Once again, the Analyst thought of some charts he really would have wanted to publish in last week’s article about the NOC’s Line of Business (LoB) results but did not think of until a few days later. We know. We will speak to him about that. But he is right, the graphs are interesting so we will publish them this week.

Colombia’s Chamber of Infrastructure (CCI) made a proposal for the resources the government could get by selling 8% of Ecopetrol’s (NYSE:EC) shares.

Ecopetrol (NYSE: EC) will hold its Annual Shareholder General Assembly at the end of March, and this has generated much discussion among experts, analysts and members of the sector. One of the main topics has been possible new members of ECP’s Board of Directors.

Ecopetrol (NYSE: EC) announced an ambitious plan to boost production and reserves in the coming years. Analysts talked about this strategy and its effects in the market.

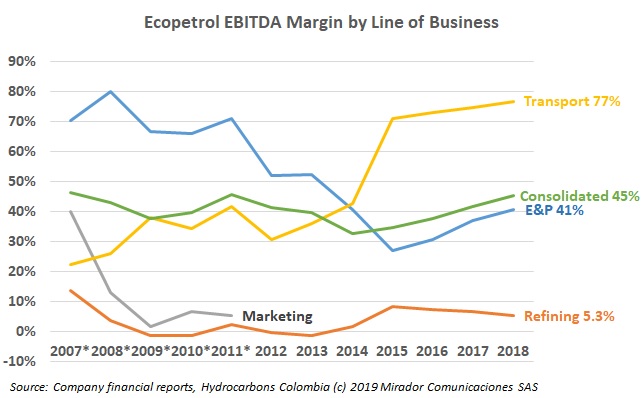

Ecopetrol published its results this past week and CEO Felipe Bayón was rightly trumpeting the NOC’s earnings for their contribution to the nation’s coffers. But hidden in the results presentation was worsening margins in the Refining Line-of-Business (LoB).

Alberto Carrasquilla, Minister of Finance (MinHacienda), proposed selling a portion of the State’s Ecopetrol (NYSE: EC) shares to private investors, generating much discussion in the country. Felipe Bayón, CEO of ECP, spoke on this topic and other relevant matters.

The firm signed an offshore E&P contract with the National Hydrocarbons Agency (ANH) to develop the COL 5 block. Here are the details.

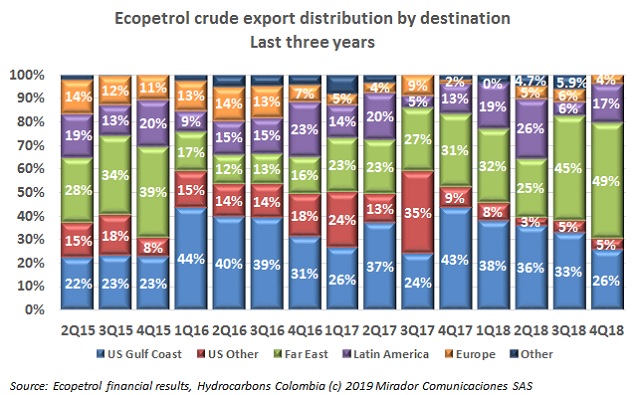

Ecopetrol’s (NYSE: EC) reported its export metrics for the fourth quarter of 2018. ECP’s export distribution is changing, and the Far East is positioning itself as the principal destination of Colombian crude. Exports reported an increase in the last quarter of the year.

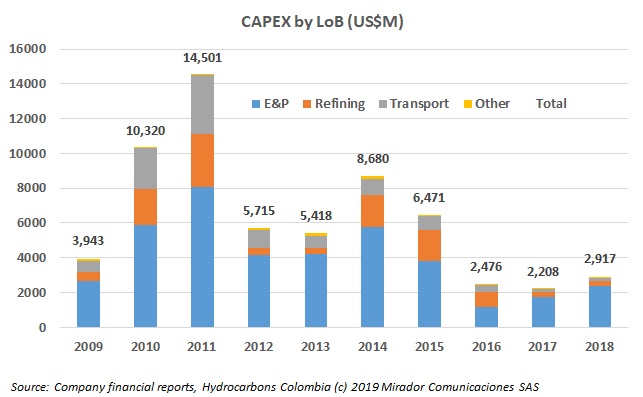

Felipe Bayón, CEO of Ecopetrol (NYSE: EC) spoke about key issues for the company such as unconventional resources, investment, production and dividends, among others. He highlighted that the NOC managed to overcome the oil crisis with good financial and operational results.

Ecopetrol’s (NYSE:EC) operations were so profitable in 2018 that the value of its shares could be twice what they were in 2017. Here are the details.