There has always been something that felt different about September. It is a ‘wake-up call’ that the year is coming to a close or maybe it is a new beginning.

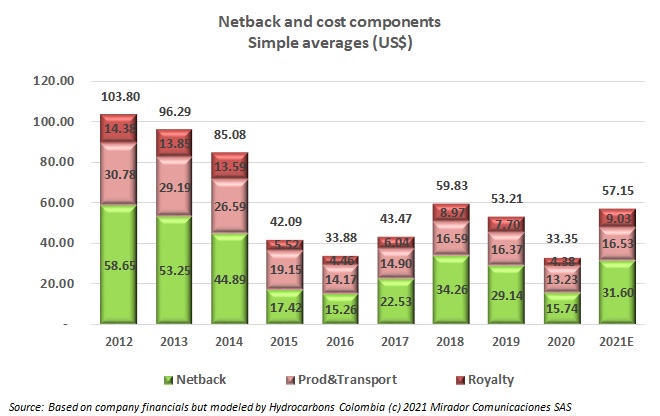

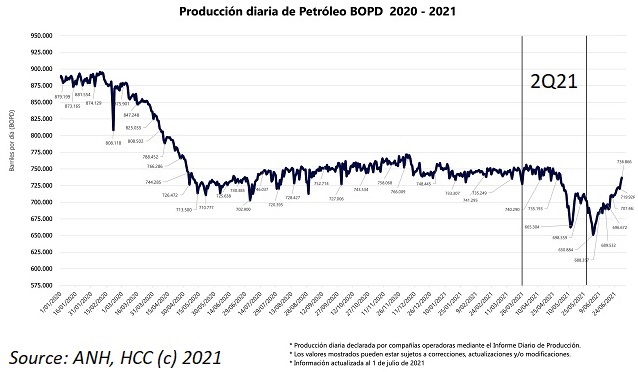

Halfway through 2021, prices and netbacks are looking significantly better than they did in 2020. The prices are the driver of higher netbacks and so while it would be hard for managers to take a lot of credit for the improvement, let us at least enjoy the higher cash flow.

On Tuesday, August 31st, we shut down the Hydrocarbons Mexico newsletter, principally because the country elected a populist (AMLO) who is re-monopolizing the entire value chain, upstream and downstream. A year from now, we will have a new government in Colombia and the current front runner is a populist (Gustavo Petro) who says he will suspend oil exploration.

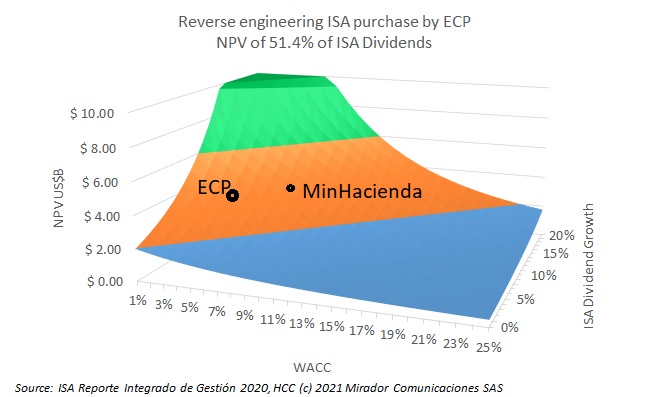

We know. We said we were tired of writing about the ECP / ISA deal which we view as a nothing more than a financial game by MinHacienda. But we had been making some qualitative statements without quantitative support and that was not consistent with our philosophy. Warning: this article is nerdy.

I just got back from an extended “stay-cation” in Eastern Canada, mostly spent with my family. But an evening with friends that go back to university days, reminded me just how controversial our industry is today.

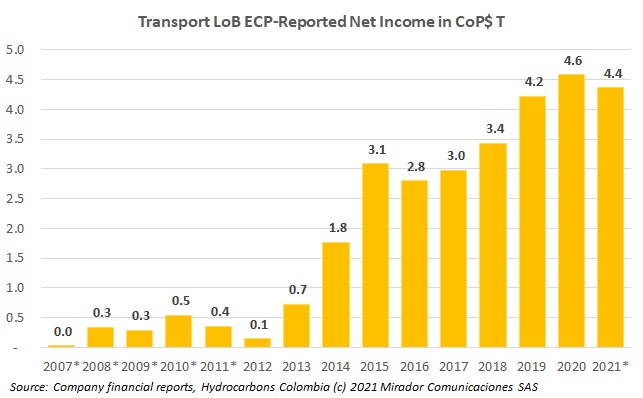

Brief comments this time on the charts updated for first half results because the story has not changed much.

Last week, we picked up a news report saying the ANH was excluding offshore blocks from the upcoming bid round. Armando Zamora says they have not. Is there anybody going to listen to my story / All about the block that went away?

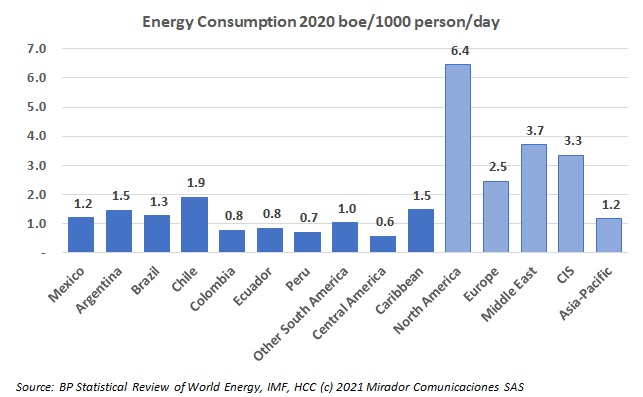

Last year when BP published its annual energy statistics, we published a pair of articles entitled suggesting that global warning is not the country’s fault because, despite being an oil and gas producer, its electricity generation is not based on fossil fuels.

According to Wikipedia, “Writer’s block is a condition, primarily associated with writing, in which an author is unable to produce new work or experiences a creative slowdown. This creative stall is not a result of commitment problems or the lack of writing skills.” Well, that last bit is some comfort at least. However, the article goes on to say “The condition ranges from difficulty in coming up with original ideas to being unable to produce a work for years.” Ouch!

We frequently mention that Colombian E&Ps have been unable to take advantage of the recent run up in prices because of social unrest and the resulting blockades. Investors seem to have noticed.