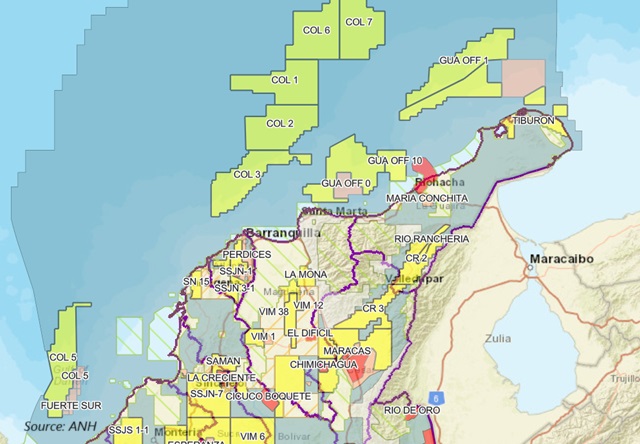

As widely anticipated, Ecopetrol’s offshore Komodo-1 well in the Colombian Caribbean will not be drilled in 2026, despite having regained its environmental license at the end of 2024.

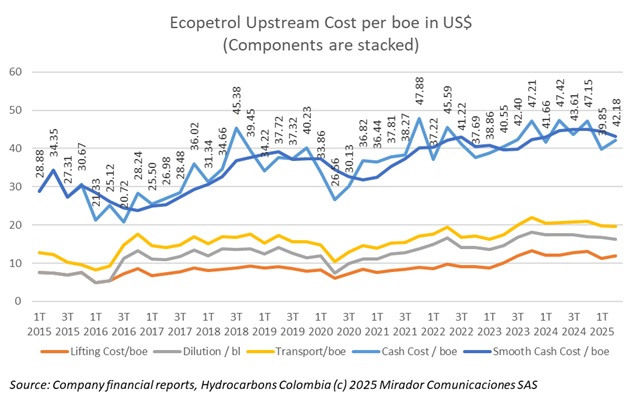

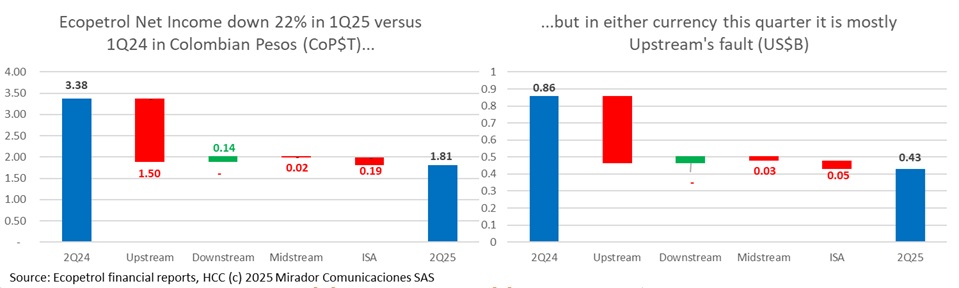

Ecopetrol (NYSE: EC) released its quarterly results for March–June 2025 recently. Despite a recovery in hydrocarbon production, the company’s profits fell for the second consecutive quarter, reporting CoP$3.1T in March and CoP$1.8T in June and the lifting costs played a key role in this behavior.

Ecopetrol announced the expansion of natural gas coverage in La Guajira, delivering 3,000 new household connections that will benefit more than 11,000 people, many of them in vulnerable conditions.

Colombia’s State Council ruled against Ecopetrol (NYSE: EC) and Oleoducto de los Llanos Orientales S.A. (ODL), confirming their responsibility for damage to a rice crop during the construction of an oil pipeline in Casanare in 2009.

Ecopetrol’s deteriorating Net Income continues to consume (virtual) column inches in the Colombian business press. Our perhaps counter-to-the-current view has been that short-term financial performance is the wrong place to look for what might be wrong with the NOC. This week we dive deeper into the qualitative comments we made last time.

The Unión Sindical Obrera (USO), one of Colombia’s most powerful oil workers’ unions, is facing mounting internal tensions after its president, César Loza, openly suggested that Colombia should resume fracking to safeguard energy self-sufficiency.

Ecopetrol (NYSE: EC) is navigating one of its toughest moments in recent years. Falling profits, weaker oil prices, and rising costs have shaken investor confidence, leaving markets debating whether to hold or sell the stock. The company, however, insists its operations remain stable, diversified, and strategically aligned with energy transition goals.

Ecopetrol (NYSE: EC) announced new changes in its Board of Directors.

Ecopetrol (NYSE: EC) has begun supplying marine fuel blended with 2% biodiesel to wholesale distributors in Colombia’s Caribbean region, marking another step in its strategy to produce cleaner fuels and advance national sustainability goals.

Ecopetrol (NYSE: EC) warned of a significant drop in production from the Permian Basin, its flagship U.S. asset that has been a key driver of the company’s results in recent years.