Felipe Bayón, CEO of Ecopetrol (NYSE: EC) spoke about key issues for the company such as unconventional resources, investment, production and dividends, among others. He highlighted that the NOC managed to overcome the oil crisis with good financial and operational results.

Ecopetrol’s (NYSE:EC) operations were so profitable in 2018 that the value of its shares could be twice what they were in 2017. Here are the details.

The National Hydrocarbons Agency (ANH) announced that Ecopetrol (NYSE: EC) and Petrobras (NYSE: PBR) will conduct exploration activities in the Colombian Caribbean Sea.

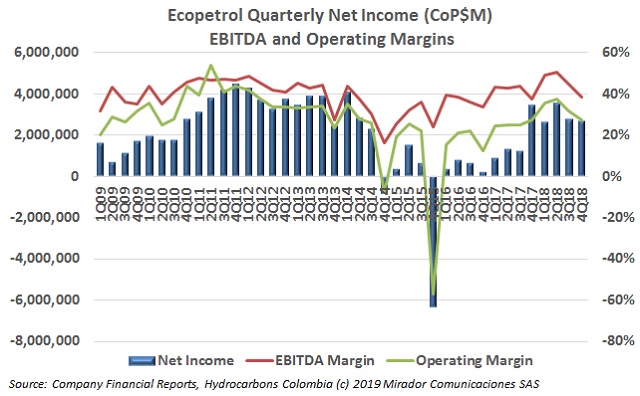

Ecopetrol (NYSE: EC) announced its fourth quarter and 2018 results. The NOC’s financial and operational performance in 2018 considerably increased compared to previous year. The firm reported the highest consolidated EBITDA in its history.

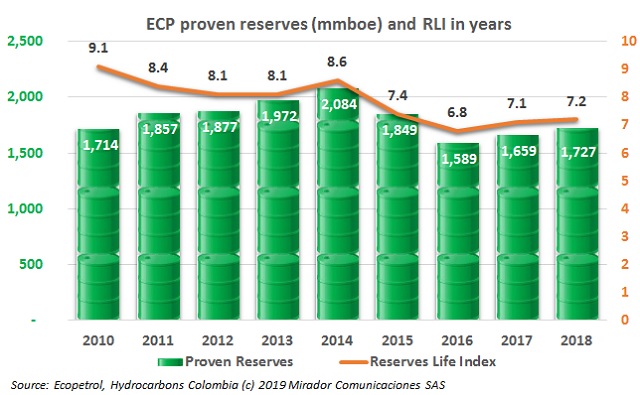

Ecopetrol (NYSE: EC) reported its reserves as of December 31, 2018. The NOC reported positive results despite social problems and attacks on its infrastructure. Higher oil prices played a key role to increase this metric during the past year. De Golyer & MacNaughton, Gaffney, Cline & Associates and Sproule International Limited audited the majority of reserves (99%).

The union accused the NOC’s management of using outdated regulations to weaken the union.

According to authorities, the results of the Technological Cooperation Agreement between Ecopetrol (NYSE:EC) and the Pontificia Bolivariana University (UPB) in Bucaramanga left positive results.

The ELN said they want to restart the peace dialogues and are willing to renegotiate some of the Agreements, but their actions show otherwise.

Alberto Carrasquilla, Minister of Finance (MinHacienda), made a proposal about the country’s participation in the Ecopetrol (NYSE: EC) stake, creating a huge debate in Colombia. Analysts spoke on this topic.

Authorities reported the highest levels of oil theft back in 2001. This is what they did to bring the metric down significantly.