The NOC announced the protocols for its 2020 Shareholders Meeting, after the government declared a health emergency in Colombia, following the Covid-19 outbreak.

The NOC joined the initiative of other industry firms, announcing modifications to its spending, among others.

Ecopetrol (NYSE: EC) reported on contracting levels with local suppliers in different municipalities of the country.

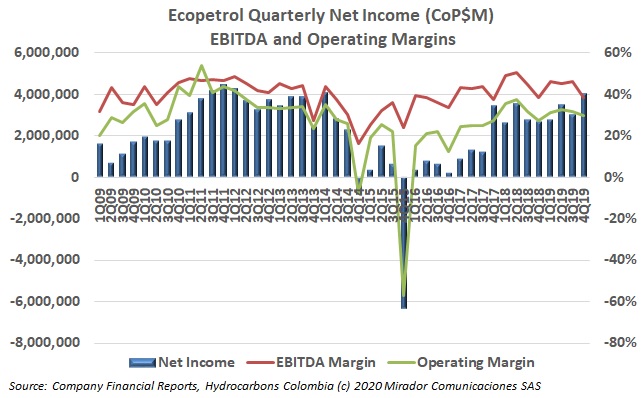

Ecopetrol (NYSE:EC) said it has everything it takes to be profitable, despite current prices.

This is why the Superintendence of Home Public Services (Superservicios) sanctioned Ecopetrol (NYSE: EC) and the Cartagena Refinery (Reficar).

The NOC spoke about the results of its Local Exports program, and about local contracting figures in the departments of Casanare and Meta.

Ecopetrol (NYSE: EC) started operating the Floreña and Pauto fields (Casanare), after the operation contracts of Equíon and BP Exploración Colombia (LON: BP) ended.

This is how much the State will receive from Ecopetrol (NYSE:EC), if the company’s board of directors agrees on the current profit distribution plan.

Ecopetrol (NYSE: EC) announced its fourth quarter 2019 results. Here are the details.

According CEO Felipe Bayon, Ecopetrol (NYSE: EC) will start developing fracking pilot projects (PPII) at the end of this year, as long as it complies with authorities’ environmental and social standards.