Gas is a ‘hot topic’ presently with concerns about self-sufficiency and the right strategies to address them. In a very timely contribution, Tomás de la Calle returns with a multi-part article on the Colombian gas market.

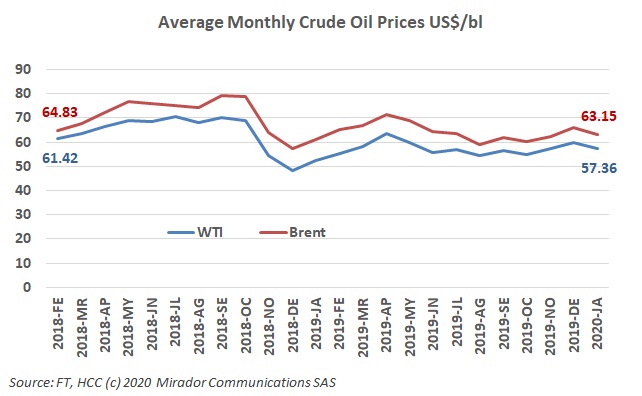

With oil prices on a roller coaster since the start of the new year, we thought we should update our usual graphs. Last presented in September, the panaorama has changed considerably.

Or even in Latin America. The headline might have upset your board members or institutional investors when it appeared a few weeks ago but it was false. Colombia is not exactly a shining example of public service morality but not the most corrupt in the world or even the region.

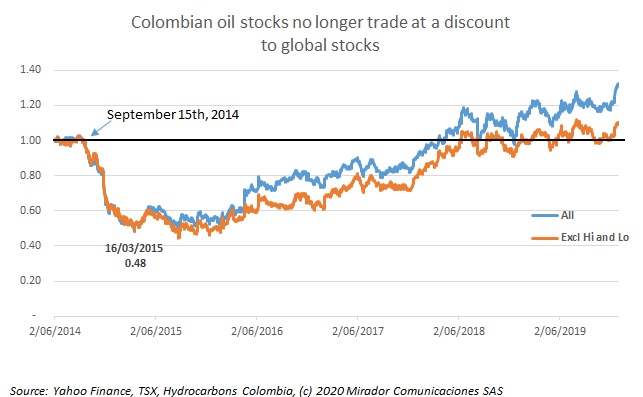

Our index of shares of Colombia -focused companies is rapidly becoming a set of special cases – a small set which has just got smaller.

As a belated Christmas gift perhaps, the Energy Ministry published a draft decree to govern Integrated Investigation Pilot Projects for unconventional technologies (PPII). The public has until Monday January 20th, 2020 to comment.

About half the ‘end-of-year’ articles I see look forward and half look backward. I like to do both as we cross into a new year, some (most?) say into a new decade. This week I look backward and then about one month from now with the first What We Think article of 2020, I will look forward.

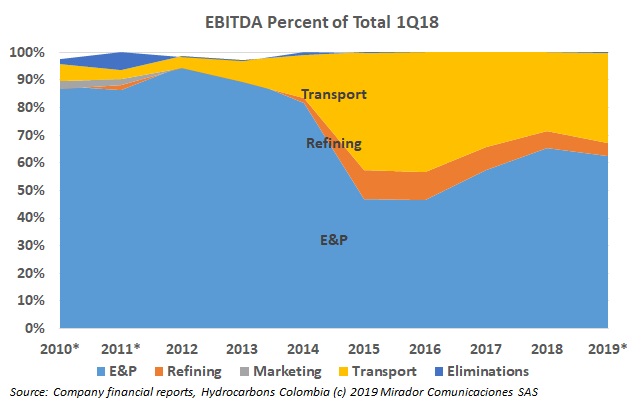

Ecopetrol’s 9-month results to September 2019 show that, once again, the Transport Line-of-Business (LOB) has compensated for lower oil prices and poorer margins in the Refining LOB. Ecopetrol (NYSE:EC)

This week I came across the phrase “Forget whether the glass is half-full or half-empty: just be happy you have a glass and there is something in it”. This nicely sums up the ANH’s recent bid round.

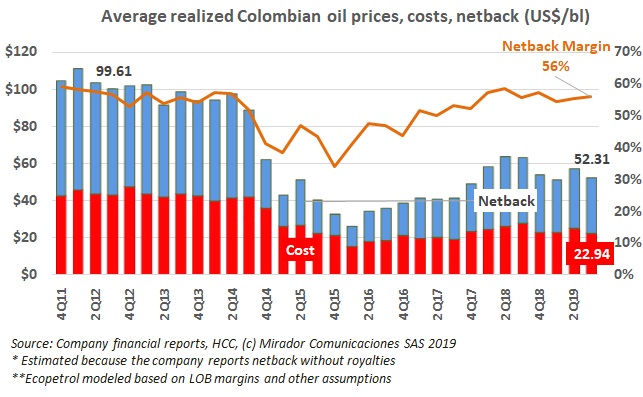

Lower oil prices inevitably led to lower netbacks in 3Q19 and that could not have made the CFO happy. But production costs were slightly lower on average so operations people should not catch any flak (or at least, not any more than usual).

As we approach the end of the year, most boards are in their annual strategic planning exercises and I think this article should be required reading. It will not tell you where to drill the next well but it might give the board and senior management some perspective on their larger contribution to the economy and society.