Striking construction workers involved in the Cartagena Refinery expansion project reached an agreement with the contractor in charge of the labor, CB&I to return to their posts and start negotiations this week.

Last week Petrominerales published its 2Q13 and while there was some good news from Brazil and new heavy oil finds, the overall production picture continued its decline. The company produces only about half the crude it did at the beginning of 2011.

The count went up again to 30 right at the recent average but still below the long-term average of nearly 40. This was a below average week for non-armed forces reported/guerrilla-initiated incidents. Our 4-week Moving Average incident count was up to 25.8 but the 52 week average was stable at 38.6 incidents per week.

The 12th round of peace talks started in Habana this Monday, July 28th as government and Farc representatives look to advance on the second point of the peace agenda, political participation.

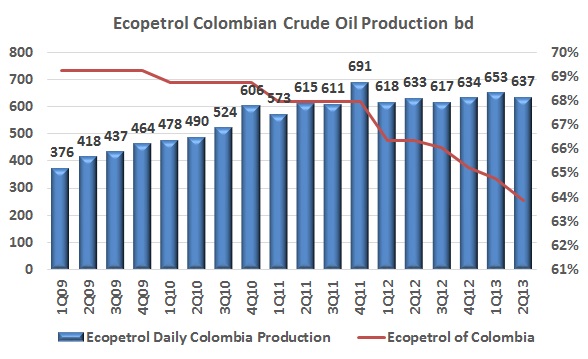

Heavy crude production increased, but lower prices and higher costs from its spinoff of transportation services cut into Ecopetrol’s profits in the second quarter of 2013 although it held production to last year’s level, growing 2.1%.

This month has an emphasis on investment with an update to our Colombian stock index and a conversation with a fund manager about the country’s attractiveness. Frequent collaborator León Teicher worries whether government complacency might drive investors away.

It’s no secret that labor relations within Colombia’s hydrocarbon’s industry are tense at best, if not completely contentious. Some companies have better relations and some worse but all are experiencing challenges at the present time.

We classify our security counts into the ANH’s geographic basins but separate out incidents near roads and pipelines, independent of the geographic location of the event.

We talked to an investment fund manager who has been around the Colombian and Latin American petroleum industry for a long time. He helped fund the early years of many producers in the region and at one time was heavily invested in engineering and services firms.

Maya and Castilla

Mexico’s Maya was adjusted according to the recent WTI-Brent changes in the differential (as part of the price re-connection process due to the reversal and expansion of some key pipelines), which also has a direct effect in WTS, one of the main components of the Mexican heavy grade price formula.