Q24 was very similar to 2023 and so was netback.

Former ombudsman (Defensor del Pueblo) Carlos Negret says the country is in the same situation it was in 1998. In Cauca, where he hails from, he is probably right. There are other similarities, like a peace process going nowhere it seems, but some differences.

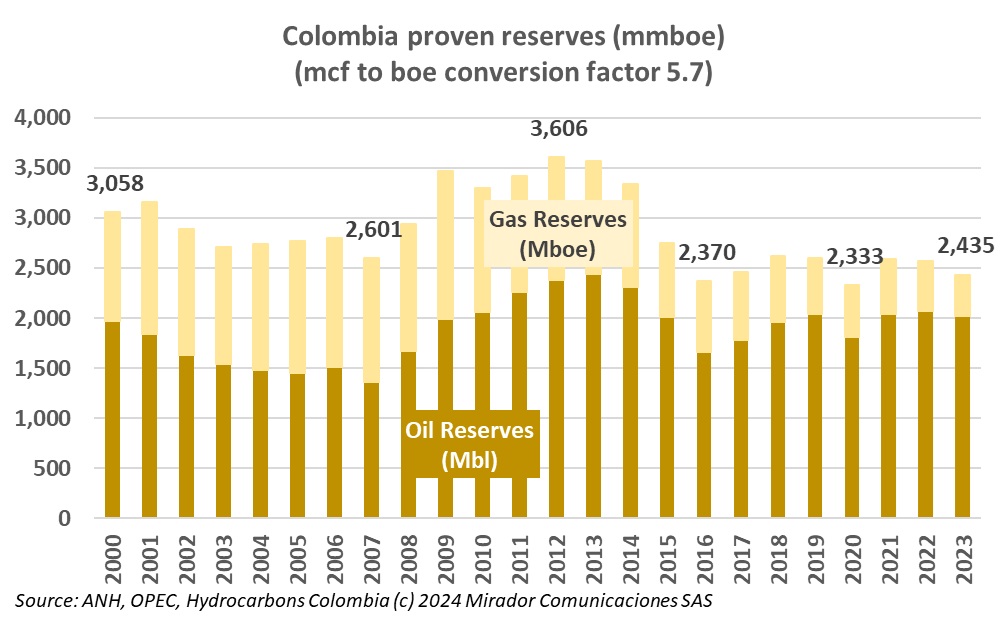

Seven graphs that illustrate the country’s shrinking resources.

A vacation trip to Valledupar in the Colombian department of Cesar showed me some successful and some failed royalty projects which I think have lessons for oil and gas companies.

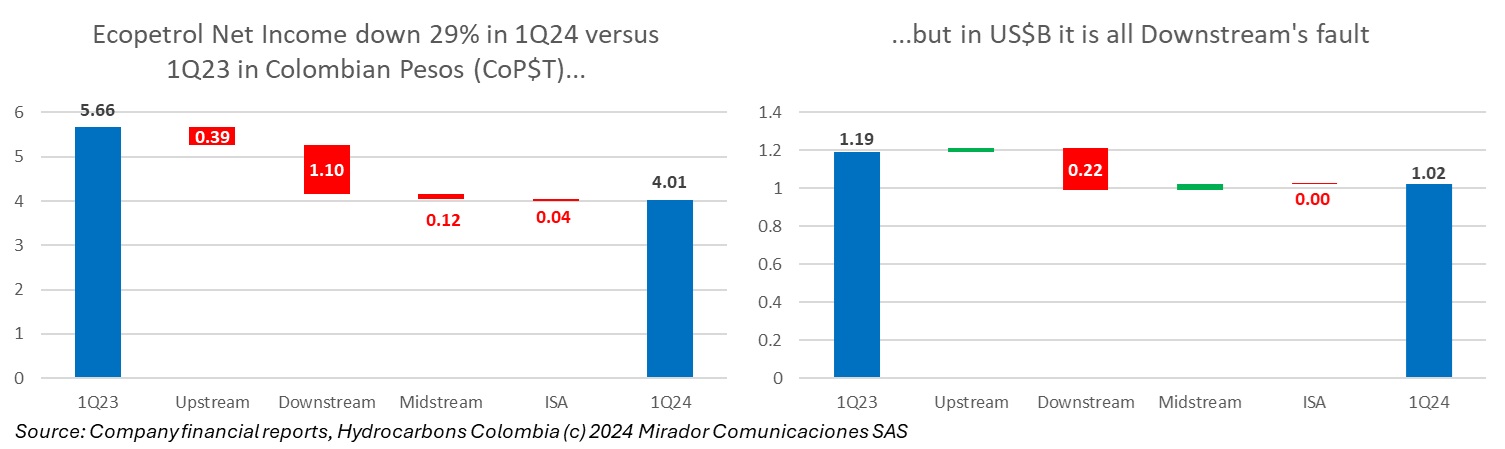

The headlines scream “Ecopetrol Net Income falls 29%!” with a picture of Ricardo Roa looking forlorn (as he often does these days). The text alludes to Roa’s (many) legal issues caused by his responsibility for Gustavo Petro’s presidential election campaign, trying to tie these somehow to the NOC’s falling performance. As always, the reality is considerably different – and more complex than what you read in the popular press although they sometimes get it right. Roa’s leadership and tenure remain controversial.

Colombian President Gustavo Petro said this in his X (Twitter) account after the country’s Armed Forces successfully downed 15 dissident FARC soldiers near hotspot El Plateado, Cauca. Maybe it was the president’s well-known flare for the dramatic. Maybe it was frustration. Maybe it was a message to the dissident FARC or the ELN or the Clan del Golfo or all. Maybe it was a mix of all three reasons.