New presidential election polls have come out and, once again, they predicts that Gustavo Petro will win in a runoff on June 19th. We also recently published a roundup of the leading candidates opinions of the oil and gas industry and all were in favor except Petro. That paints an unpleasant future for the industry but this may be exaggerating the risks.

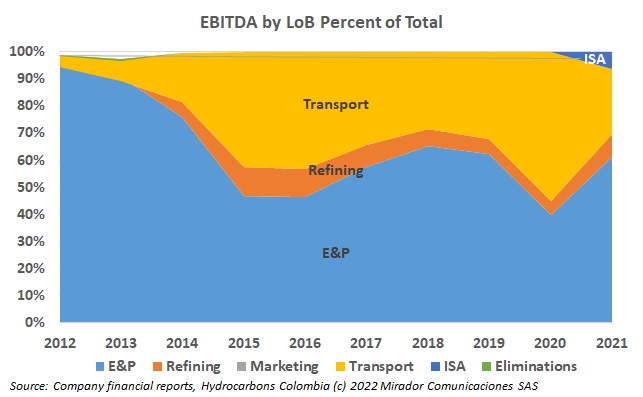

We updated our Ecopetrol Line-of-Business (LoB) financial charts for fully year 2021, which now include ISA broken out separately. The effect on Income Statement numbers is only from September so about 1/3 of what we should see in 2022.

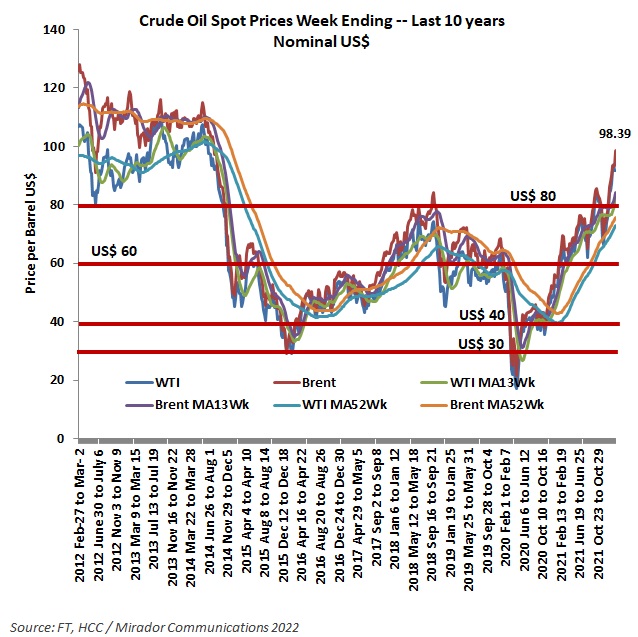

Oil prices were up again last week, Brent closing Friday at US$111.70 (according to FT.com). This is not a record or even a record for the period since Russia’s invasion of the Ukraine on February 22nd. But the 13-week Moving Average hit US$102.36 for the first time in almost 8 years and the 52-week moving average was US$81.52 for the first time since 2015, nearly seven years. These signals may mean some changes in producer and consumer behavior. But probably not yet in Colombia on the consumer side.

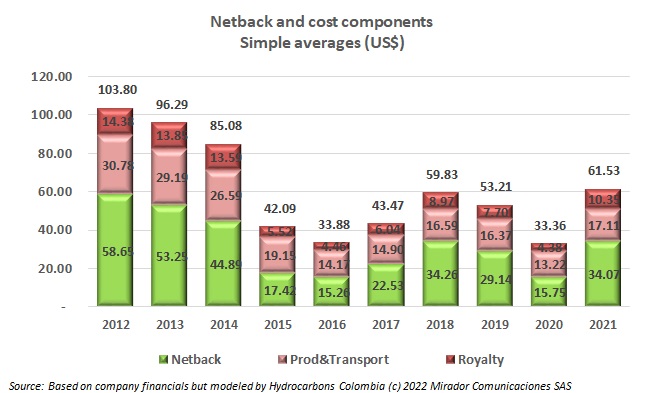

Oil prices have risen so dramatically so far this year that it might be hard to recall that, in addition to the special conditions caused by the Ukrainian conflict, prices have been rising for over a year and a half. And we really do not need to remind anyone that higher prices are good for key indicators like netback.

A recent New York Times (NYT) article quoted Anthony Leiserowitz, the director of the Yale Program on Climate Change Communication calling the phrase “energy transition”, a “floating signifier”, going on to define this as “a blank term that you can fill with your own preferred definition.” Since MinEnergia talks about energy transition a lot and it seems to define current policy, this seems to be an important discussion.

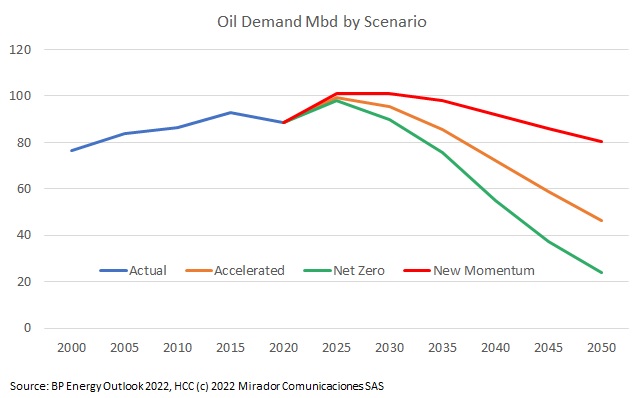

BP recently published its annual Energy Outlook, its long-term forecasts of major energy-related variables. Among the major points is the oil major’s view of peak oil demand and peak gas demand.

I am just back from a major technology conference and I happened to read a Thomson Reuters study about downstream and technology. These got me thinking about the role of technology in “greening” the industry.

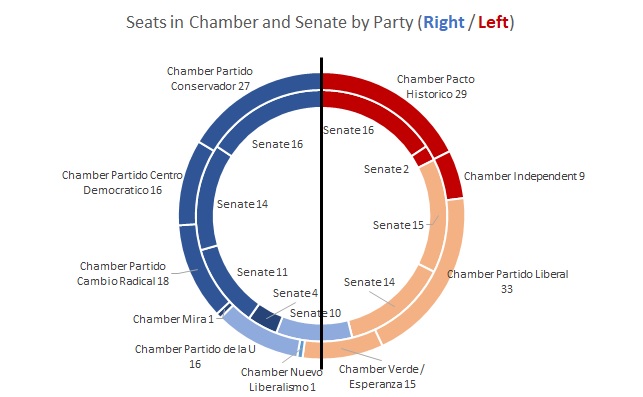

There was more excitement than expected on Sunday night but the eventual outcome was that predicted by pundits if not polls. Gustavo Petro garnered by far the largest number of votes but voting patterns had important implications for how the presidential elections might turn out.

There has been a flurry of fracking articles lately, mostly negative one way or another so I started wondering about what they were trying to accomplish.

As this was being finalized on Sunday morning, February 27th 2022, Russian troops had entered the Ukraine’s second largest city but Kyiv, the capital, had still not fallen. By the time you read this, the situation will no doubt be different.