Ecopetrol lived through “golden years” from 2007-2012 and now confronts not only a challenging operational scenario, but also questions affecting its potential moving forward.

While 2014 has proven to be a difficult year for Ecopetrol (NYSE:EC), its president Javier Gutiérrez says the company will return to its production goals in 2015 and produce a million barrels a day.

A decision on whether or not Ecopetrol will take over the production contract of the Rubiales field will not be made until the middle of 2015, and the president of Ecopetrol Javier Gutiérrez has told the Senate that the NOC is capable of operating the field on its own.

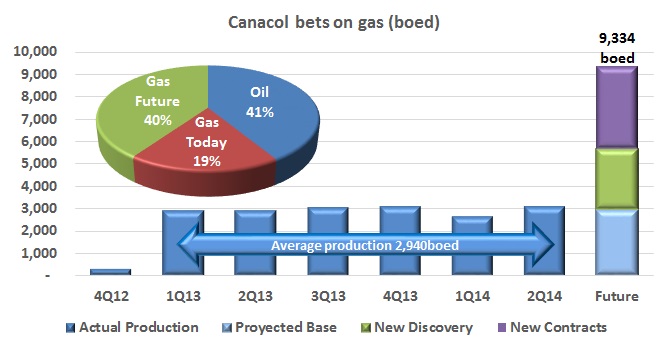

Canacol Energy (TSX:CNE) says that the first of three gas exploration wells, Palmer 1, has tested 14.4mmcpd, or 2,732boed, of dry gas.

After 30 hours of continuous negotiations and on the eve of the deadline, Ecopetrol (NYSE:EC) and its main workers union USO reached a collective bargaining agreement that will run from 2014-2018. The agreement came in the midst of threats of a union wide strike, and concedes a study group to limit the outsourcing of workers.

Ecopetrol (NYSE:EC) shipped proportionally less crude to the US than at any time in the last three-and-a-half years. Europe continues to increase in importance to the NOC.

After a delay of at least a year for the sale of the 57.6% share that the government has in electrical energy generator Isagén, the idea of floating more of its control of Ecopetrol (NYSE:EC) on the public market to pay for infrastructure investments has resurfaced.

Ecopetrol’s (NYSE:EC) Chichimene field has reached a new production record of 66,029bd, and the firm expects water injection and secondary recovery programs to grow that number to 100,000bd by the end of 2015.

Pacific Rubiales Energy (TSX:PRE) said that its second quarter 2014 total production grew 17% year-over-year to reach a new record, as the firm added more barrels of light oil and tripled profits, when compared to last year. Company executives also assured that its dependence on Rubiales has fallen as other fields and sources kick in.

Ecopetrol (NYSE:EC) says that contracts managed by the firm in the first half of 2014 reached CoP$10T (US$5.22B), putting it in line with contracting during 2013, when the NOC’s total contract pool valued COP$20B. The NOC said that 92% was performed with national suppliers.