Colombia’s vice-minister of energy Orlando Cabrales says that unconventional resources are a critical element for the country’s energy future and following in line with US policy, touts energy security as the long term goal.

Speaking before an industry audience in Cartagena the Minister of Mines and Energy (MinMinas) Amylkar Acosta offered a thorough defense of the industry, its practices and its role in regional economies.

Excluding the ‘Additional Participation’ aka ‘Factor X’, average royalty rates in Colombia declined from 16.3% in 4Q12 to 15.5% in 4Q13, reflecting the slow shift in production from Traditional contracts to production from E&P Contracts, and from mature fields to newer fields with lower rates. But the graph shows there is considerable variation around the average.

This week President Juan Manuel Santos, who is up for the first re-election round in two months, said that none of the other candidates in the pool have the minimum experience required to handle the peace process.

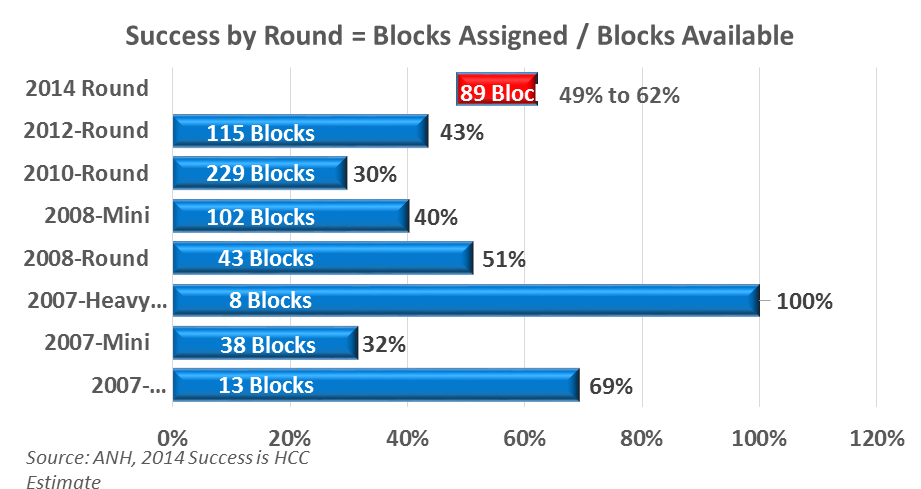

The government has expressed great hopes for the 2014 Round and with normal Colombian political processes the auction in Caribbean will be the current MinMinas, Almykar Acosta, swansong with the industry. He no doubt wants it to go well.

President Juan Manuel Santos told local press that an agreement with the Ecuadorian government to transport crude from Putumayo to the Ecuadorian Pacific coast is ready, an option to help alleviate congested transportation routes in the area but not without security problems due to guerrilla attacks.

With an eye on the nearly US$10.6B that Ecopetrol has to invest over 2014 in different aspects of its business, the Colombian Chamber of Infrastructure (CCI) has formed an alliance with the NOC to ensure the hydrocarbons investment plan brings benefits for the sector and oil producer alike.

Casanare oil operators and authorities have taken a more active reaction to the emergency drought conditions in the department to both offer support to communities affected and contradict criticism and allegations that oil production has caused the emergency. Critics still remain.

In Monterrey a tanker passing another tanker truck crashed into two other tankers that had just collided while ascending a curvy bit of highway outside the locality known as “The curves”. Witnesses of the accident said that the driver passing the other tanker managed to avoid a full collision with the two other tankers that were stopped, but in doing so ended up in the ditch destroying all the trees and vegetation in its path.

Colombia state owned electrical transmission company Interconexcion Electrica (ISA) is looking to acquire 5% participation of the Pacific Pipeline as part of a new business venture.