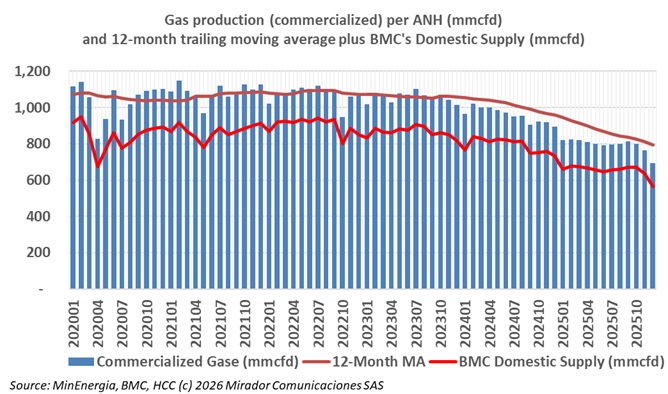

The ANH reports that commercialized natural gas production in December 2025 stood at 692.91 million cubic feet per day (mcfd). This monthly variation does not compromise the country’s energy security nor is it due to public policy decisions by the national government.

Financiera de Desarrollo Nacional (FDN) and BTG Pactual announced financial close for Ecopetrol’s Regasificadora del Pacífico project designed to import natural gas through Buenaventura.

Energy Minister Edwin Palma announced Santander’s largest historical natural gas expansion with CoP$51.675 billion investment across 15 projects delivering natural gas, liquefied petroleum gas networks, and eco-efficient cooking solutions to 19,246 households, particularly benefiting women who traditionally perform cooking tasks.

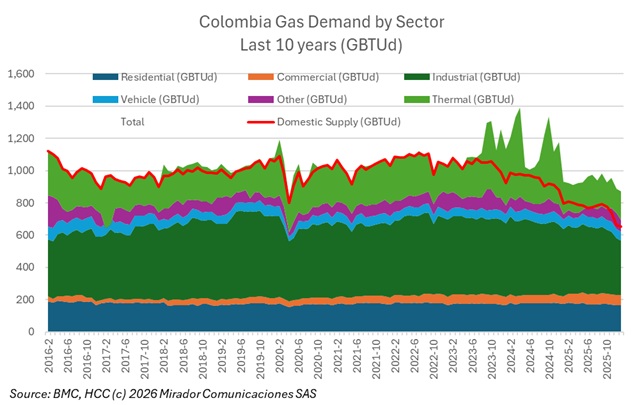

Natural gas market manager BMC published its January report and updated its online databases. Both demand and supply continue to decline.

Empresas Públicas de Medellín will enter the imported gas market through a new regasification facility in Copacabana, north of Medellín, marking Antioquia’s principal public company’s strategic entry into the regasification business.

The joint Ecopetrol-Frontera Energy regasification project at Puerto Bahía in Cartagena is advancing ahead of schedule, representing Colombia’s first concrete progress in gas imports from a second regasification facility.

Colombia’s plans to import Venezuelan natural gas face regulatory and infrastructure obstacles following talks in Caracas between Minister of Mines and Energy Edwin Palma and Venezuelan interim president Delcy Rodríguez. While Venezuela’s side of the Antonio Ricaurte pipeline—enabled in 2007—is ready, Colombia’s segment remains non-operational and Ecopetrol cannot lead the project.

Promigas announced December 23, 2025, it brought online 20 mmcfd additional natural gas transport capacity ahead of schedule, increasing total capacity from 100 mmcfd to 120 mmcfd on the Barranquilla-Ballena Bidirectionality Project in a widely reported news item.

Colombia’s main Pacific port faces a complex logistics crisis requiring sustained coordination between government and private operators, according to contrasting assessments from port management and government authorities released mid-February 2026.

Amazónica LNG will commission Colombia’s first land-based liquefied natural gas regasification terminal in the second half of 2027, following a US$190 million capitalization that includes US$150 million in debt financing from Mitsubishi Financial Group and US$40 million in equity from project partners.