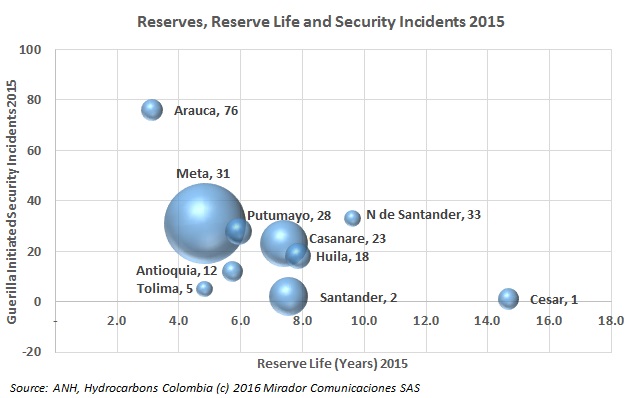

A few weeks ago we showed a graph that tried to show where the post-conflict opportunities might be at the department level. This week we look at basins and, within basins, at companies.

Since so much of the oil / gas and mining investment in Colombia is by Canadian companies, speaking to the Canada Colombia Chamber of Commerce is a good way to talk to the extractive sector in one session.

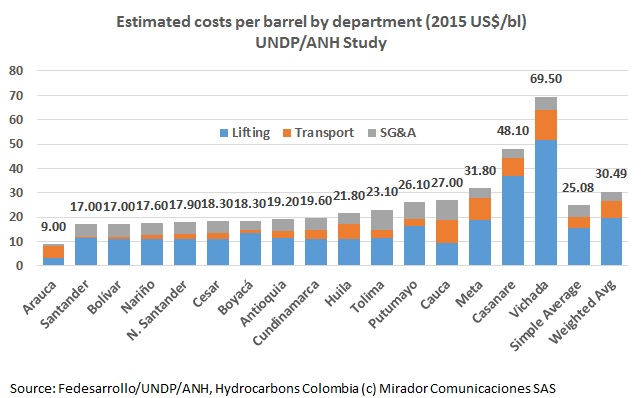

A few weeks ago, we reported the latest results from the National Hydrocarbons Agency (ANH) Territorial Strategy initiative: a series of four academic studies sponsored by the United Nations Development Program (UNDP).

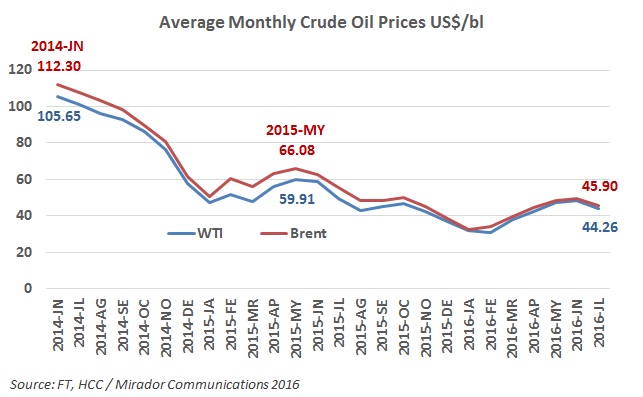

Like last year and the year before that, July oil prices finished in negative territory with respect to June. Not a great start for the third quarter.

We do not want to fill up HCC with social conflict articles but that is what is getting published. And looking at some recent anti-oil articles which have prominent placement in national newspapers, it looks like the industry is just letting go with the Colombian public.

Carrying on from last week’s commentary, thoughts on the disconnect between Bogotá and the countryside. The memory of an old Star Trek TV episode merged with the ‘Athens of the Americas’ and the ANH’s ‘Territorial Strategy’.

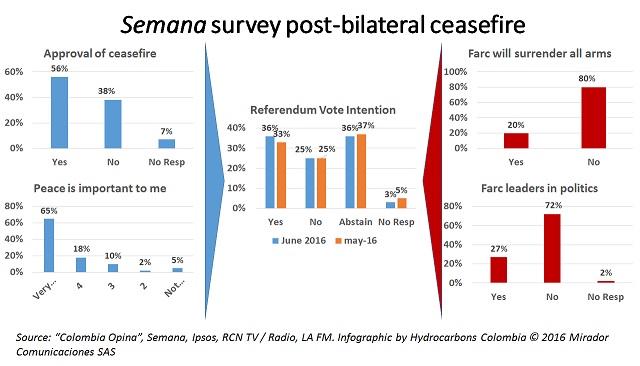

Last week the Constitutional Court approved the government’s proposed referendum on the peace agreements with the Farc. The Colombian people still have their say, but the last legal hurdle has been surmounted.

We updated our Quick Colombian Committed Producers Share Price Index for 2Q16 and things are looking better.

I was invited to the recent launch of four academic reports on the Colombian countryside, commissioned by the National Hydrocarbons Agency (ANH), coordinated and paid for by the United Nations Development Program (UNDP in English, PNUD in Spanish).

The historic signing of a ceasefire between the Farc and government of President Juan Manuel Santos has given a boost to public opinion on the peace process.