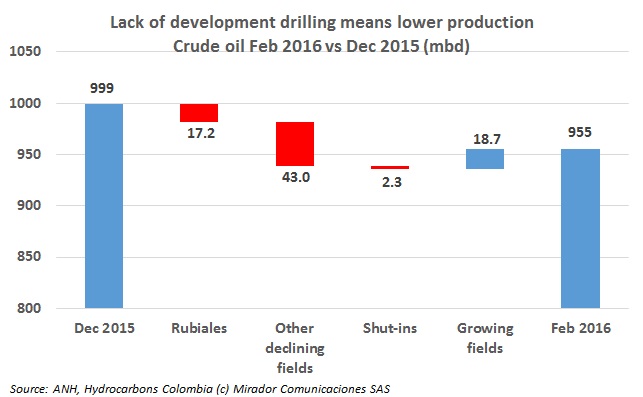

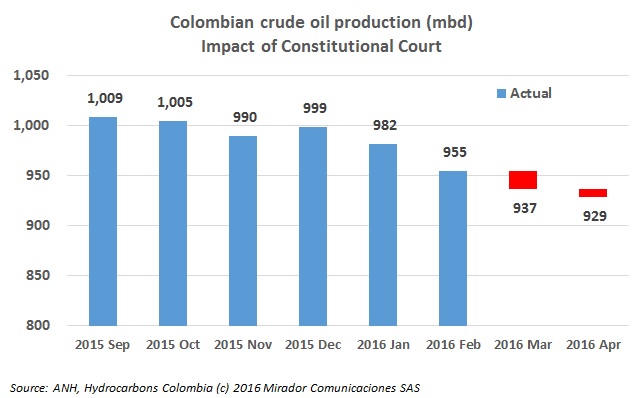

Last week’s announcement of 916 mbd for March production was a shocker but MinMinas said nothing about why it happened. Virtually the next day, April 22, 2016, the ANH published field level detail for January and February (but not, unfortunately, March).

A few years ago, it seems that there was an oil conference every other week in Colombia. Low oil prices killed that trend but, considering its longer time frame (relatively unaffected by current price woes), offshore is the new ‘belle of the ball’ and so there is a flurry of related events.

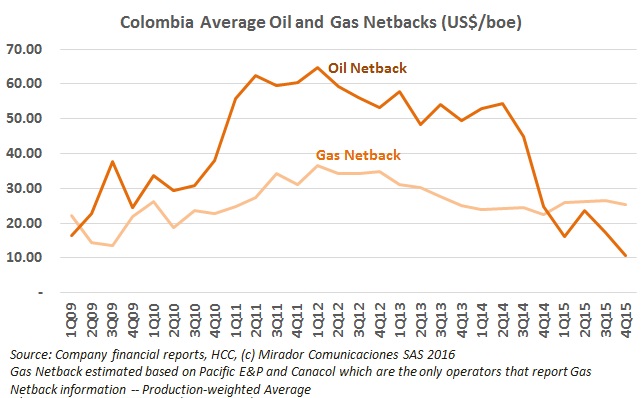

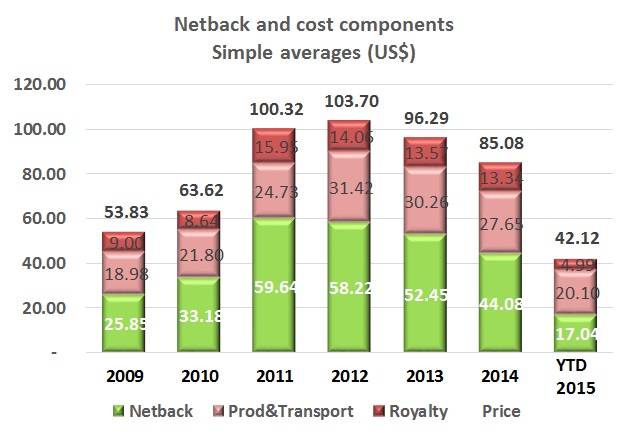

Last week we updated our estimates of netback and Production and Transport costs for crude oil. This week we look at gas and although the sample size is much smaller, gas widened its advantage over crude oil in terms of netback.

On March 15, 2016 the Vice Minister of Mines María Isabel Ulloa presented Colombia’s first transparency report, elaborated according to the standards of the Extractive Industries Transparency Initiative (EITI).

The publicly listed companies that will give us enough information to calculate netback have reported for 4Q15 and so we update our quarterly and annual graphs. The good news is that Production and Transport costs dropped 27% in 2015 (on average).

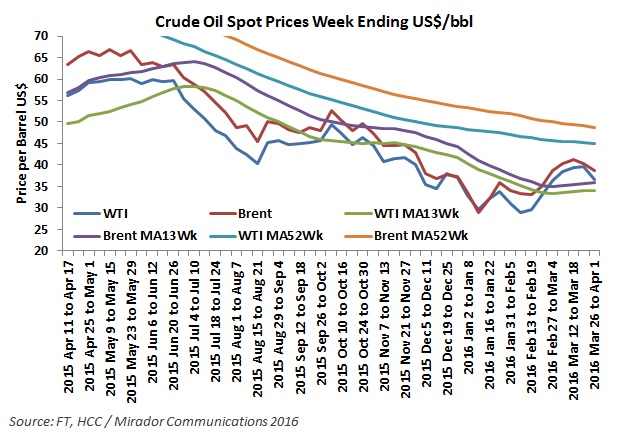

Guess we can say the rally is officially over. Brent hit a 2016 peak of US$41.20 for the week ending March 18 but has slid in each of the past two weeks. WTI hit its peak last week at US$40.44 but dropped 7.5% this week.

The continued commentary from the Naturgas conference (even though it was before Easter) and Canacol’s results meant the week’s news had a decided bias towards gas.

The recent oil production results for February, 2016 were published without commentary by MnMinas. Perhaps it is because there is only an Acting MinMinas, Maria Lorena Gutiérrez and her role is the electrical ‘crisis’.

Too much time on my hands during the Easter break, too much Janice Joplin and too much thinking about the Constitutional Court had definitely brought me down.

Colombia’s highest court has been very active lately, deciding on a number of community rights issues in a way that makes it difficult to plan long-term projects.