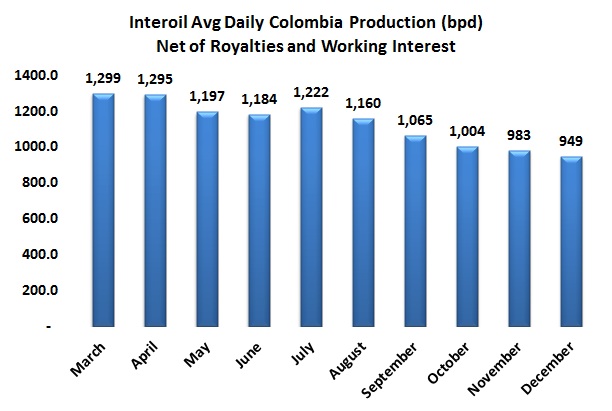

Interoil has been telling the market they are getting out of Colombia for several months now. Yesterday they announced the sale of their exploration assets to Trayectoria Oil and Gas. Interoil says they received US$2M in cash for its working interest in the Altair and COR-6 blocks and avoided US$26M in exploration costs. The transaction is subject to approval by creditors and the ANH. Their working interest in the producing block LLA-47 is still on the market.

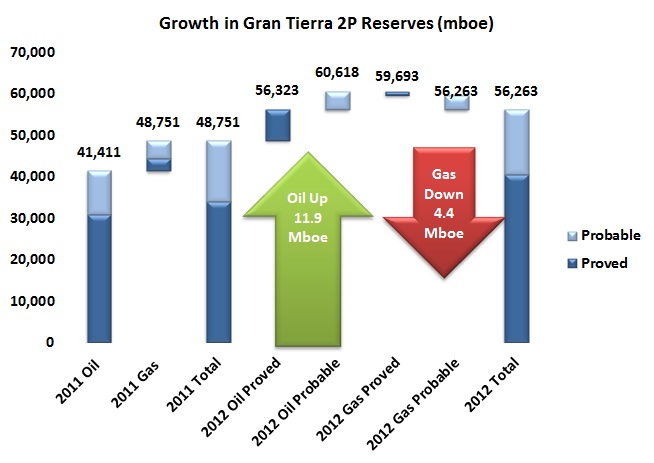

Gran Tierra recently issued a press release on its reserves for year-end 2012. The good news is that the company’s Colombian oil reserves 2P (Proved and Probable) are up 34% over 2011. Proved (P1) reserves are up 22% and Probable (P2) are up 85%. The bad news is that Colombian 2P gas reserves are down 64% although Proved gas reserves are only down 35%. Gas now represents only 5% of the company’s Colombian 2P reserves. Argentina gas reserves have also declined but the growth in oil in Colombia, Argentina and Brazil is sufficient to push 1P reserves up 20% and 2P reserves 15% on a total company basis. The official long-form filing may not appear until the end of this month and the company gave no explanation of the decline in gas reserves in its press release.

As reported by newspaper Portafolio, a delegation of UK Export Finance, the United Kingdom’s Export Credit Agency, visited Colombia in order to explore possible investments in the country in the areas of infrastructure, mining, oil and gas. The agency also provides financing services to Colombian companies that want to purchase equipment from British companies.

An Argentinian Justice ratified the foreclosure of US$19B against Chevron for causing environmental damage in Ecuador’s Amazon. The plaintiffs’ lawyer, Pablo Fajardo, said that Chevron “has to pay or deposit (in a bank account in favor of the plaintiffs), each month, 40% of all its revenues in Argentina”. The plaintiffs claim to have been victims of contamination caused by Texaco, later acquired by Chevron, between 1964 and 1990.

The Ecuadorian state-owned oil company is in Bogotá looking for partners to develop three blocks in that country from the Southeast Round. Canacol is one Colombian-focused oil and gas company that has property in the country. Now Petroamazonas wants more. From a Ecuadorian government news agency report, translated and with commentary by Hydrocarbons Colombia.

National business newspaper Portafolio reports that the State Council (a superior court that decides on government-related cases) ruled in favor of Ecopetrol in a lawsuit in which 56 individuals sued the company for US$239M claiming ownership of the Cuisiana and Cupiagua fields subsoil. Ecopetrol provisioned the money in the mid-nineties while resolving the lawsuit, so now, after the ruling, it will be returned to the company and will be used on investments.

Website ConfidencialColombia.com reports that Pacific Rubiales will invest US$30M in social projects this year, 5% more than in 2012. Alejandro Jimenez, corporate social responsibility manager of the company, stated: “2013 investments will benefit indigenous and ethnic communities, and other minorities. The good relationship with communities was evident in the harmonious atmosphere that maintained an uneventful operation; there were no blocks or public order disturbances during 2012 or so far this year.”

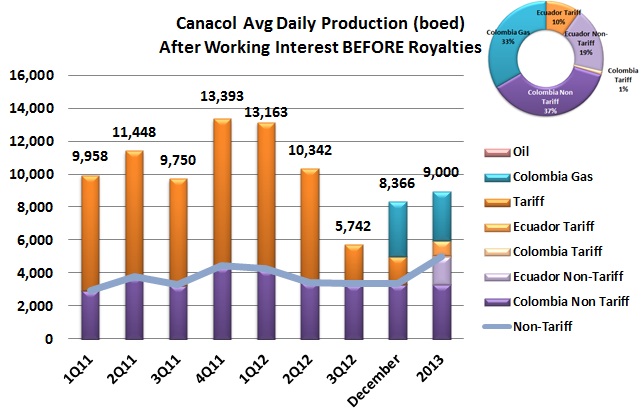

Canacol’s production reports always generate work in the HCC offices because their business is never simple. Through the first half of 2012, most of their revenue-generating production was so-called “Tariff” which was essentially was a services contract where they pumped oil for another company at a set fee per barrel. This was a low-netback business that the company has been deemphasizing, expecting it to be only about 11% of its business in 2013. As the graph shows, they also report figures before royalties, a not uncommon practice but one we do not agree with and normally try to adjust for.

Business newspaper La Republica reports that Pacific Rubiales awarded suppliers and contractors with the best performance in 2012. To this end they organized the third meeting of suppliers and contractors. Federico Restrepo, the company’s vice president of corporate affairs and sustainability said these incentives allow service companies “continue to accompany us on this journey towards higher levels of activity, efficiency and competitiveness.”

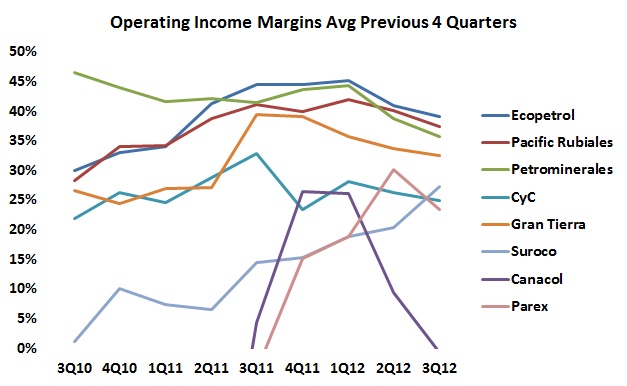

The graph shows Operating Income Margins (averaged over the previous four quarters) fell in 3Q12 for all companies except Suroco and have been falling for two quarters except for Suroco and Parex. The companies shown are the largest producers who are specialized in Colombia and who publish sufficient financial detail for us to do the calculation. The trailing four quarter average (MA 4) smooths out some of the variation but does not do justice to Gran Tierra which has actually had rising margins this year but these are lower than the corresponding quarters in 2011.