Ecopetrol published its 3Q25 financial results recently and as might be expected, the headlines screamed that earnings had fallen 28% which, in fact, they had, year-over-year. Sequentially however, they were up 41%. Should Ecopetrol be castigated for the year-over-year, applauded for the sequential growth, both or neither?

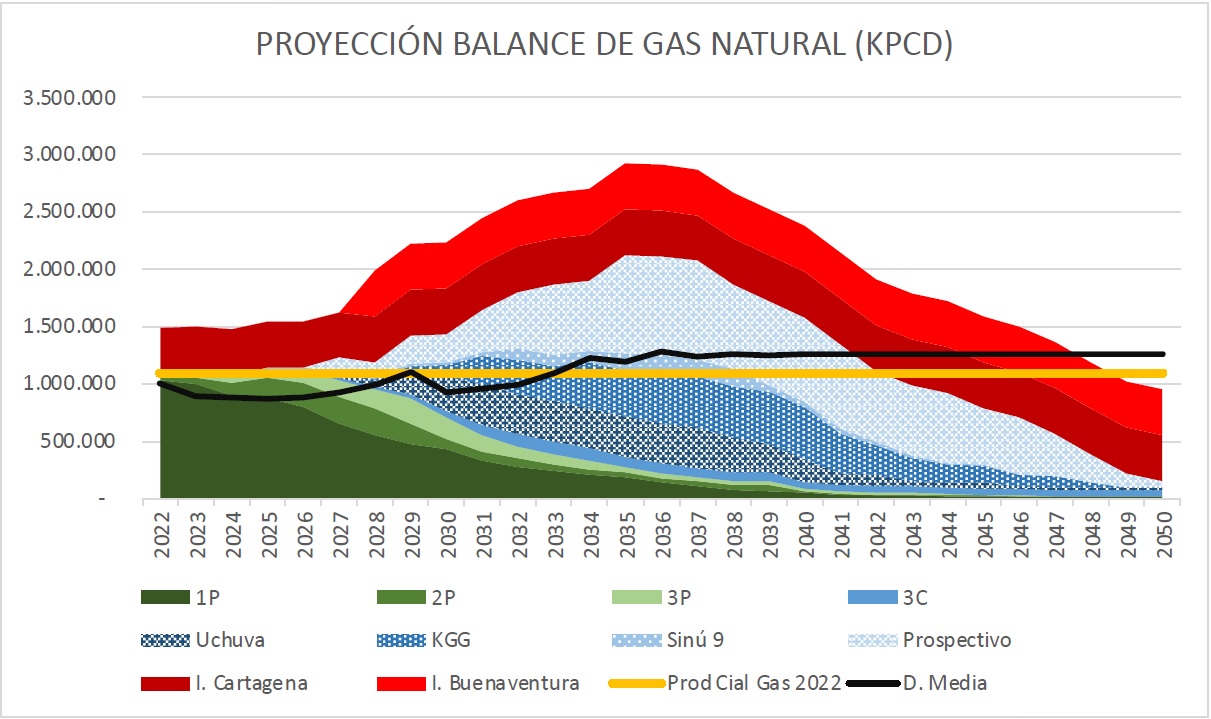

That depends on whether we are talking about demand or supply. The Petro government is obsessed with both peak demand and peak supply, insisting that Colombia’s energy system be reconfigured to deal with a declining oil sector in the 2030s. As a lead up to the COP30 meetings in Brazil, the International Energy Agency (IEA) gave its latest view.

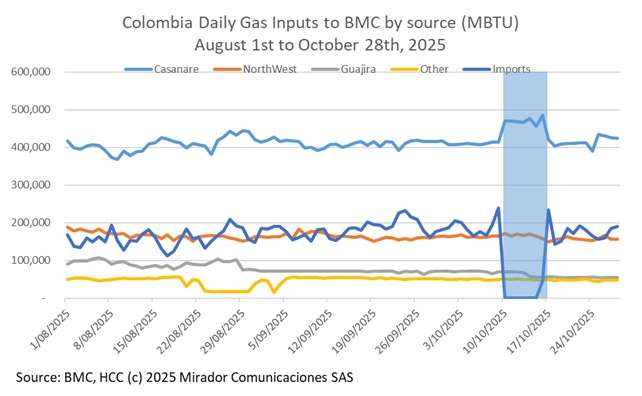

Recently, we published an article that showed what happened when the country’s only regas facility, SPEC, closed for scheduled maintenance. One might have expected that since SPEC programmed the maintenance well in advance, some planning might have avoided any stress about shortages. We look for evidence of that planning. (UPDATE: Technical difficulties overcome and graphs and full text now loaded.)

This year, Halloween falls on a Friday which is when we start to think about what we will write for the weekly essay. We could call this week’s contribution odds and ends or good news / bad news or potpourri or, because it is Halloween…

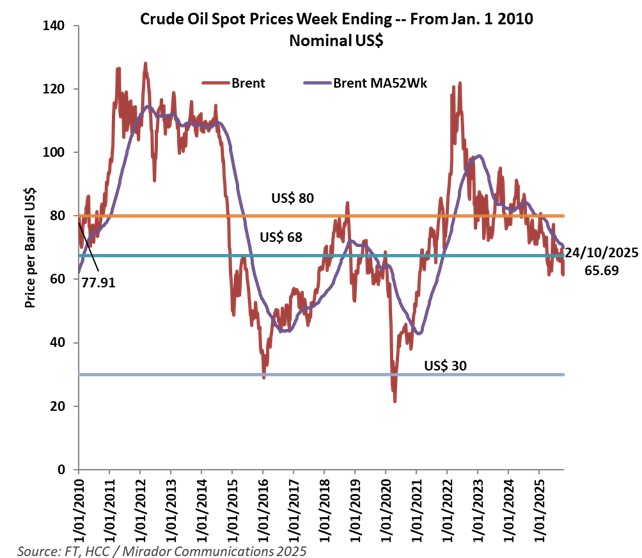

Ok. Last week, Brent went up in response to rising geopolitical tensions. But the fundamentals point in the other direction. OPEC wants to raise production to force out marginal E&Ps and the International Energy Agency predicts a “glut” next year. How far will prices fall and will that force Colombian producers out of the market?

Lately, Ecopetrol has talked about a third regas facility at Coveñas which makes (somewhat) more sense than its comical Buenaventura plans. Why would anyone but Rube Goldberg propose such a scheme? On second thought, maybe we don’t want to know why the NOC came up with them.

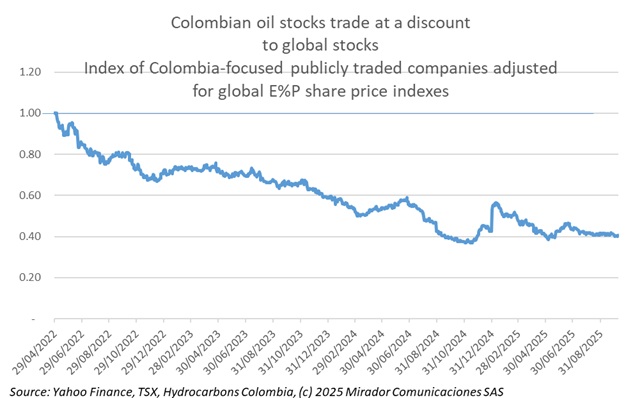

We have updated our index of the stock prices of Colombian-focused, publicly listed companies to the latest data and rebased so that the index begins on May 1 2022, perhaps the last time that anyone might have hoped that Gustavo Petro would not become president of Colombia. This makes comparisons easier and leaves no doubt that Colombian E&Ps, including Ecopetrol, have suffered from his administration.

Earlier this month the Colombian-Canadian Chamber of Commerce held its annual Dialogo Canada day, an event that discusses Colombian policy topics of interest to the major Canadian investment groups in the country. The session on hydrocarbons featured a discussion between Orlando Velandia, president of the industry regulator, the ANH, and two industry representatives, Gran Tierra’s Country Manager, Diego Perez-Claramunt and Parex’s Government Affairs VP, Rafael Pinto.

In January of 2023, I wrote an article entitled Don’t get me wrong critiquing a report by the Ministry of Energy proving that Colombia had lots of gas, enough to export in fact. How did that work out?

Oil and gas industry companies in Colombia with foreign investors have no doubt had to answer questions this week about the US government’s decision to “decertify” the country. What does this mean and what do we think of the impact?