We were all happy with average production over 1mmbd in 4Q14. We were even happier with an average more than 20mbd higher during the first five months of 2015.

Contributor David Yanovich wrote this article for Revista Dinero with the play-on-words title “El peso del dolar” which unfortunately does not translate as cleverly in English.

In the international news section, the current Colombian story is its border dispute with Venezuela. Colombia’s neighbor has ejected several thousand Colombians living near the border and then closed the section in the northeast near Cúcuta to all traffic in either direction.

Analyst’s confession: we think these monthly summaries of key indicators are important for our subscribers, at least to look back at how we got to where we are today.

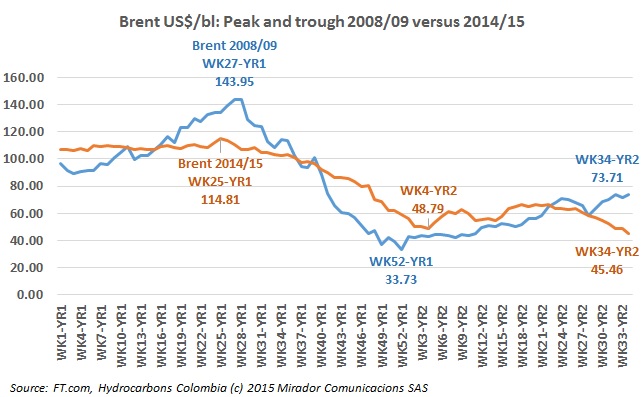

The sharp and precarious fall of oil prices has been felt from the Toronto Stock exchange, where most of Colombia’s operators are listed, all the way down to villages in the Colombian Llanos.

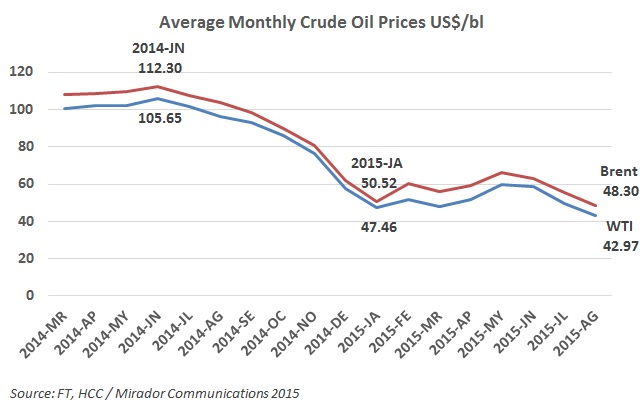

We often get asked our opinion about where oil prices are going. If we could do that well, we would be trading not commentating.

‘The Mad Economist’ is the nom-de-plume of Camilo Vega Barbosa, Director of the economic blog El Mal Economista (EME). (See his coordinates at the end of the article.)

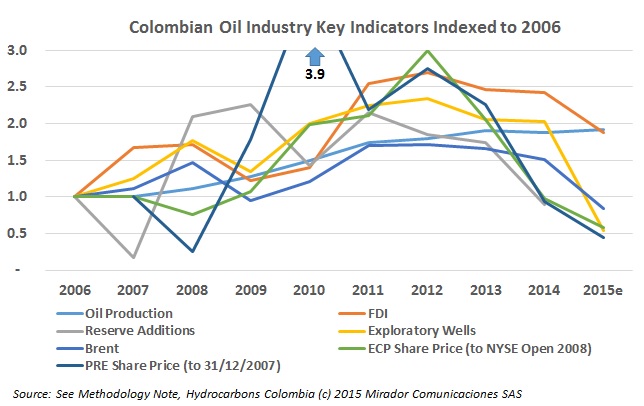

Clients ask us for quick graphs from our statistical databases for their presentations or other studies. (You can too!) Having done a number of these lately, it struck our Analyst that the peaks all occurred at the same time (roughly) 2012.

The Northern Europeans are probably jubilant with the events of the last couple of weeks and editorial cartoonists have started once again to lampoon President Juan Manuel Santos’ alleged Nobel Peace Prize ambitions.

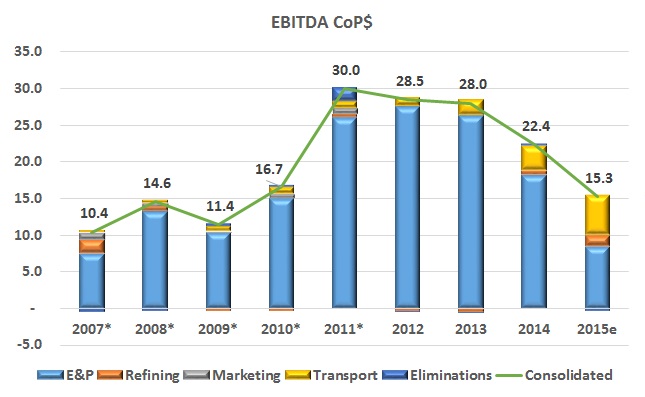

We doubt that CEO Juan Carlos Echeverry would agree with the statement in our title and it is admittedly, more than a little exaggerated for effect. But the company’s profits at least are shifting towards the hydrocarbons transportation line-of-business.