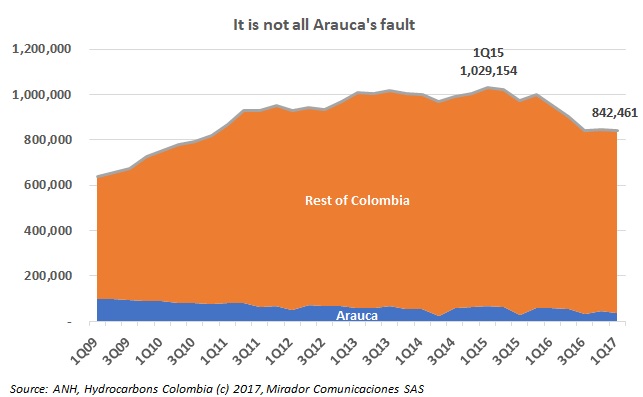

This week we got the July crude oil production results (earlier than last month at least) and while the official press release focused on year-over-year growth, I think we are flat, becalmed in the ‘mid-850s’ doldrums.

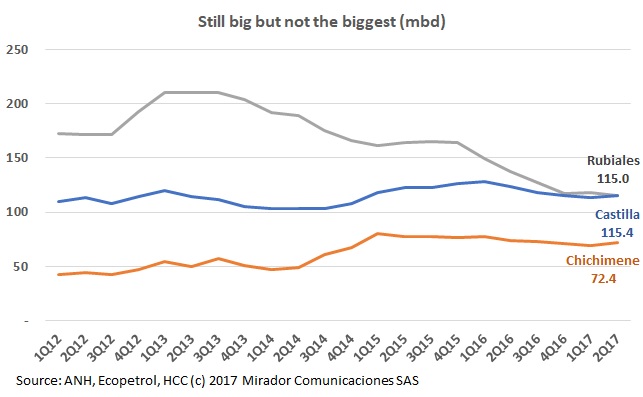

The main reason Colombia hit 1mmbd and the main reason it has been hard to get back to 1mmbd has been Rubiales field.

Over the past few weeks, there has been a considerable change in the government’s public declarations about the industry.

Monthly oil production this year has been consistently lower than that of 2016. The two usual explanations are ELN attacks on the Coveñas / Caño Limón (CCL) pipeline and the general malaise of the industry driven mostly by lower oil prices.

I have not had a good rant for a while. I need one because it was a rough week last week; hard not to believe that things are moving at best ‘sideways’ in the Industry as the government expresses much concern but does very little to help.

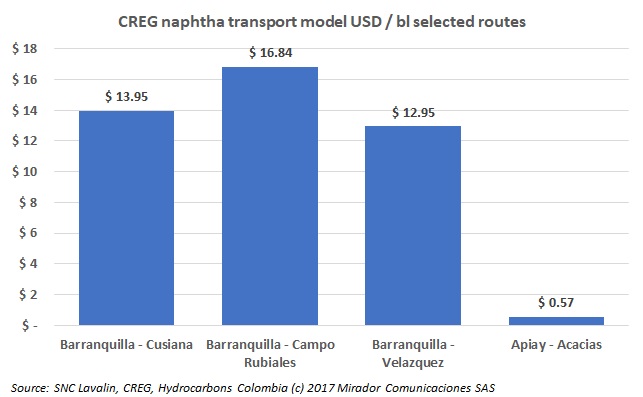

A few weeks ago, Colombia’s Energy Regulator (CREG) published a cost model for tanker truck transport of refined hydrocarbons.

Now Part 4 of our ongoing series written by Leopoldo Olavarría and the team at Norton Rose Fulbright on the Agreement 2, the National Hydrocarbons Agency’s (ANH) rewrite of the rules for block assignment and contracting.

Now Part 4 of our ongoing series written by Leopoldo Olavarría and the team at Norton Rose Fulbright on the Agreement 2, the National Hydrocarbons Agency’s (ANH) rewrite of the rules for block assignment and contracting.

Professor Freddy Humberto Escobar gave a talk at Javeriana University about the debate between oil and water.

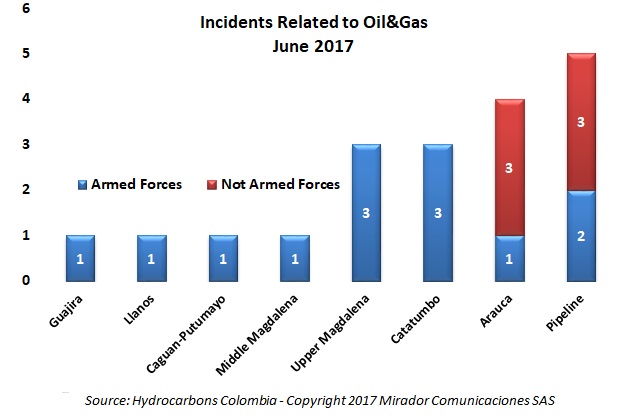

The trend in security incidents near oil or gas infrastructure continued to slide in June 2017. The only recorded guerrilla-initiated events were either attributed to the ELN directly or took place in traditional ELN territory.