Colombian E&Ps have published their strategy and investment documents for 2022 and many of them are looking beyond Colombia for growth, including Ecopetrol. Is this normal diversification or cause for concern?

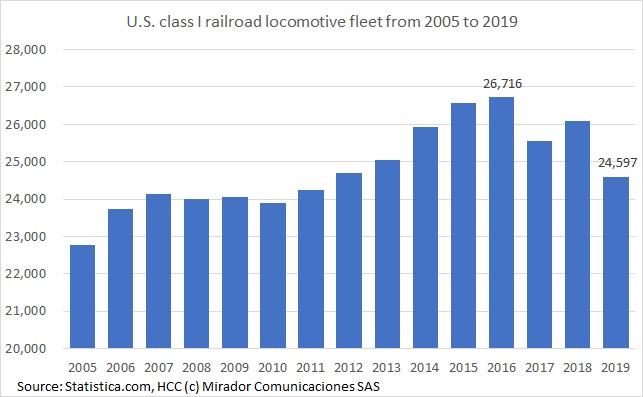

Last week the Analyst was in a meeting which touched on energy transition and he illustrated the challenge with some off-the-cuff statistics about converting the North American rail fleet. After the call, he checked his math which was fairly good but only because he got both components wrong in opposite directions.

Sunday morning and a blank page. I checked my list of pending topics. I looked over what we published in the past week. I put on my cleanest dirty shirt. I sacrificed a chicken – ok an egg – in the hope of attracting the muses. Nothing.

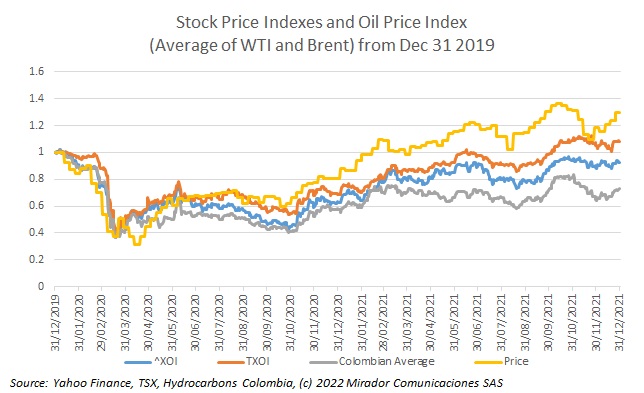

“Normal” does not seem to mean much lately but there is some hope that the Covid-19-induced uncertainty has passed and for 2022 we will just have the usual or normal uncertainty. So what happened with Colombia-focused stock prices over the last two years?

Deep breath. Time to write my annual “Fearless Forecasts” article where I give my baseline scenario for the coming year. Unfortunately – for me, for the industry, for Colombia, for the world – we enter this year with a higher-than-average amount of uncertainty.

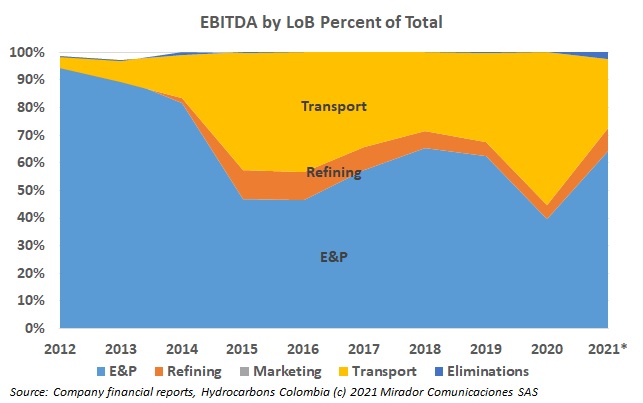

Now that the Ecopetrol / ISA deal is official, the NOC has to report consolidated numbers. For the company’s overall numbers, the accountants should have no difficulties. But how will the Line-of-Business (LoB) reporting look? We some hints with the 3Q21 report.

Left-wing candidate Gustavo Petro continues to lead in the polls and his most controversial economic proposals – stopping oil exploration and halting oil exports – continues to make headlines in Colombia. Over the holiday period, business newspaper Portafolio published a Spanish translation of Alliance France Press (AFP) article which it entitled (translated to English) “Is the world ready to live without oil?”

In my fearless forecasts for 2021, I got the most important variable wrong and I am very glad I did, because I got it wrong in the right direction.

This past week, the ANH held its Colombia Round 2021 auction and there can be no doubt it was a great success. Thirty blocks were awarded, the most since 2012 when oil prices were over US$100/bl (and to be frank, many of the blocks assigned were never worked). What went well and what could be improved?

As we have said on several occasions, given Gustavo Petro’s stated intention to stop oil exploration if elected, one of the most important planning questions for 2022 and beyond is “Who will win the Presidential elections?” With just over six months to go to May 29th, the first round, the chess pieces are moving but we could hope Colombians would be more direct with pollsters.