Among MinEnergia Irene Vélez’s many ‘faux pas’ is telling the Colombian Mining Association’s annual conference that developed countries should shrink their economies to reduce the load on the environment. This would also allow her and her cabinet colleagues to reduce the extractive sector – guilt free – because there would be less consumption.

We spoke to Maria Lara Estrada of LATAM Airlines Colombia and she told us that the secret to cleaner aviation is all in the process. Sustainable Aviation Fuel (SAF) is the airline industry’s solution to lowering air travel emissions. (This was published last week in our sister publication ePower Colombia. We know that many of you read both but we thought this article was important to be in the two databases, for those that do not subscribe to both and for future searches.)

Now that 2022 is half over (from a financial viewpoint) we have a good view of what ISA is contributing to Ecopetrol’s results. We also take a look at the E&P Line of Business (LoB) and update our usual (and popular) charts on Transport.

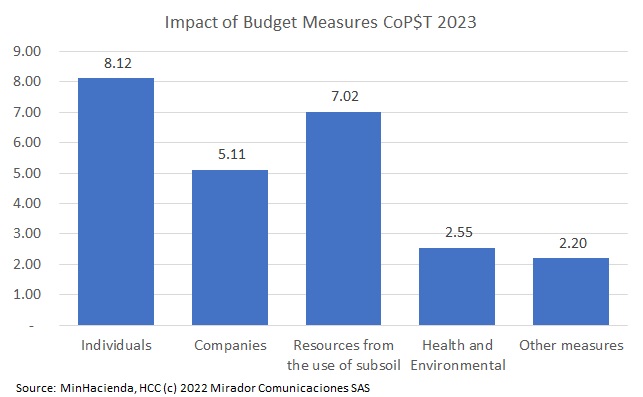

Last week, we published some quantitative analyses on certain aspects of Colombia’s proposed tax reform. Here are some qualitative comments on ideas in the draft bill that are either not quantifiable or where we decided there were too many scenarios to make quantitative analysis feasible. Note that as we write – August 21, 2022 – MinHacienda is talking about changes to the draft and there will be negotiations in Congress from now until the bill passes. If there are significant changes to the bill, we will likely publish a new commentary rather than updating this one.

It is hard to believe that President Gustavo Petro was only inaugurated a week ago (as we write). The new government has already submitted two draft laws which represent its campaign commitment to hobble the extractive industries, especially oil and gas: a tax reform and a law against unconventional reservoirs. Here we do some simple graphics to illustrate the potential consequences of the windfall tax included in the former.

This date had been (virtually) red-circled in our Long Form Report planning calendar as the week to respond to whatever President Gustavo Petro said in his inaugural speech about energy. Frankly, he said almost nothing that he had not already said. But he did name his MinEnergia and that was news with implications for the industry.

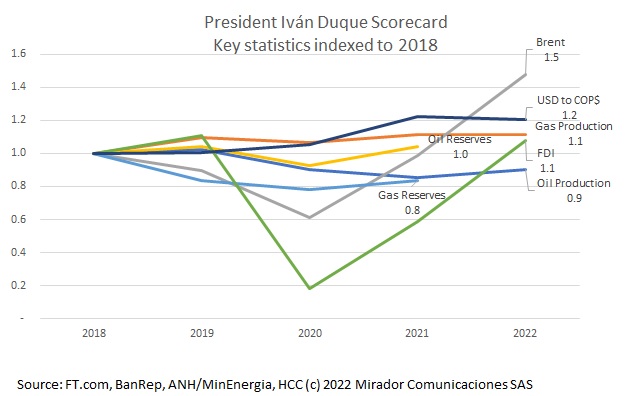

A week from when this is published, there will be a new administration running the energy sector in Colombia. If they have not already done so, members of the current team will be packing up their personal effects (beloved coffee mugs, family photos) and polishing their resumes to work on what comes next in their careers (but will not get them in trouble with Colombia’s conflict-of-interest regulations). How did they do in the job that is coming to an end?

Last Wednesday, July 20th 2022, the new Colombian Congress was sworn in. Despite the arithmetic we did at the time it was elected (way back in March) and again when the presidential elections concluded (just over a month ago), the majority is now supporting Gustavo Petro. Who would have thought it? I certainly did not but I should have.

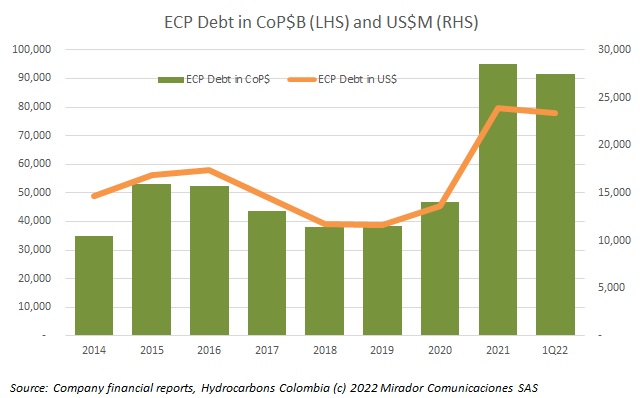

The story was titled basically “Everyone in the world is reducing their debt – except Ecopetrol”. Well, we have all had problems with our credit cards from time to time. Unable to resist that bright shiny thing – like ISA, for example – when we are already had unexpected expenses, like Covid-19 for example.