With oil prices rising seemingly week-after-week, some commentators have gotten excited by the fiscal implications. There may some short-term relief for tired taxpayers but the medium and long-term is challenging.

After a long absence, A Reader returns with a warning on sophistry and controlling the messaging in the climate debates. The economic consequences of an overreaction could be dramatic.

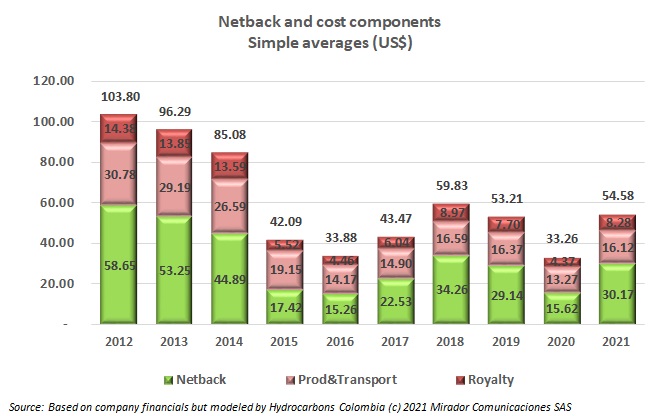

We updated our Netback charts based on 1Q21 results from major Colombia-focused publicly-traded E&P companies. This time we introduce a new chart showing how Production & Transport Costs vary with Average Realized Oil Prices.

New oilfield technologies could have political consequences if they upset the delicate balance between companies and communities.

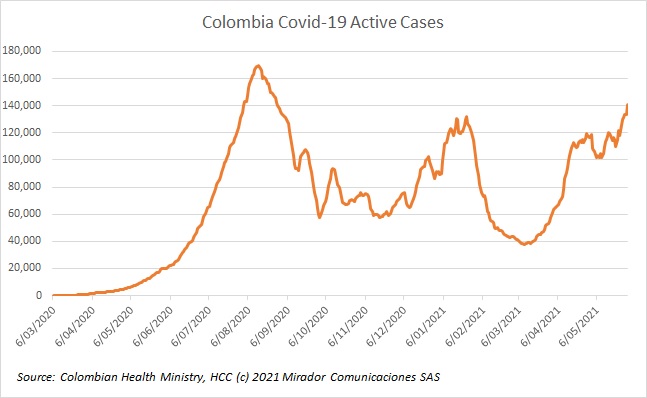

We are updating our Covid-19 graphs for those who are not doing their own tracking but there will not be much commentary as the charts, unfortunately, speak for themselves.

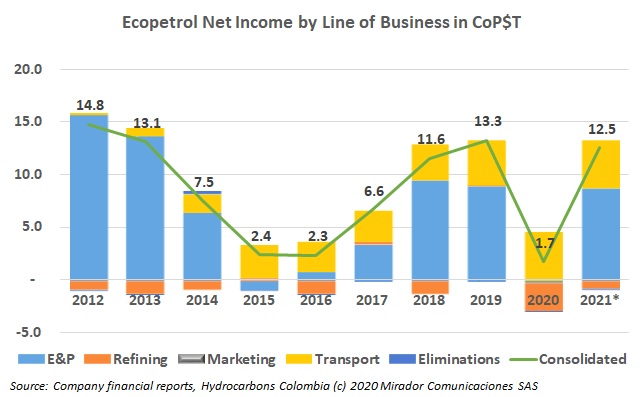

Colombia has not had a monarch since the first decades of the 19th century, but this week S&P lowered the country’s sovereign debt rating from investment grade to junk. This has serious implications for the county and the industry.

… and even if it is sold, why it won’t have the transformative impact it could.

I was not planning to write about this, assuming that, like tax reform, by the time that anything was published life would have moved on. But then my 94-year-old mother called, upset because CBC News had shown her the violence and looting in Bogotá and she was worried. I realized board members and major investors might also be upset and worried.

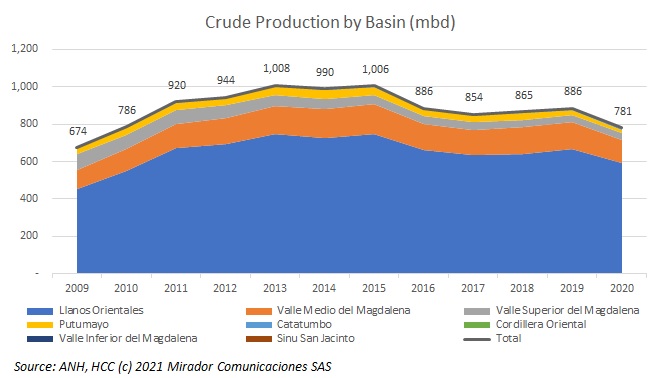

We did a partial update of our production by field database and this week we publish some illustrative charts. No surprise really, but it is hard to find a silver lining in the clouds of 2020 although companies are upbeat about Capex in 2021 with oil prices rising.